1. U.S. Inflation: The Rate Cut Could Be More Moderate Than Expected

2. China: After the Stimulus Announcements, Implementation Details Under Scrutiny

3. Geopolitical Tensions Impact Oil

4. Chart of the Week: Chinese vs. Japanese Rates

U.S. Inflation: The Rate Cut Could Be More Moderate Than Expected

In September, inflation in the United States slowed, but less than anticipated, mainly due to stronger-than-expected core CPI inflation. However, this slight surprise is not expected to jeopardize the possibility of the Federal Reserve (Fed) cutting interest rates by 25 basis points at its next meeting, scheduled for November 7. In August, inflation and employment figures had already paved the way for the Fed’s first rate cut, which was implemented on September 18. However, after the release of September employment data and the Consumer Price Index (CPI) report published this Thursday, market expectations have somewhat shifted. The expected rate cut for the Federal Open Market Committee (FOMC) meeting on November 7 may now be 25 basis points, down from the 50 basis points initially considered at the end of summer. The annual consumer price index, calculated by the U.S. Bureau of Labor Statistics (BLS), declined for the sixth consecutive month, reaching 2.4% in September (down from 2.5% in August). However, this figure remains above forecasts, which expected 2.3%. On a monthly basis, inflation rose by 0.2%, slightly above the expected 0.1%. This slowdown is mainly attributable to falling energy prices (-6.8% year-on-year and -1.9% month-on-month), although these prices could rise again in October. Food prices, on the other hand, have started to increase, reaching 2.3% year-on-year and 0.4% on a monthly basis.

Core inflation, which excludes volatile items like energy and food, also surprised by reaching 3.3% year-on-year, slightly above expectations (3.2%), and 0.3% month-on-month. Although this figure is disappointing, the six-month annualized trend, closely monitored by FOMC members, fell to 2.6%, its lowest level since early 2021. Yields on 10-year U.S. Treasury bonds rose slightly, from 4.08% to 4.10%, but this did not affect market expectations regarding a Fed rate cut. Futures markets are still betting on a 25-basis-point reduction in November, as well as three to four additional cuts by March 2024.

In detail, goods prices continue to decline year-on-year (-1% after -1.9% in August), although they increased slightly month-on-month (+0.2% after -0.2%). Prices for new vehicles fell by -1.3% year-on-year but rose by +0.2% month-on-month. Used vehicle prices, however, fell less sharply: -5.1% year-on-year, with a +0.3% monthly increase. Clothing prices, as often in September, rose by 1.8% year-on-year and 1.1% month-on-month. Other sectors, such as recreation (-1.5% year-on-year, -0.3% month-on-month), technology (-7.9% year-on-year, -1.2% month-on-month), and pharmaceuticals (-1.6% year-on-year, -0.7% month-on-month), recorded declines.

It is in the services sector where price increases persist, with annual growth of 4.7% and a monthly rise of 0.4%. Transportation prices, in particular, surged by 8.5% year-on-year and 1.4% month-on-month, due to rising airfares (+3.2% in September after +3.9% in August). Lastly, auto insurance continues to soar, with an annual increase of 16.2% and a monthly rise of 1.2%. In the housing sector, which accounts for 36.5% of the overall index, prices slowed slightly, with annual growth of 4.9% (down from 5.1% in August) and a monthly increase of 0.2 (down from 0.5% in August). This is seen as encouraging for the future trajectory of inflation.

In the end, despite some surprises, the report should reassure markets about the health of the U.S. economy, which does not appear to be overheating. Inflation remains under control, likely allowing the Fed to continue its rate-cutting cycle, while closely monitoring upcoming risks, particularly the potential rise in oil prices and political uncertainty ahead of the U.S. elections..

Our Opinion: Like employment, inflation is a factor encouraging Fed officials to slow down, with the possibility that inflationary risks have not yet completely dissipated. Although we are not currently concerned about a re-acceleration of inflation, the prospect that it may simply stabilize at an uncomfortably high level remains a significant risk. The key challenge for the Fed is to avoid needing to raise rates again, by reducing them much more gradually, with prolonged pauses.

China: After the Stimulus Announcements, Implementation Details Under Scrutiny.

After a week of market closures (Golden Week), the reopening already sends mixed signals regarding investor sentiment, especially following comments from Zheng Shanjie, the head of economic planning. Since the announcement of major stimulus measures, Chinese stock indices saw significant gains, but the rise observed this morning was notably reduced as the details provided by Zheng Shanjie seemed to fall short of the hopes raised in recent days. While the economic planning head expressed “confidence” in achieving the 5% growth target for 2024 and deemed it attainable, he did not provide specific details about the amounts associated with the fiscal stimulus. According to him, the stimulus will focus on “households’ capacity to consume and invest,” through support for goods trade, disadvantaged and elderly people, and natality.

