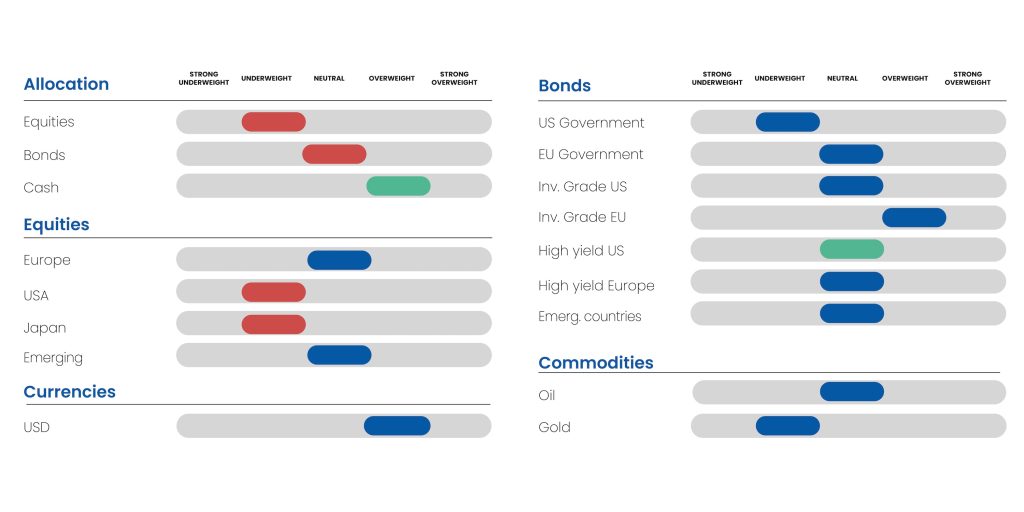

We are making a few adjustments in terms of asset allocation, taking into account the latest developments in monetary policy (see Macro economic Point) and market trends since the announcement of the US central bank’s rate cut.

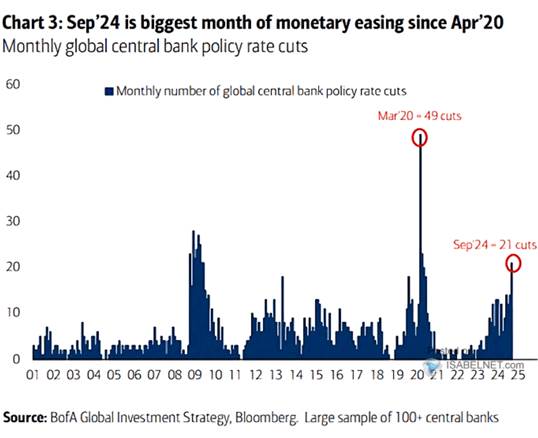

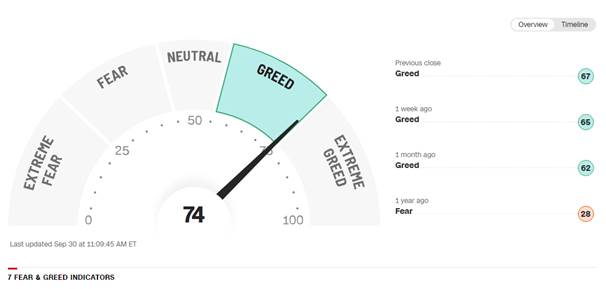

With oil prices falling and wages moderating, the disinflation process is set to accelerate, allowing central banks to implement a visible monetary policy by cutting rates. However, US elections and geopolitical risks will begin to impact asset volatility this month. The market remains in a “Goldilocks” scenario, which justifies valuation levels. Sentiment indicators point to strong short-term optimism, driven by Jerome Powell’s latest statements. We believe that doubt could set in over the coming weeks. We are opting for a more cautious approach in the short term.

Market sentiment indicator

The term “Goldilocks” in economics is used to describe an economic situation that is considered to be “neither too hot nor too cold”, i.e. a period of moderate and stable economic growth, with a balance between growth and inflation, without excesses or severe contractions.

- EQUITIES: Thanks to China and the Fed, geographic selectivity can be implemented despite general caution

- SOVEREIGN RATES: Too many expectations on long rates

- CREDIT: Quality still predominates, but we must seek to capture yield at all costs

- EMERGING CREDIT: The triple shock seems to be over

- DOLLAR: Expectations of a U.S. rate cut will diminish

- OIL: Saudi Arabia changes strategy

EQUITIES

We don’t believe in a US hard landing at the moment. We are on the side of the proponents of a year-end recovery in US growth (and even employment), which could put the Fed in an uncomfortable situation. However, third-quarter economic figures are likely to surprise on the downside, and could initially undermine expectations of earnings growth in 2025.

