The Fed’s rate cuts bring relief to everyone. Indeed, the U.S. economy remained robust compared to its neighbors in less favorable situations. A deliberately restrictive monetary policy had prevented other central banks from taking effective action. The ECB, PBoC, BoJ, and others are now free from this burden!

- United States: Economic normalization

- Eurozone: The ECB faces the risk of faster disinflation

- China: Time for stimulus

- Japan: BoJ is in no rush

United States: Slowdown or Simple Economic Normalization?

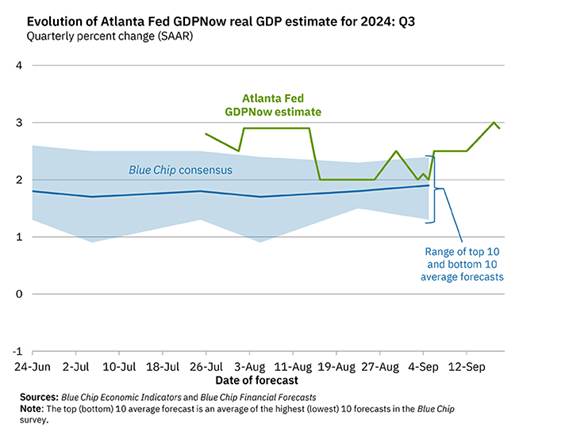

Over the summer, long-awaited signs of a U.S. growth slowdown finally began to appear. However, since September, this hypothesis seems less supported. Numerous recent statistics highlight the impressive resilience of U.S. economic activity. The Atlanta Fed’s leading indicator has returned to an annualized growth rate of nearly 3%. With growth above potential, resilient consumption, record stock market levels, and inflation still above the Fed’s target, it’s hard to justify a monetary easing cycle without fearing inflation risks. Unless the Fed sees elements we’re missing, a more aggressive rate-cutting policy could complicate achieving the 2% target, especially in a growingly uncertain environment, notably ahead of the U.S. presidential elections and the likely Chinese economic rebound.

Wage growth versus inflation

A Slowdown to Put into Perspective

The expected economic slowdown in the U.S. seems closer to a simple softening or normalization of activity rather than a real recession. According to recent interviews with U.S. economic actors, since June, hiring and investment decisions have slowed, partly due to uncertainty surrounding the November presidential elections. However, this climate of uncertainty should be temporary, with growth possibly rebounding after November 3, once election results are clear. We continue to rule out the possibility of a recession, largely because American households still have strong leeway for consumption, thanks to rising real incomes and easy access to credit.

Wage growth versus inflation

A short-term interest rate cut could once again stimulate lending, helping to boost the U.S. economy. Thus, although monetary adjustments are expected, the prospect of a recession in the United States seems to be ruled out for now, and the economic momentum should strengthen after the elections, with a more favorable environment for the recovery of consumption and investments.

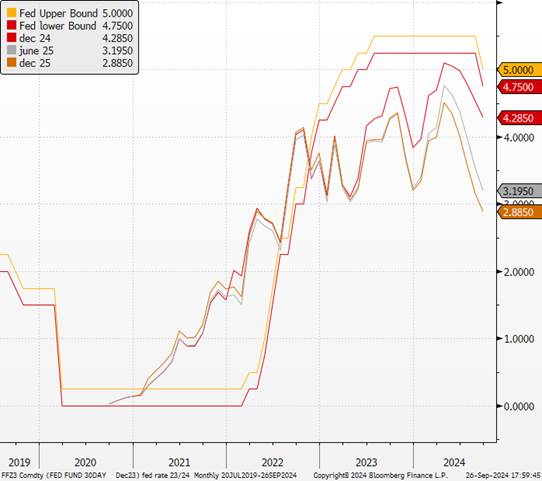

Prospects for Rate Cuts

Given recent speeches by central bankers, we now anticipate a total rate cut of 50 basis points by the end of the year, with two 25-basis-point reductions at the November and December meetings. Our previous forecasts only expected one cut in December. Subsequently, a series of additional 25-basis-point cuts could bring the Fed’s policy rate to 3% by 2025. However, it is important to note that there is no clear consensus among different monetary policymakers on the path forward.

