US: Growth at all costs

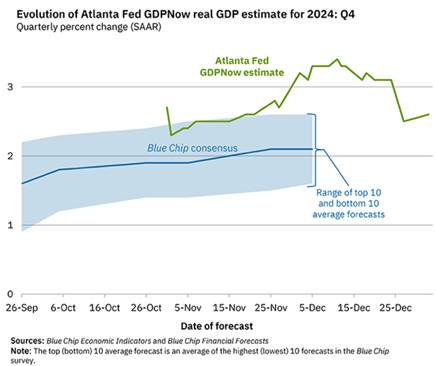

Overall, we believe that Donald Trump’s economic program will have a positive effect on activity in the short term, but that the negative effects will eventually prevail by 2026. The overall impact remains uncertain, however, and will depend on the timetable for implementation, as well as on the measures ultimately adopted. The Atlanta Fed’s GDPNow nowcasting indicator still forecasts growth of 2.6% in the fourth quarter, a level above potential growth. However, the trade war will create uncertainty and inflation. There is a risk that households will gradually lose purchasing power as companies pass on additional costs.

Consumers: consuming for now

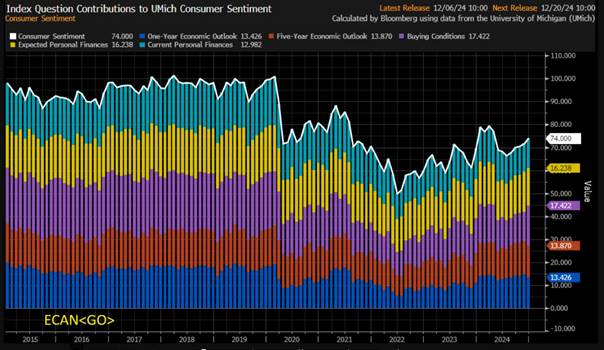

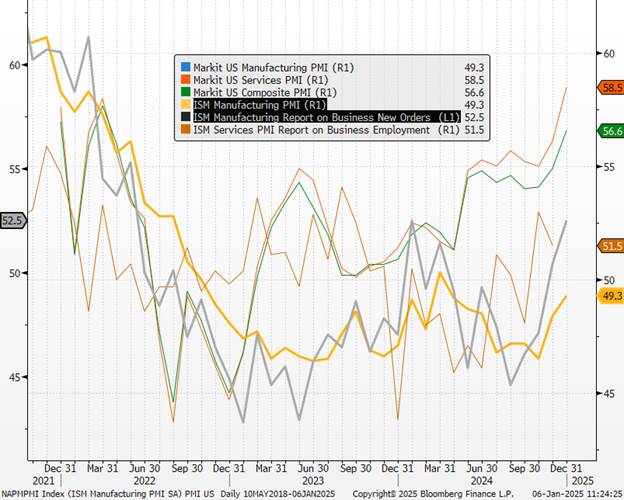

At consumer level, the signals remain positive for the time being, supporting the country’s short-term growth. Net nonfarm payroll job creation, which had dipped in October due to the vagaries of the weather and strikes, rebounded more than the consensus forecast in November, even if the total number of people registered with unemployment insurance continues to rise very slowly. Consumer confidence, as measured by the University of Michigan, has continued to improve in recent months. Both the ISM and PMI surveys indicate that the US economy is growing at a steady pace.

Decomposition of the University of Michigan indicator

Companies: Trump makes you optimistic

On the business side, optimism rebounded strongly after the US presidential election. ISM manufacturing data for December showed a recovery, with the overall index rising to 49.3, while the “new orders” component reached 52.5, its highest level in a year.

The last two years have been disappointing for the US manufacturing sector. Despite extensive fiscal programs designed to support the industry, domestic production has stagnated. We believe that the new year will mark a turning point and that manufacturing output will rebound.

The main factors behind the manufacturing sector’s weakness over the past two years are the sharp rise in borrowing costs and tighter credit conditions, which have made doing business more difficult, and the shift in consumer spending towards services, after excessive consumption of goods during the pandemic.

Looking ahead, we anticipate favorable winds for the manufacturing sector. Business confidence has surged following Trump’s election, and manufacturers are optimistic about their production prospects. Spending on equipment should benefit from the boom in plant construction seen over the past three years: private companies have invested nearly a trillion dollars in these subsidized industries under the Biden administration. In addition, investment in artificial intelligence is growing strongly and should continue to do so.

Leading economic indicators

Politics: Trump and Musk at the helm

On the political front, “hopes” that Donald Trump and Elon Musk’s ambitions would be curbed by members of their own camp were dashed. In the House of Representatives, Mike Johnson managed to retain his position as Speaker thanks to Donald Trump’s intervention. Republican representatives are massively behind him.

