- Markets Alarmed by French Debt

- A U.S. Treasury Secretary to Implement Trumponomics

- Eurozone: A Decline in Consumer and Business Confidence

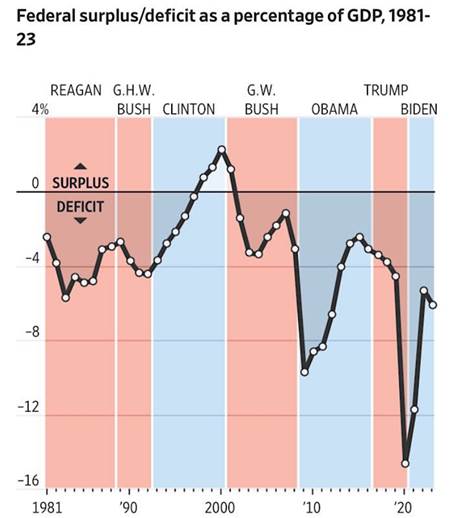

- Chart of the Week: U.S. Budget Deficit Over the Long Term

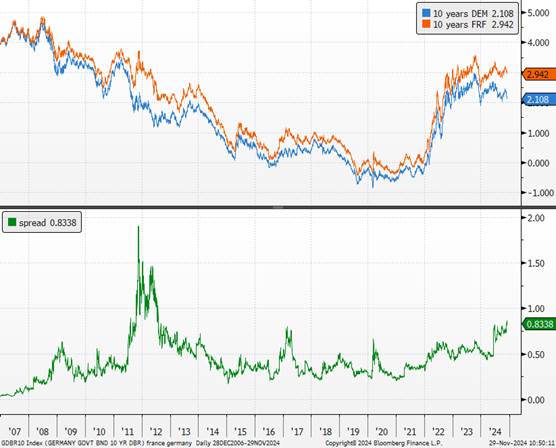

Markets Alarmed by French Debt

French debt is raising fresh concerns in financial markets, exacerbated by President Emmanuel Macron’s dissolution of the National Assembly, which had already led to a widening of the OAT-Bund spread. Between Tuesday evening and Wednesday morning, this spread surged to 90 basis points, its highest level since the Eurozone crisis in 2012. Speaking on TF1 on Tuesday night, the Prime Minister warned that a financial “storm” could hit if the government’s budget proposals were rejected and the executive were overthrown. Despite the lack of a parliamentary majority, the government still has constitutional tools to pass the state and social security budgets by the end of the year.

Article 49.3 allows the adoption of a text without a formal vote, while Article 47 permits the implementation of necessary budgetary measures to ensure the functioning of the state in case of deadlock, as constitutional experts have pointed out. However, the threat of a no-confidence motion has gained credibility in recent days. The National Rally has hinted it might join forces with La France Insoumise and other deputies from the New Popular Front to bring down the government. If such a motion were adopted in early December, Emmanuel Macron would have the option to appoint a new Prime Minister and form a technical government to incorporate some opposition proposals, while once again relying on Article 49.3 to pass the budget. A potential no-confidence vote, however, could draw greater investor attention to France’s institutional fragility and the political gridlock that might persist until July 2025, before which the National Assembly cannot be dissolved, and new legislative elections cannot be called.

In the short term, another source of tension looms: the upcoming evaluation of French debt by Standard & Poor’s, expected on November 29. Despite a budget deficit projected at 6.2% of GDP in 2024, analysts consider a downgrade of France’s sovereign credit rating unlikely. However, the “stable” outlook could come under pressure, introducing additional uncertainty. Tensions may also escalate during the holiday season if the budget is only passed at the very end of the parliamentary session on December 20, a period when market liquidity is particularly thin. Investment banks estimate a 30% probability of the government falling, a scenario that could push the OAT-Bund spread closer to Italian levels, around 125 basis points.

For now, debt auctions conducted by the French Treasury Agency are proceeding without disruption, as investors continue to absorb issuances despite political turbulence. These participants appear to factor into their analyses considerations that go beyond purely budgetary and institutional uncertainties. Meanwhile, the European Commission on Tuesday praised France’s medium-term budgetary and structural plan. This framework, evaluated within the first package of the European Semester and the new fiscal rules, includes corrective commitments on spending trajectories as part of the excessive deficit procedure.

Our Opinion: Spanish and Italian sovereign bonds are expected to outperform their German and French counterparts, supported by relatively strong macroeconomic fundamentals and proactive fiscal policy management. In 2025, net sovereign bond issuance in the Eurozone is projected to reach approximately €770 billion, a level higher than in 2024. France will be the largest issuer, thereby increasing supply in the secondary market. We remain bearish on French assets.