Main indices in local currencies

In our previous report, we stated: “If the Fed lowers rates by choice because inflation is normalizing, then the reduction in discount rates would provide a second wind for equity markets. Conversely, if it does so out of necessity due to a rapid deterioration in the macroeconomic situation, it would be accompanied by a rise in the risk premium, which would be detrimental to markets.” This is the movement that occurred in the S&P 500 following the FOMC, which was sufficient for our taste.

We are taking into account the multiplication of various risk factors at least through October to be more cautious. The approach of the U.S. elections and the rhetoric of candidates in the final stretch, along with recent meetings in the Middle East and significant U.S. market valuations, leave little room for positive surprises. Furthermore, we are not immune to another unwinding of carry trades. Indeed, the change in Prime Minister in Japan could put pressure on the BoJ.

We are temporarily lowering our positioning on equities, but believe that geographic rotation could, in relative terms, take place in favour of Europe and China to some extent.

Uncertainty linked to the US election and the widely divergent platforms of the two candidates should bring volatility to US indices.

With the ECB expected to cut rates further in the short term, European stocks could take advantage of this to make up some of their lost ground, helped by a more optimistic view of activity in Asia.

In the current climate of uncertainty, we prefer a “barbell” strategy, combining more defensive sectors with neglected stocks benefiting from the enthusiasm linked to Chinese expectations (chemicals, luxury goods).

A downturn should enable us to reinvest at more attractive levels.

Lower interest rates should encourage US mid-caps to catch up, as they are of better quality than US small caps (when comparing the S&P 400 mid cap and the S&P 600 small cap).

In Europe, real interest rates should fall, “finally” benefiting small caps. We remain cautious on companies directly linked to French politics and the economy.

Big, Mid and Small US indices

BoJ has taken into account market reactions to its recent measures( Augustsell-off ) and is signaling a cautious approach. However, the appointment of the next Prime Minister could raise fears of pressure towards a more restrictive monetary policy. Japan’s future Prime Minister, Shigeru Ishiba, has been critical of the Bank of Japan’s ultra-accommodative monetary policy. He remains in favor of higher key rates and a strong yen.

Emerging countries can be a good asset diversifier, given their undervaluation and the low impact of US and European policy on their own markets. We had long been waiting for the Fed’s first move to be more constructive on China. India has largely remained our preferred geographic zone since the beginning of the year. China is not yet at the “Whatever It Takes” stage, but it seems to be getting closer. These initiatives will take time to materialize, and investors are waiting for guarantees before fully believing in renewed growth. Nevertheless, this new awareness is an encouraging sign, and we are now more optimistic about the outlook for Chinese assets. Meanwhile, in India, volatile food prices may pose a risk to inflation. Without being alarmist, we are lowering our view on the country, whose stock market performance has been widely acclaimed.

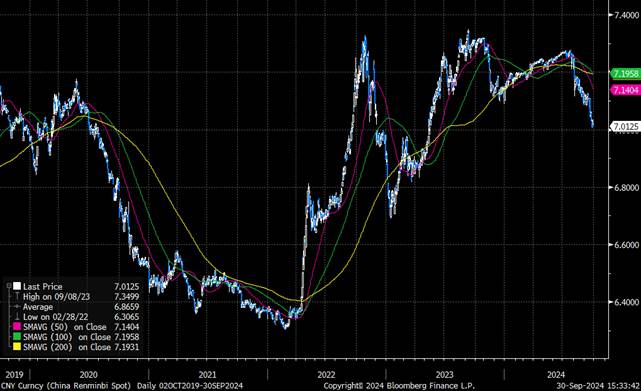

USD versus CNY

SOVEREIGN RATES

The arrival of the Fed’s pivot point and fears of recession have enabled sovereign rates to reach the lows of the beginning of the year, when investors were anticipating six rate cuts in 2024. Even if expectations for 2024 are now 100 bps (we anticipate only two or even three 25 bps cuts), it seems to us that short-term rate cut expectations on the part of the Fed are far too high.

As far as US rates are concerned, we believe that the distance between the recession and the Fed’s action should enable the yield curve to steepen, with short rates (2 years) remaining stable and the long end rising moderately. We are further lowering our duration outlook on sovereign bonds (lowering our positive view on bonds in our asset allocation in favor of short-term cash).