Fed rates and the futures market

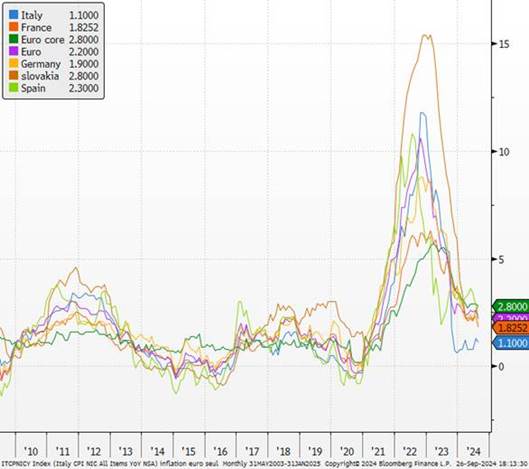

Eurozone: The ECB Faces the Risk of Faster Disinflation

As expected by most analysts, the European Central Bank (ECB) implemented a second consecutive cut to its key interest rates. However, the threat of faster-than-anticipated disinflation, with inflation now projected at 2.2% in 2025, could force the institution to adjust its monetary policy sooner and more drastically than the current consensus predicts. Christine Lagarde, President of the ECB, indicated that the next rate cut is unlikely to occur at the October 17 monetary policy meeting, but rather at the December 12 meeting. Nevertheless, inflationary prospects in the Eurozone seem to be eroding faster than expected. The recent drop in Brent oil prices, if it persists, should significantly reduce energy-related inflation. In August, overall inflation, measured at 2.2%, was mainly driven by the rise in service prices (+4.2% year-on-year), heavily influenced by wages.

Eurozone inflation

Signs of Weakness in Domestic Demand

The labor market is showing signs of rapid easing, with the vacancy rate falling from 2.9% to 2.6% in the spring. At the same time, European domestic demand remains fragile. Productive investment is in decline, while industrial capacity utilization continues to fall, highlighting weak growth dynamics in the sector. Despite an increase in household purchasing power, consumption has yet to rebound, held back by a high savings rate, encouraged by now-positive real interest rates. This raises the question: is the ECB further weighing on European domestic demand with its current policy? A rate cut could occur sooner and more aggressively if European inflation stabilizes below the symbolic 2% threshold, forcing the ECB to adopt not a neutral, but a decidedly accommodative stance.

Savings Rates

A Turning Point Ahead?

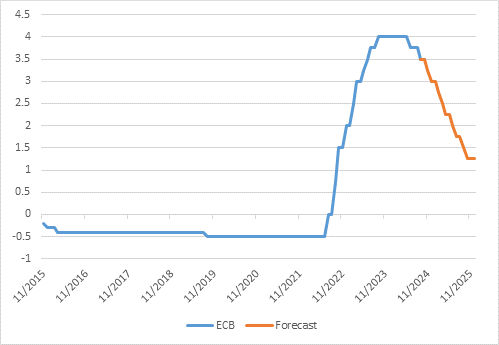

If the ECB were American, the prospect of a series of rapid rate cuts would likely already be in place. However, caution seems to prevail in Frankfurt. Nonetheless, in an environment where disinflation is accelerating and domestic demand remains weak, it is increasingly likely that the ECB will be forced to adjust its trajectory. For the end of the year, we anticipate two further rate cuts, despite the more reserved stance displayed by Christine Lagarde and the markets. The economic situation in the Eurozone is evolving quickly, and the ECB may find itself obliged to respond more proactively to a now tangible risk of disinflation. We contrarily forecast 50 bps by the end of the year.

