The 3 must-know news stories of the week

1. Big debate at the ECB

2. Finally, a Chinese stimulus plan

3. Saudi Arabia: a strategic U-turn on oil on the horizon

4. Chart of the week: French 10-year rate spreads versus Spain (and Greece!)

Big debate at the ECB

Discussions within the European Central Bank (ECB) are heating up regarding the pace to adopt for monetary easing in the Eurozone. According to media reports, debates are particularly intense among the institution’s members. Central bankers with more “dovish” positions (in favor of a more accommodative monetary policy) are advocating for a rate cut as early as October, due to growing concerns about the health of the European economy, supported by recent confidence surveys, such as the PMI and IFO indices. The business climate in the Eurozone for September is set to be published, adding another data point to this debate.

However, these calls for quick easing face opposition from more “hawkish” members (advocating for a more restrictive monetary policy), who believe the ECB should rely more on concrete economic data, such as GDP and wages, as well as the institution’s projections. These projections will be updated in December, and the “hawkish” members prefer to wait until then to confirm or refute the deterioration in activity. During the September meeting, Christine Lagarde emphasized the importance of allowing time for monetary easing to take effect on the economy and noted that little new data would be available before the next meeting, scheduled for October 17.

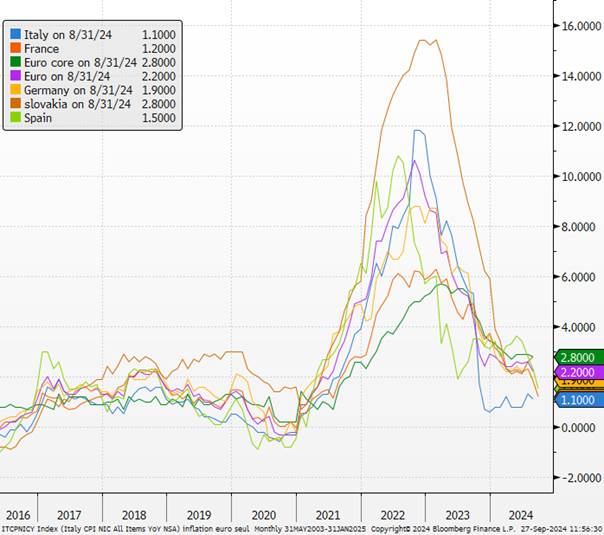

A key indicator, September inflation, will soon be released. The first national data, published this morning, is expected to confirm a slowdown in inflation due to a smaller contribution from energy prices. In Spain, overall inflation continued to slow, reaching +1.9% year-on-year (compared to +2.3% in August), while core inflation may slightly rebound to +2.8% (from +2.7% in August). In France, overall inflation also slowed more than expected, reaching +1.2% year-on-year (compared to the expected +1.6% and +1.8% in August), with a significant monthly decline (-1.2% versus +0.6% in August).

Although inflation is now below the ECB’s target, the institution remains focused on the dynamics of service prices, which remain resilient due to still-strong wage growth. However, the recent slowdown in wages could gradually reflect on prices, contributing to a slowdown in core inflation…

Euro Inflations

Our opinion: The economic situation in the Eurozone is evolving rapidly, and the ECB might find itself obliged to respond more proactively to a now tangible risk of disinflation. We take a contrarian stance, opting for a 50 bps cut by the end of the year.

China: Finally, a stimulus plan

Chinese stock markets experienced their best weekly performance since 2008 following Beijing’s announcement of a large-scale economic stimulus plan, including a $114 billion package to support financial markets. The CSI 300 Index, which tracks major companies listed in Shanghai and Shenzhen, surged by 15.7% this week, marking its best performance since November 2008, when China last introduced a stimulus plan in response to the global financial crisis. This rally, which also boosted European markets and industrial metals, comes as Chinese leaders seek to support the country’s financial markets, stabilize the real estate sector crisis, and encourage domestic consumption in order to meet the 5% economic growth target for the year.

On Tuesday, the People’s Bank of China unveiled an 800 billion yuan ($114 billion) lending fund for the country’s financial markets. This fund will be used to finance corporate share buybacks and lend to non-bank financial institutions, such as insurance companies, to purchase local stocks. The recent interest rate cut by the U.S. Federal Reserve provides a favorable tailwind for China, the world’s largest exporter. This is the first time the government has encouraged leveraged investment in the stock market. A rally supported by liquidity and leverage could continue, and a shift of investments from expensive global tech assets to cheaper emerging market assets is possible.

Industrial metals such as copper, aluminum, and zinc, for which China is a major consumer, made significant gains, extending a rally that began earlier this month. Copper, widely used in electrical installations, surpassed the $10,000 per ton mark, a three-month high. As for iron ore, a key ingredient in steel production, the stimulus measures reversed a trend that had seen it fall to a two-year low, mainly due to weak demand for steel.

Our opinion: The political calendar suggests significant measures could be announced at the Politburo meeting and the Central Economic Work Conference at the end of the year. However, these initiatives will take time to materialize, and investors are waiting for assurances before fully believing in the recovery of growth. Nonetheless, this awareness is an encouraging sign, and we are now more optimistic about the outlook for Chinese assets.

Saudi Arabia: A strategic U-turn on oil on the horizon?

Saudi Arabia, the world’s largest oil exporter, may soon abandon its unofficial goal of keeping oil prices at $100 per barrel, signaling a major shift in its energy policy. According to sources close to the matter, the kingdom is ready to increase production as early as December, a move that could lead to a sustained decline in crude prices. This strategy aims to regain market share lost to non-OPEC competitors, notably the United States and Brazil.

Since 2022, Saudi Arabia, the leader of OPEC+, has orchestrated production cuts to support oil prices. However, weakened global demand, driven by China’s economic slowdown and increased supply from non-cartel countries, has led to a drop in Brent prices below $80 in recent weeks. In response to these prospects, oil prices have already fallen by 4%, with Brent dipping to $70.7.

This potential increase in supply would mark a reversal of Saudi Arabia’s recent strategy, which sought to maximize oil revenues by limiting supply. According to analysts, this shift reflects a realization of OPEC+’s miscalculations in managing the market, as well as the kingdom’s desire not to lose further ground to its rivals.

At the same time, tensions between Riyadh and Washington, exacerbated by disagreements over oil production following Russia’s invasion of Ukraine, seem to have influenced this decision. Despite its significant budgetary needs to finance ambitious projects, Saudi Arabia appears willing to endure a period of low prices, relying on alternative resources such as its foreign exchange reserves or sovereign debt issuance.

If this strategy materializes, it could usher in a new paradigm in oil markets, with the risk of a prolonged decline in crude prices. This situation could affect major industry players, already impacted by this announcement.

Brent and WTI Prices

Our opinion: This situation of discord within OPEC and the desire to regain market share (against the US) has already occurred in 2014, leading to a nearly 50% drop in crude prices. Given this experience, Saudi Arabia may avoid making the same mistake this time. We are lowering our Brent price targets to $65-75 to account for this risk.

Chart of the week

Spread on 10-year yields: France versus Spain / France versus Greece