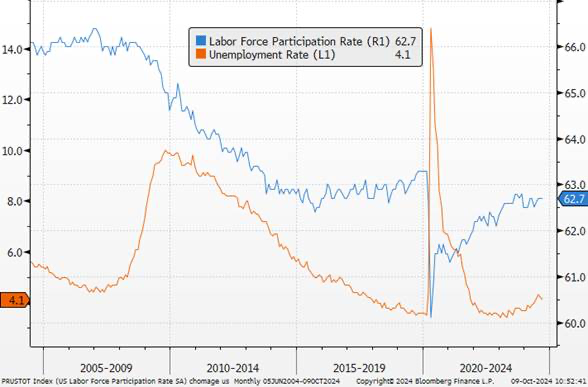

The significant rebound in U.S. employment suggests that the Federal Reserve could slow the pace of interest rate cuts after an aggressive start to its rate-cutting cycle, and may even consider a pause in reductions if this trend continues. Data released by the Department of Labor on Friday showed an increase of 254,000 jobs in September and a drop in the unemployment rate to 4.1%.

Unemployment Rate and Participation Rate

In September, Fed officials stated that they planned to lower interest rates more quickly, partly because they expected a steady rise in unemployment to 4.4% by the end of the year. We believe that, based on recent statements, there should be a 25 bps reduction in both November and December. We do not support a 50 bps cut. This confirms our expectations.

A pause at the beginning of 2025 is quite plausible. There could even be a pause as early as December if we get another strong jobs report, and perhaps inflation data will be slightly higher. We have already explained the reasons for a 50 bps cut in September. However, the labor market is, and was, strong, and inflation remains high.

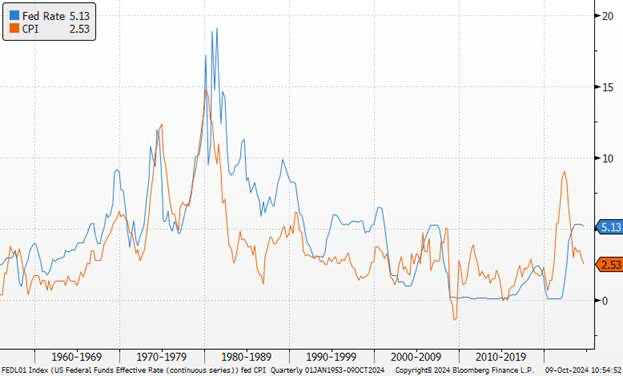

Fed Rates and Long-Term Inflation

If the data continues to be strong, the Fed might not cut rates again this year, though this is not our base scenario. Fiscal support remains strong, and a wealth effect from high asset prices is contributing to a solid economy, which saw 3% growth in the second quarter. One thing is certain: FOMC members do not want to lose the battle against inflation.

One factor prompting Fed officials to slow down is the possibility that inflationary risks have not yet fully dissipated. Even though we are not currently worried about a re-acceleration of inflation, the prospect that it could simply stabilize at an uncomfortably high level remains a significant risk. The Fed’s main challenge is to avoid having to raise rates again, by reducing them much more gradually, with prolonged pauses in between.

These new outlooks have pushed long-term rates above 4%, compared to 3.60% in mid-September. Our scenario for long-term U.S. rates is therefore taking shape.

U.S. 2-Year and 10-Year Rates

Regarding U.S. rates, we believed that the Fed’s actions, which have steered the economy away from recession, should lead to a steepening of the yield curve through the stability of short-term rates (2 years) and a moderate rise in the long end. In September, we lowered our duration targets on sovereign bonds (by reducing our positive outlook on bonds in our asset allocation in favor of short-term cash). We wrote that “Any increase in long-term U.S. rates beyond 3.95% will be an opportunity to reposition.”

Even though we might see long-term rates reach higher levels, we believe that the current level indeed provides an opportunity to reposition.