Deposit facility rate

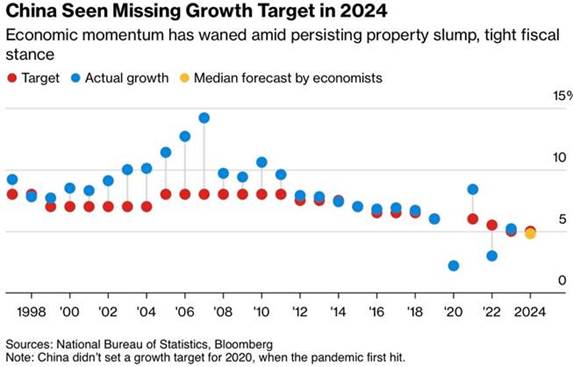

China: Time for Stimulus?

At an exceptional Politburo meeting chaired by Xi Jinping, Chinese authorities emphasized several key economic priorities: fiscal policy, countercyclical management, and support for the private sector, with a particular focus on stimulating consumption. The decision to hold this meeting in September, a month when such discussions are typically rare, highlights the “growing urgency” in response to mounting deflationary pressures. This meeting followed a series of initiatives by the People’s Bank of China (PBoC) and financial regulators, including interest rate cuts and massive liquidity injections to stabilize the stock market and encourage share buybacks. In our last monthly report, we noted that the Caixin indicator, which focuses on small and medium-sized private enterprises, had shown some signs of improvement.

An Expected but Constrained Monetary Easing

Domestic conditions call for a more aggressive monetary easing, but the People’s Bank of China (PBoC) faces several obstacles, notably the weakness of the yuan and the deterioration of Chinese banks’ balance sheets. However, the recent interest rate cuts by the U.S. Federal Reserve (FED) have provided China with a window of opportunity. This new environment allows Beijing to adjust its policy without excessively fearing the effects on its exchange rate. What distinguishes this new wave of measures from those seen earlier in the year is a much stronger sense of urgency. After months of underperforming economic results, the hope of seeing the economy recover without intervention has now been discarded. The Chinese government views the FED’s easing cycle as an opportunity to stimulate its economy.

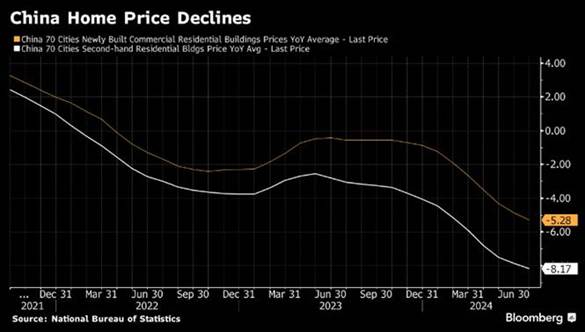

A Resolute Governor and Broader Measures

The Governor of the People’s Bank of China, Pan Gongsheng, has adopted a much firmer and more aggressive stance. The recent measures are also broader than before, signaling a more persistent stimulus effort. These measures include rate cuts and specific adjustments to support the real estate sector, a central pillar of the Chinese economy. Existing mortgage rates will be aligned with those of new loans, with an average reduction of 0.5 points. This initiative is expected to ease household burdens by around 150 billion yuan per year, thereby boosting consumption capacity. In total, China could inject nearly 130 billion euros into its economy, marking the first such large-scale stimulus since the global financial crisis of 2008.

The blurred boundary between monetary and fiscal policy

Although no new fiscal measures have been officially announced, it is crucial to remember that the line between fiscal and monetary policy in China is often blurred. Many of the PBoC’s actions, such as strengthening the capital base of major banks or exchange facilities, are in fact akin to fiscal measures in disguise. This clearly demonstrates Beijing’s growing awareness of mounting economic and social pressures. However, for this rebound to turn into a sustainable recovery, deeper structural reforms are needed. China is not yet at a stage equivalent to the “Whatever It Takes” pronounced by Mario Draghi in 2012, but it seems to be getting closer. Like Japan’s “Abenomics”, any strategy to revitalize the Chinese economy will have to rest on three essential pillars:

- Massive stimulus measures to boost domestic demand.

