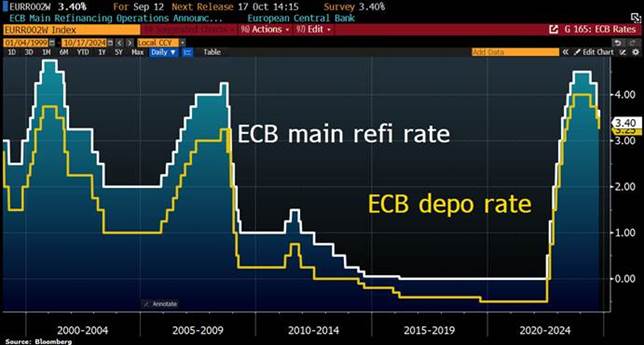

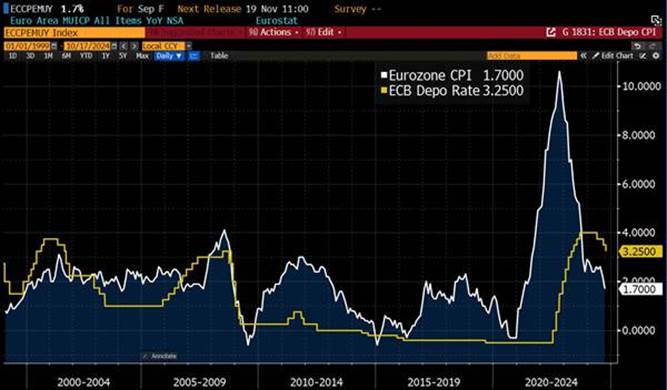

The European Central Bank lowered its interest rates by 25 basis points for the second consecutive meeting on Thursday, stating that the disinflation process was “well underway” and that it would continue to take a meeting-by-meeting approach.

The latest data shows that the inflation downturn process is continuing as the ECB wishes..

“We will continue to do exactly the same,” said ECB President Christine Lagarde at a press conference, adding that the decision to cut rates had been made unanimously due to lower-than-expected inflation data and a weaker economy.

“I’m not sure we had anticipated this 1.7%, but neither did anyone else,” she said, referring to the downwardly revised September inflation data, adding that the eurozone was on track to sustainably reach its 2% inflation target by 2025.

The final inflation figure for September has been revised downward from its flash estimate, from 1.8% to 1.7%. Core inflation stands at 2.7%. All trimmed inflation measures are once again declining. Out of the 73 components of core inflation, 40 are contributing to its decrease, notably air and rail transport, and restaurant services. A few components are actually contributing to the increase: furniture (a volatile category), vehicles, holiday packages, and transport insurance.

There is still a balance of risks regarding missing or exceeding this target, but there are “probably more downside risks,” she added. “Have we broken the neck of inflation? Not yet. Are we in the process of doing it? Yes,” she asserted..

The risks to economic growth are tilted to the downside, said Lagarde, adding, “We are concerned about growth insofar as it impacts inflation.”

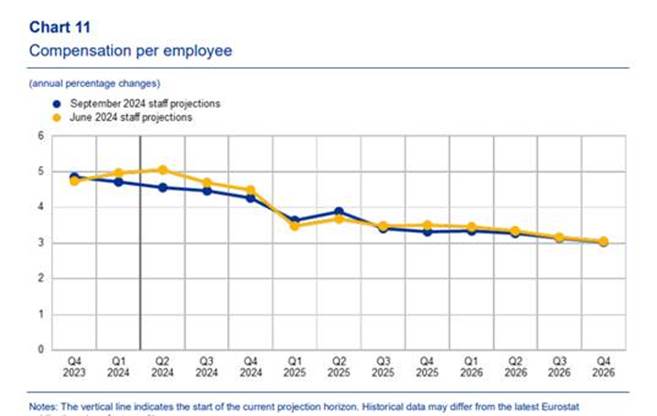

There are also risks in both directions for inflation, with higher-than-expected wages potentially playing a role, as well as geopolitical tensions in the Middle East, which could influence prices either upward or downward. The growth of unit labor costs is expected to decline significantly. The rise in unit labor costs has already decreased from its historically high levels in 2023 to an estimated 4.7% in the second quarter of 2024. It is projected to fall further, and sharply, to reach 2.1% by 2026. This reflects the expected productivity gains, along with a decrease in wage growth.