Furthermore, he mentioned that part of the new issuances planned will be drawn from next year’s budget (100 billion yuan), while several media reports have suggested support between 1 and 3 trillion yuan. Substantial support would be welcome to revive Chinese growth, which has been heavily impacted by the struggles in the real estate sector and weak domestic demand. In the absence of large-scale structural reforms, the economic trajectory will remain compromised in the coming years (demographic decline, the liquidity trap in the financial system, limited fiscal room for maneuver, the party’s tight grip on the economic environment, low inflation, and trade confrontations with the United States).

Msci world versus Msci China

Sources : Bloomberg , Groupe Richelieu

Our Opinion: We had long been waiting for a first move from the Fed to become more constructive on China. While China is not yet at the stage of “Whatever It Takes,” it seems to be moving closer. These initiatives will take time to materialize, and investors are looking for assurances before fully trusting in the growth recovery. Up until the Fed meeting, we were negative on this market. However, this new awareness is an encouraging sign, and we are now more optimistic about the prospects for Chinese assets.

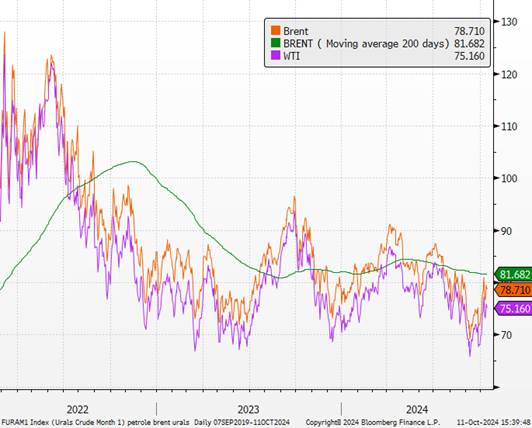

Geopolitical Tensions Impact Oil

The oil market is once again facing growing geopolitical uncertainties. On October 7, Brent prices surged by more than a dollar and a half, crossing the $80 per barrel threshold. This rise reflects heightened concerns over Israel’s impending response following the Iranian strikes on October 1, with the possibility of reduced oil exports from Tehran looming in the background. Since the start of the Israel-Hamas conflict a year ago, the oil market has experienced several periods of stress. However, this time, the speed and scale of the increase indicate stronger investor apprehension. Within a week, Brent, the global benchmark for crude oil, surged by over 10%, marking its fastest revaluation in nearly two years.

Despite this spike, oil prices remain aligned with levels observed over the past two years. In September, Brent even closed below $70 for the first time since December 2021, making the current rebound more moderate in a context of ongoing decline. Therefore, the recent price recovery should be viewed cautiously, especially as doubts about global demand, driven by China’s economic slowdown, persist.This return to higher prices could, however, signal a further spike if tensions in the Middle East worsen. Three concerning scenarios are being considered: attacks on Iranian oil infrastructure, strengthened economic sanctions against Tehran by Western countries, and an escalation of the conflict that could disrupt tanker traffic in the Strait of Hormuz, a crucial route for global oil supply.

Despite these risks, the market might find balance thanks to OPEC. While Iran produces 3.5 million barrels per day (bpd), its exports reach only 1.75 million bpd, less than a third of Saudi Arabia’s output. The Organization of the Petroleum Exporting Countries, led by Riyadh, could easily compensate for these losses. OPEC members are currently following a supply reduction policy to support prices, which is expected to end in December.The key question now is whether OPEC members will take advantage of any potential disruption to increase their production and gain market share, or simply benefit from the price rise. According to options markets, there is roughly a 5% chance that prices will rise by $20 per barrel, a scenario that could materialize if there is a 2 million bpd supply interruption over six months, without OPEC intervention. Goldman Sachs revealed that these speculative positions, while marginal, are at historically high levels.

Brent and WTI Prices

Sources : Bloomberg, groupe Richelieu

Our Opinion: The oil market remains under pressure, and volatility could intensify depending on upcoming geopolitical events, particularly Israel’s response and OPEC’s stance. The Saudi kingdom is ready to abandon its target of $100 per barrel and increase its production. The goal: to regain lost market share, particularly to the United States. Saudi Arabia had maintained its production levels to preserve market share, even if it meant lower prices. In November, OPEC decided not to cut production despite the oversupply. We have lowered our 12-month upper range to $75.

Chart of the Week: Chinese Rates vs. Japanese Rates

Sources : Bloomberg, groupe Richelieu