- Debt reduction programs for local governments, combined with a new incentive structure to encourage technocrats to adopt pro-growth policies.

- A credible commitment to domestic private enterprise and foreign investors, reaffirming Beijing’s determination to pursue liberal reforms.

Reforms Expected by Year-End

China’s political calendar indicates that significant measures are anticipated during key upcoming meetings, particularly the Politburo and the Central Conference on Economic Work at the year’s end. However, these initiatives will require time to materialize, and investors will need to wait for assurances before fully committing to the notion of a sustainable economic recovery. Nonetheless, these signals are encouraging and reflect Beijing’s strong resolve to rejuvenate its struggling economy.

Japan: The BoJ is in No Rush

Kazuo Ueda, the Governor of the Bank of Japan (BoJ), recently stated that the yen’s appreciation over the past two months has helped mitigate inflationary risks, making a rate hike less urgent in the short term. He downplayed the likelihood of an interest rate increase in 2024, despite the continued positive trends in the economy and prices. However, Ueda reaffirmed that the Bank could adjust its accommodative monetary policy if economic and price targets are met, noting that real interest rates remain low. The decision by the Board to maintain the rate at 0.25% was widely anticipated, although it followed a surprising 15 basis point hike in July, which had a significant impact on the economy due to carry trade unwinding.

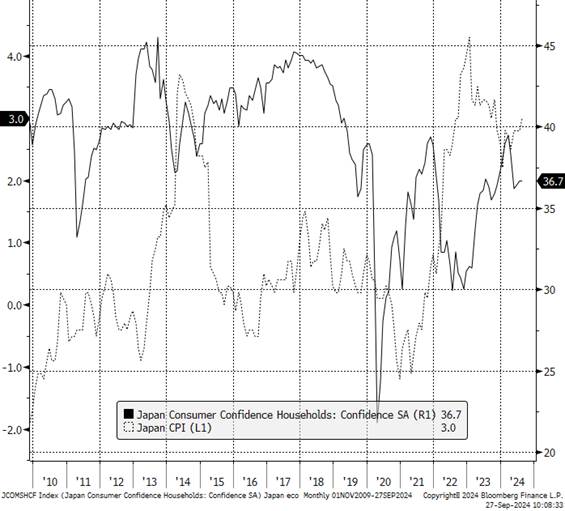

Rising Inflation in Japan

August inflation data revealed an acceleration in price increases. Year-on-year, inflation rose to 3%, up from 2.8% the previous month, while core inflation increased by 10 basis points to also reach 2.8%. Month-on-month, the rise was even more pronounced, with inflation climbing from 0.2% to 0.5%. Kazuo Ueda also emphasized that the Bank would closely monitor financial market volatility and the U.S. economy to assess whether the Federal Reserve could successfully orchestrate a “soft landing.” However, U.S. economic data since August has shown signs of weakness. A recession in the United States could dampen the wage increases expected for 2025, despite gains observed following the wage agreement in April.

USD versus JPY

Moderate Optimism and Revision of Consumption Outlook

The BoJ’s Board has maintained its overall assessment of the economy while slightly raising its outlook for private consumption. The Bank anticipates economic growth to exceed Japan’s potential growth rate, despite the effects of rising prices. The BoJ aims to express confidence in the recovery of domestic consumption, bolstered by improved wages, including in small businesses.

“Looking at consumption data and other indicators, the Japanese economy is on the right track and evolving in line with our forecasts. We could have even revised our inflation forecasts upward based on domestic data. However, the increasing uncertainty surrounding the U.S. economic outlook somewhat moderates our optimism regarding inflation forecasts,” Ueda clarified.

Consumer confidence and inflation

Upcoming Key Economic Events

The results of the Tankan survey on business sentiment, scheduled for October 1, along with branch manager reports expected at the quarterly meeting on October 7, will be closely monitored. The next meeting of the BoJ Board is set for October 30 and 31.

Business survey in Japan