French 10-Year Yields vs. German 10-Year Yields

A U.S. Treasury Secretary to Implement Trumponomics

Donald Trump’s appointment of Scott Bessent as Treasury Secretary has brought relief to financial investors regarding the trajectory of public finances, reflected in the drop in U.S. sovereign yields and the dollar’s decline against major currencies this morning. Scott Bessent, founder of the investment firm Key Square Group, has long been concerned about the size of U.S. debt and believes the most effective way to reduce it is by stimulating growth to increase tax revenues.

Bessent has advised Trump to take inspiration from the policies implemented in Japan by Shinzo Abe, based on three pillars (a “3-3-3” policy):

- Reducing the budget deficit to 3% of GDP by 2028,

- Targeting 3% GDP growth through deregulation,

- Increasing oil production by 3 million barrels per day to lower prices.

Scott Bessent aims to implement Donald Trump’s economic program (“Trumponomics”) through cost reductions, deregulation, and private investments. His priorities include extending the 2017 tax reform (set to expire by the end of 2025) and eliminating taxes on tips, Social Security benefits, and overtime pay. However, he emphasizes that these tax cuts must be offset to reduce their fiscal impact, either by cutting other public expenditures or increasing revenue. For instance, Bessent proposes freezing discretionary non-defense spending or eliminating certain provisions of the Inflation Reduction Act, particularly subsidies for electric vehicles. To achieve these goals, he will rely on Russel Thurlow Vought, who served as director of the Office of Management and Budget from 2019 to 2021. In a recent interview, Bessent stated that he also intends to focus on implementing tariffs, maintaining the dollar’s status as the world’s reserve currency, and overseeing the Federal Reserve.

Oil prices

Our Opinion: These policy positions offer financial investors hope that the economic strategy to be implemented will avoid a deterioration of public finances and debt, which would have reignited concerns about debt sustainability and a surge in sovereign yields. The appointment of Scott Bessent reinforces our scenario of a “moderated Donald Trump,” likely putting an end to the rise in sovereign yields and the dollar. We believe Donald Trump views lower energy prices as a dual strategy: first, to counter the inflationary effects of his program and satisfy American consumers (a key factor in the election outcome), and second, as leverage on Russia to engage in conflict resolution. Additionally, Saudi Arabia’s desire to gain market share, particularly in the U.S., could be intensified if the U.S. supports increased production. Our targets remain $65–$75 per barrel, with additional downside risk if U.S. crude production rises further or if sanctions on Russian oil are eased, undermining OPEC’s position.

Eurozone: A Decline in Consumer and Business Confidence

The latest economic data from the Eurozone reveal a decline in consumer and business confidence, although some indicators show signs of stabilization.

In November, the French household confidence index fell for the second consecutive month, dropping from 93 to 90 points, according to INSEE. Households are increasingly pessimistic about their future standard of living, financial prospects, and fears related to unemployment, which have risen significantly.In Germany, the GfK consumer confidence index also declined, losing 4.9 points to reach -23.3, its lowest level since May 2024. German consumers express growing concern about the economic outlook, income expectations, and job security, particularly due to corporate bankruptcies. The propensity to buy has slightly weakened.

Germany remains a cause for concern. The IFO business climate index recorded another drop in November, reaching its lowest point since the COVID-19 crisis in the industrial sector. By sector, industry continues to be heavily impacted, along with construction and services. However, a slight improvement was noted in retail and wholesale trade, though levels remain low. The IFO’s economic clock remains in crisis territory.

At the European level, the European Commission’s Economic Sentiment Indicator (ESI) was nearly stable in November (+0.1 points to 95.8). Business sentiment in the industrial sector improved modestly (+1.3 points), driven by higher order books and production expectations. Conversely, the services sector saw further deterioration. Geographically, the ESI worsened in Germany and, to a lesser extent, in Italy. By contrast, France and Spain showed a strong rebound, offering a slightly more positive outlook compared to PMI indices.

An encouraging note comes from the biannual investment survey: for 2025, the proportion of companies anticipating an increase in investments exceeds those expecting a reduction, marking a break from the intentions expressed for 2024.

On the credit front, loans to the private sector grew by 1.6% year-on-year in October, maintaining a stable pace compared to September. Loans to households show a slight acceleration (+0.8% after +0.7%), as do loans to businesses (+1.2% after +1.1%). However, flows remain weak: loans to businesses amounted to just €3 billion in October, down from €16 billion in September, while loans to households held steady at €9 billion, supported by an increase in consumer loans that offset a slight slowdown in housing loans (€6 billion versus €7 billion in September).

Despite these trends, high interest rates continue to weigh on credit recovery, limiting medium-term growth prospects.

Macroeconomic Surprise Indicators

Our Opinion: During the last ECB meeting, central bank members expressed greater concern over weaker-than-expected economic activity compared to September’s projections, rather than inflation trends. We believe the deterioration in Eurozone growth prospects, potentially exacerbated by the confidence effects of Donald Trump’s forthcoming trade policies, will prompt the ECB to continue lowering key interest rates in December and throughout 2025, while adopting a more accommodative monetary policy in 2025.

Chart of the Week