Wage growth in the Eurozone.

As we had anticipated, the decision in December will depend on incoming data and new economic projections, Lagarde explained.”I haven’t opened anything at all. At each meeting, we will review the data,” said Lagarde, emphasizing that the decision to cut rates in October was a “perfect example of data dependency.” It is worth noting that, at the last meeting in September, a rate cut in October had been almost ruled out.

The ECB is not currently forecasting a recession in the Eurozone, although it remains concerned about growth. The economy is not rebounding as strongly as the ECB had expected, but it does not foresee a recession and still considers a soft landing as the most likely scenario. The ECB believes that financial conditions remain restrictive (and will continue to be so as long as necessary), even though there has recently been a slight rebound in credit demand within the Eurozone..

Regarding the reduction of the ECB’s balance sheet, reinvestments under the PEPP will stop at the end of 2024 (-€7.5 billion per month since July 2024).

As for the implications of the U.S. elections and the potential impact of a Donald Trump victory on the ECB, Lagarde responded that any increase in tariffs would have a negative effect on the Eurozone economy. They believe it would have a deflationary impact in the Eurozone. (See Flash: Economic Repercussions of a Second Trump Term on the Eurozone)

The larger-than-expected economic slowdown supports these forecasts and should allow for a quicker return to the 2% target. Another 25 basis point cut in December seems more than likely, especially as the negative growth outlook is strengthening and worrying the ECB.

ECB rateversus Inflation

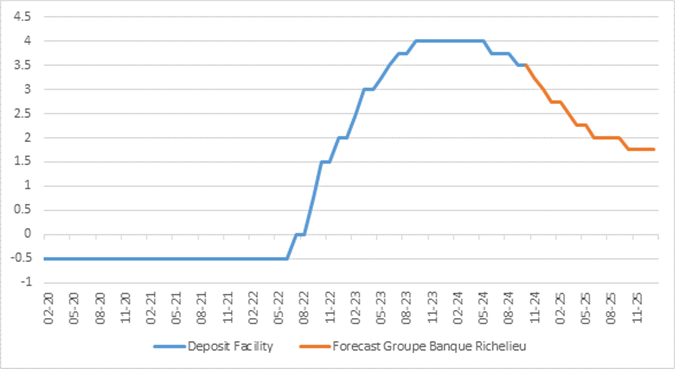

Our scenario anticipates the deterioration of recent activity indicators, the easing of wage pressure, and the continued decline in inflation. As a result, the scenario of successive 25 basis point adjustments at each meeting starting in December is becoming more likely, with a terminal rate expected to reach 1.75% by the end of the year (with a rate of 2% by June 2025).

ECB Deposit Facility Rate and Expectations

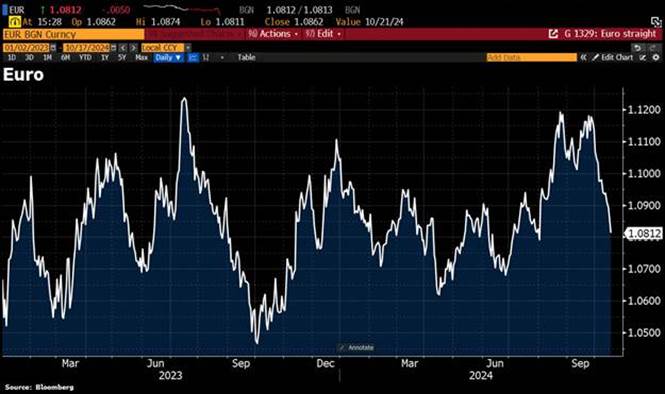

Regarding the Euro-USD, since the beginning of the year, we have maintained a range between 1.07 and 1.12. We believe that the dollar should continue to strengthen in the short term, as expectations of rate cuts in the U.S. are tempered due to the resilience of the labor market, unlike in the Eurozone.

Euro versus USD