Mike Johnson has made clear commitments to reduce the budget deficit. These negotiations are a reminder that the issue of spending cuts will be at the heart of political priorities in the United States, partially offsetting the rest of the measures sought by Donald Trump. The latter’s priorities are clear: to rapidly draw up a vast text combining tax cuts, tighter border controls and increased energy production.

Tweet from D Trump reposted by Elon Musk

While this program should have a positive effect on growth in the short term, it is also likely to support inflation to some extent, which could erode household purchasing power and force the Fed to maintain a more restrictive monetary policy.

Monetary policy: growing doubts about inflation

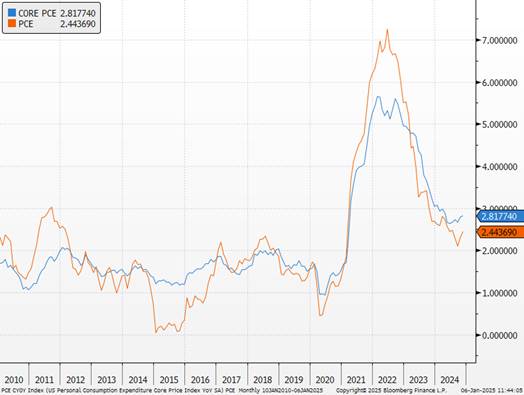

In terms of monetary policy, the risk lies more in an interruption or pause in the Fed’s monetary easing. The more inflationary environment will probably force the Fed to adopt a more restrictive policy than currently envisaged. For the time being, total inflation as measured by the PCE index came in below expectations at +2.4%, while core PCE inflation posted one of its lowest monthly variations in recent years. The contribution of “housing” to core PCE continued to fall, while that of “services excluding housing” stagnated. Although inflation figures have been encouraging in recent months, the halt to disinflation is clear, and more evidence is needed before the Fed will again consider cutting its key rates.

US inflation indicators

Beyond tariffs, it’s Donald Trump’s migration policy that raises questions for the Fed. Trump’s restrictive migration policy is likely to cause labor shortages. This will accelerate wage growth, making the new administration’s policy inflationary, even before tariffs are taken into account.

The Fed, seeking to avoid a wage-price spiral at all costs, will have no choice but to keep interest rates high for longer. For some time now, members of the central bank have been adopting a more cautious stance. We now expect a maximum of 2 rate cuts by 2025. This trend has been confirmed in recent days. Adriana Kugler (Fed Governor) and Mary Daly (President of the San Francisco Fed) rejected the idea that inflation had turned the corner, while reiterating that they did not wish to see any further deterioration in the labor market. Thomas Barkin (Richmond Fed President) said he was more concerned about being surprised by higher-than-expected growth and inflation, rather than the opposite.

Let’s not forget that, as every year, the composition of the voting members of the FOMC among the regional bank presidents changes. With the exception of Austan Goolsbee (Chicago), the new entrants (Susan Collins, Alberto Musalem , Jeff Schmid ) seem to be more hawkish than the outgoing members.

EURO zone: The list of risks to the European economy is very long

Our baseline scenario for early 2025 remains unchanged: sluggish recovery, low inflation, ECB terminal rate at 1.75% by September. The list of risks to the European economy is very long: trade tensions, energy prices, domestic politics, heterogeneous domestic growth dynamics. Risks occupy an important place, and unfortunately, bearish risks continue to dominate the continent even though it is still difficult to integrate too much trade uncertainty for the time being. Donald Trump will be blowing hot and cold in the coming weeks. Hopes of a frank and cyclical economic recovery from the Ukrainian crisis remain thwarted by a number of obstacles: European industry’s loss of international competitiveness, households’ persistent desire to save and the constraints associated with consolidating public finances. For the time being, the market is focusing on trade tensions, Chinese repercussions or energy prices, but domestic dynamics could deteriorate on their own.

Hot and cold on customs duties

Consumption: supporting sluggish growth

In the short term, European consumption should gradually show signs of recovery, driven by disinflation and a temporary rise in real wages. However, despite this improvement, savings rates remain high, reflecting increased precautionary savings motives in a context of growing uncertainty. The slowdown in retail sales seen in early autumn suggests that the main phase of consumer acceleration may already be behind us. While a fall in savings rates could encourage a stronger rebound in consumption, European households continue to prefer saving to preserve their recently regained purchasing power. Added to this, uncertainties over employment are likely to reinforce this precautionary saving behaviour.