As this scenario regains credibility in the eyes of the majority of investors, US sovereign yields should, in our view, reappreciate (towards our targets of 3.9% 10-year, versus 3.76% currently), even though they remain the main asset against a systemic crisis. We therefore need to reduce duration and take advantage of overly generous central bank expectations.

Any rise in US long rates above 3.95% will be an opportunity to reposition.

The fall in yields will be more marked in the eurozone, and we are more comfortable with European bonds. However, we remain cautious about the trajectory of French debt and its ability to reassure the market in the short term, whether in political or budgetary terms.

Sovereign rates 5 years

CREDIT RATES

We are maintaining the same carry strategy on corporate bonds.

We believe there are potential risks for lower-quality and less liquid segments, which are more vulnerable in scenarios marked by reduced liquidity, economic slowdown or unforeseen shocks.

On the credit side, the Fed’s rate cut is not expected to translate into a strong reaction on credit spreads, as it rather validates the scenario of a soft landing for the economy.

We were underweight the US HY segment.

The fall in short-term rates should help attract yield-seeking investors.

We do not expect spreads to fall any further, but the yield looks attractive given the new market configuration.

With a view to a more significant ECB rate cut in 2025, we are increasing our duration in the region. We maintain our positive view on credit, whose performance will materialize through carry. The gathering momentum of the economic rebound in Europe and continued ECB monetary easing should keep spreads relatively stable, including in the High Yield segment. Within Investment Grade, non-financial hybrids still seem attractive compared with senior non-financial debt (spread differential for equivalent issuer credit risk). The spread on senior financials is also attractive compared to senior non-financials, with a significantly higher composite index rating. Nevertheless, we remain cautious on the lowest ratings.

Corporate credit spreads

EMERGING CREDIT

Covid crisis, war in Ukraine and monetary tightening: the triple shock seems to have passed. After three years of negative flows into emerging bond markets, despite recent good performances, the US Federal Reserve’s rate cut may have kick-started renewed interest in the asset class. The most fragile countries now have the opportunity to restructure their debt. The default cycle that has affected emerging markets in recent years seems to be over. Lower interest rates, combined with the Fed’s rather positive stance on US growth, are positive for emerging markets.

Credit spreads on emerging countries

DOLLAR

Our year-end forecast was rather optimistic for the euro, given the resumption of the disinflation process in the second half of the year and stronger-than-expected weakness in the US economy towards the end of the year. This turned out to be correct. Only a very marked deterioration in the US economy could lead to a higher level. For the time being, it’s the European economy’s turn to disappoint, as indicated by the economic surprise indicators. Since the beginning of the year, we have maintained a range between 1.07 and 1.12. We believed that the dollar could, in the short term, strengthen as expectations of rate cuts tempered. We expect the ECB to follow suit. We are maintaining our range pending the next meeting of the European Bank, with a preference for the US currency, whose carry remains attractive.

Economic surprise indicators

OIL

The Wahhabi kingdom is ready to abandon its target of $100 a barrel and increase production, with the aim of regaining market share lost to the USA in particular.

Disagreement within OPEC and this desire to gain market share, particularly from the USA, have already occurred in 2014, causing crude prices to fall by almost 50%.

The Organization of the Petroleum Exporting Countries (OPEC), in particular Saudi Arabia, played a crucial role in shaping oil prices in 2014.

In November, OPEC decided not to cut production, despite the supply glut.

Saudi Arabia had maintained its production levels to retain market share, even if this meant lower prices.

On the strength of this experience, Saudi Arabia may not make the same mistake again. We are lowering our Brent target to USD 65-75 to take this risk into account.

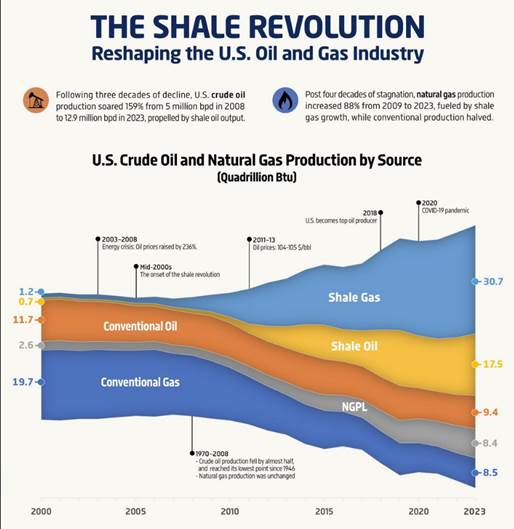

Visualization of the American shale revolution, which has helped make the United States the world’s largest oil exporter.