Despite significant uncertainty surrounding both the outcomes of the U.S. elections and the behavior of assets in the aftermath, we aimed to evaluate the most probable scenarios for the latter.

Beyond the short term, the impacts will depend on the order of implementation of the economic program. For instance, if D. Trump begins with tax reform and delays trade wars, it could be very favorable for U.S. assets, as was the case in 2017, but it would endanger the disinflation trend that has begun in the United States.

The anticipation of a Trump victory has exerted upward pressure on the dollar and interest rates, amid a potential increase in the deficit and an inflationary agenda.

Regarding U.S. equity markets, uncertainty remains high. In the very short term, the reaction could be positive if markets focus solely on tax cuts. So far, U.S. equities have shown resilience in the face of rising interest rates, which accompanies the increasing likelihood of Trump’s reelection. However, markets have largely priced in this scenario already, which could lead to some disappointment upon the announcement of a victory. The protectionist risk continues to pose a threat to international equities, especially due to the persistent weakness in economic growth. A significant rise in the dollar would also pose an additional hurdle for emerging market assets, which are particularly vulnerable to such pressure.

A Kamala Harris victory would be more favorable for sovereign rates and corporate bonds, preserving the Fed’s path of rate cuts.

For the eurozone, the implementation of Trump’s program would have negative economic consequences, prompting the ECB to intervene more forcefully.

As for the dollar, which has been bolstered in recent weeks by the expectation of a Republican victory and anticipation of higher U.S. rates, a Kamala Harris win could lead to a rebound of the euro toward 1.12.

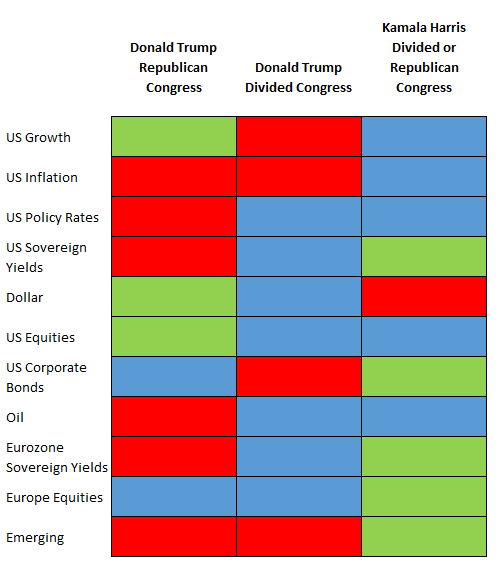

The attached table provides a summary of our views on market reactions post-election, highlighting the three scenarios we consider most likely.