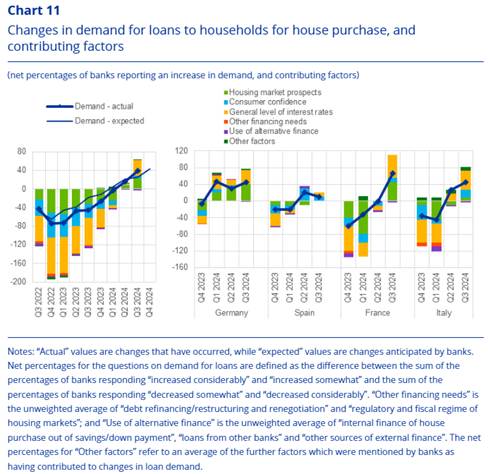

The labor market, particularly in the core countries, is showing signs of fragility. In Germany, the private sector continues to shed jobs, and the squeeze on profits, combined with a gloomy economic outlook, is putting further pressure on employment. On the household side, however, credit appears to be picking up. According to the ECB’s Bank Lending Survey for the third quarter, demand for loans, particularly mortgages, is on the rise. This recovery, accompanied by a revival in real estate investment, could underpin part of European growth in 2025, after a slowdown in 2024.

Changes in demand for loans to households for house purchases, and contributing factors

Although consumption should continue to contribute to overall growth, the fall in capital goods investment, down 4.7% year-on-year, is a major source of concern for the medium-term economic outlook.

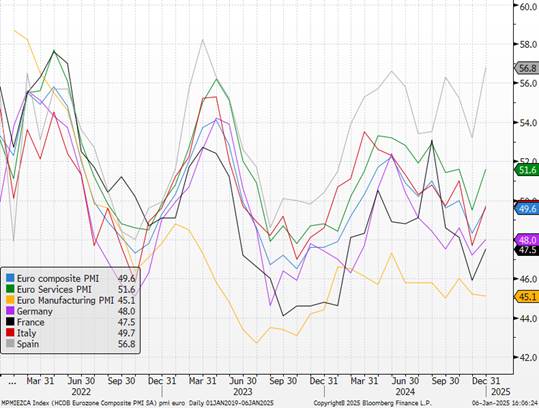

Business: confidence slowly waning

The health of companies in the eurozone has deteriorated sharply, as a result of the delayed economic recovery and the ECB’s still far from normalized monetary policy. Although the negative effects of this ultra-restrictive policy on capital investment should begin to diminish, they will only be fully felt from 2026 onwards.

The slowdown in lending to businesses, with year-on-year growth limited to +1% versus +1.2% in October, contrasts with the acceleration in lending to households(+0.9% versus +0.8% in October). Households are benefiting from lower interest rates, reflecting the ECB’s first signs of monetary easing. Businesses, however, are more cautious and finding it hard to commit, held back by an environment marked by many uncertainties.

On the political front, government instability in France and Germany, and the threat of a trade war, amplify the climate of uncertainty. This is compounded by relatively weak global demand, while companies’ order books have shrunk significantly throughout the year. In addition, European industry is facing major structural challenges, notably high energy costs and declining productivity, which are weighing heavily on its medium-term prospects.

An increase in US tariffs on European imports to 10% could reduce eurozone GDP by 40-50 basis points, analysts say. A doubling of US tariffs on European products is perhaps the most obvious risk. But in the very short term, the threat of new tariffs may actually prompt an anticipation of trade activity, as we tentatively observed prior to the introduction of tariffs by the US, Canada and the EU on Chinese electric vehicles. Anecdotal evidence of stockpiling on the US side is mounting ahead of the new president’s inauguration.

Eurozone leading indicators

Politics: instability in France and Germany

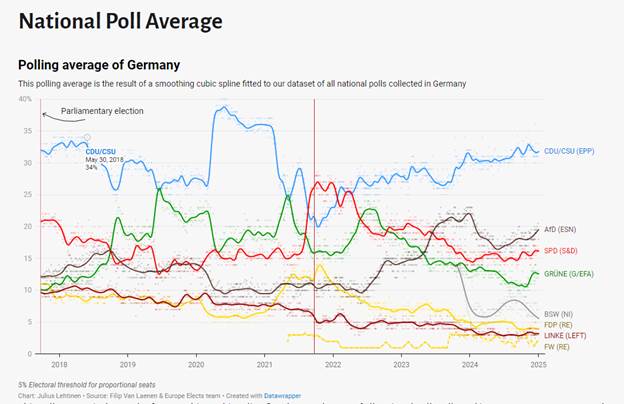

Uncertainty about growth prospects and political dynamics is particularly high in Germany and France. The 2025 budget is probably the most pressing issue for the new government led by Prime Minister Bayrou, with the new Finance Minister expressing his ambition to bring the deficit down to “slightly above 5%”, mainly via spending cuts. Moreover, the government’s ability to secure a parliamentary majority to pass a budget (or avoid a vote of no confidence) remains uncertain. The risks of further parliamentary elections over the summer remain high, reducing the likelihood of a sustainable deficit correction path. We continue to see limited potential for positive news from France. In Germany, recession risks are particularly acute, given persistent weakness in the manufacturing sector and private-sector job losses in the second half of 2024. Early elections, now confirmed for February 23, 2025, have rekindled pre-election hopes of a major overhaul of German fiscal orthodoxy.

However, it is uncertain whether the next parliament will be able to achieve the 2/3 majority required for a constitutional amendment concerning the debt brake.

Polls in Germany

Inflation: around 2%

We maintain our view that inflation in the eurozone will remain below expectations. We forecast headline inflation of 1.6% in 2025 and 2026. The recent rise in natural gas prices requires particular attention. Market prices over the five trading days to January 2 were around 6% higher than the ECB’s assumptions. A rise in inflation due to energy prices would be bad news for growth prospects and, consequently, could create noise in the communication of the more restrictive members and lead to delays in the rate-cutting cycle if the rise persisted. This rise is probably due to cold temperatures, lower inventories than last year (but higher than at the peak of the energy crisis) and the halt to Russian gas supplies via Ukraine. At this stage, we remain cautious about overestimating the potential effects on inflation and supply bottlenecks that could result from the end of Russian gas deliveries by pipeline to the EU this winter, or the next. Once again, this demonstrates the Zone’s fragility in the face of exogenous factors that are beyond the ECB’s control.

Euro zone inflation

Central bank: necessary rate cuts

In line with our growth and inflation forecasts, we anticipate that the ECB will cut its deposit rates four times, with consecutive cuts of 25 bps, to reach a terminal rate of 2.00% by September 2025. A further deterioration in growth, whether linked to trade tensions or a reversal in domestic dynamics, could however justify deeper cuts and an even lower terminal rate, a scenario that could materialize as early as this spring. The latest ECB meeting, accompanied by updated forecasts, marked a significant turning point. The restrictive bias towards “keeping rates at a binding level for as long as necessary” was abandoned.

Christine Lagarde declared: “We are approaching the stage where we will be able to say that we have brought inflation down sustainably to our medium-term target of 2%. I say this with a slight reservation, because I still think we need to be very vigilant when it comes to services.

Economists’ expectations for the eurozone in FT year-end survey

CHINA: the Trump administration’s inauguration approaches

The measures taken by the government seem to be yielding results, even if the economy is still far from having regained strong momentum. It remains dependent on further monetary easing and stronger fiscal support. .

The World Bank has taken note of the measures announced by Beijing and has revised its growth forecasts upwards. The latter is now expected at 4.9% for 2024 vs. 4.8% previously. The revision is more marked for 2025, at 4.5% vs. 4.1% respectively.

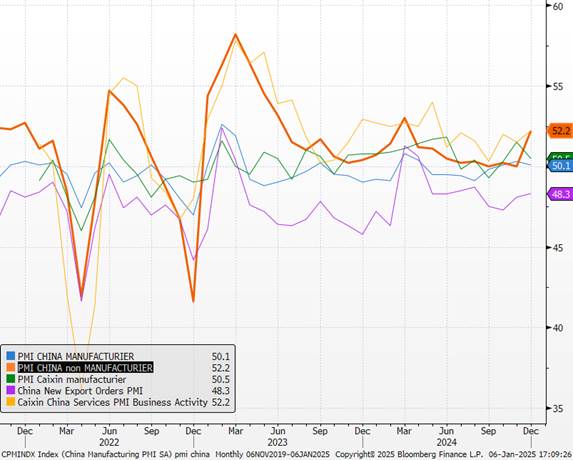

The Caixin PMI highlights the dynamism of the services sector, which contrasts with the sluggishness of industry. Indeed, the December Caixin PMI services index improved and exceeded expectations thanks to improved domestic demand, while new export orders fell for the1st time since August 2023. Business leaders are concerned about the intensification of the trade war with the United States, weighing on their business prospects for the new year. The driving force behind the Chinese economy, exports could be affected by the increase in tariffs that Trump intends to impose (an additional 10% on top of existing tariffs on Chinese products).

Chinese leading indicators

These publications send a positive signal that the support measures announced so far by the authorities are beginning to be passed on to business, but also confirm that this fiscal and monetary support will need to be stepped up in order to have a more significant impact on the economy. An improvement in domestic demand is needed to secure the next growth target, while Xi Jinping is determined to continue implementing proactive policies into 2025.

The economic situation should benefit from Beijing’s consumer support measures, which include subsidies for households, reinforcement of the social security system and wage increases for civil servants. We believe that the measures implemented by the government will enable the Chinese economy to maintain its growth rate in 2025.

2025 remains a high-risk year for China. The need to revive domestic demand in 2025 is more essential than ever, while China is likely to experience many headwinds due to the arrival of Donald Trump in the White House. The President-elect has repeatedly confirmed his intention to further toughen his tone towards China, which is likely to reignite the trade war with negative consequences for the Chinese economy.