The 3 must-know news stories of the week

1. Donald Trump becomes the 47th President of the United States: Priority given to national sovereignty

2. $500 billion in AI investments

3. Japan: A Well-Established Rate Hike Cycle

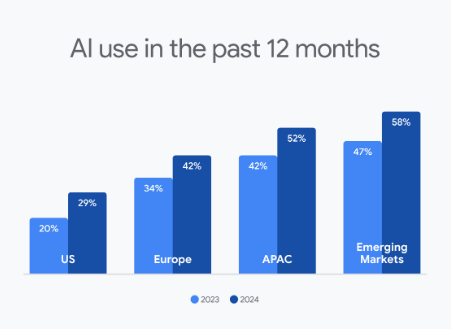

Chart of the Week: L’adoption de l’IA dans le monde entier (Etude Ipsos & Google)

Donald Trump becomes the 47th President of the United States: Priority given to national sovereignty

Donald Trump officially took office this week as the 47th President of the United States. Among his first measures, the focus is on protecting national sovereignty, particularly through a strict immigration policy. The president is considering imposing tariffs on imports from Canada and Mexico, which are accused of contributing to illegal immigration. At the same time, the administration aims to strengthen energy production and improve government efficiency through reduced public spending, increased deregulation, and a hiring freeze for federal employees.

Upon taking office, President Trump signed a series of executive orders confirming his determination to act swiftly on these issues. On the trade front, he reaffirmed his intention to reduce the U.S. trade deficit while adopting a pragmatic approach. The use of tariffs is being considered as a negotiation tool to obtain concessions from trade partners, including in Europe.

The initial announcements from the Trump administration confirm predictions of a less radical policy than initially feared, focusing on an evaluation phase before implementing more drastic measures. Regarding trade policy, the president is considering a preliminary assessment of the situation rather than the immediate application of tariff barriers, as anticipated a few weeks ago. Tariffs of around 25% on Canadian and Mexican imports could be introduced as early as February, primarily to combat illegal immigration and fentanyl trafficking. These two countries are the most dependent on the U.S. market.

For now, European partners benefit from a temporary reprieve, allowing for more open discussions with Washington. As for China, the Trump administration is taking a more measured approach, emphasizing a thorough review of the previously concluded “Phase 1” trade agreement before making any new decisions.This stance reflects an ongoing negotiation strategy.

Our opinion: These initial announcements seem reassuring regarding the new administration’s willingness to maintain a less aggressive economic policy, at least initially. Donald Trump appears willing to allow sufficient legal immigration to meet the needs of American businesses. Regarding energy, the president’s announcements, particularly the declaration of a state of energy emergency, support our scenario of declining oil prices, which also reduces inflationary risks. These prospects should also allow U.S. sovereign rates to stabilize. Our intervention range remains between 4.5% and 5%.

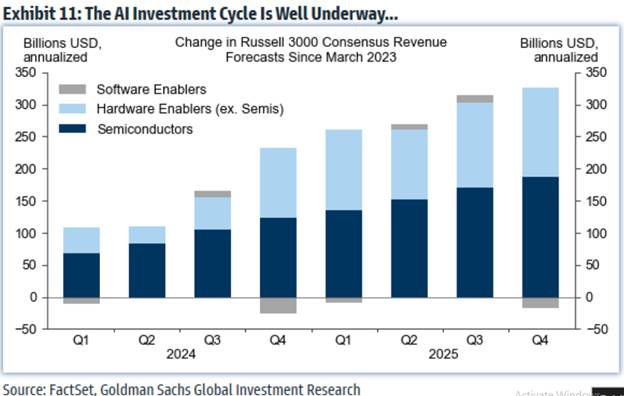

$500 billion in AI investments

The leaders of SoftBank, OpenAI, and Oracle, gathered at the White House, have unveiled an ambitious private investment project with an initial amount of $100 billion, aimed at building data centers. This commitment is part of a broader plan, projecting up to $500 billion over several years, with the goal of strengthening the United States’ position in the strategic field of artificial intelligence. The U.S. president introduced this initiative, highlighting the creation of a joint venture named “Stargate,” bringing together OpenAI, SoftBank, and Oracle. This project is expected to lead to the construction of twenty data centers, each covering an area of 500,000 square meters, and the creation of over 100,000 jobs in the United States. The initial $100 billion investment will be followed by additional contributions over the next four years.

“We are deploying cutting-edge infrastructure to support the rise of artificial intelligence and ensure that the United States remains at the forefront of this critical technology,” said Larry Ellison, Chairman of Oracle.The first data centers are already under construction in Texas. These facilities are designed to meet the growing demand for computing capacity, particularly for applications in the healthcare sector. However, questions remain about the novelty of this announcement. The U.S. president, for his part, has promised to facilitate energy access for these data centers. “AI companies require a lot of electricity, and we will ensure they can generate it easily within their own facilities,” he stated.

The issue of energy supply is crucial. With the growth of data centers and the increasing electrification of buildings and transportation, the North American Electric Reliability Corporation warned last December of an increased risk of electricity shortages in nearly half of the country over the next decade.It remains to be seen how this ambitious project will materialize, as previous presidential announcements on infrastructure—such as his $1 trillion promise during his first campaign in 2016—never resulted in significant investments.

Our opinion: These announcements are not exactly a surprise. In March 2024, the technology news site The Information revealed that OpenAI and Microsoft were working on a similar $100 billion data center project, which included an AI supercomputer scheduled to be operational by 2028. Furthermore, the announcement also echoes past commitments from SoftBank, which had already outlined a $100 billion investment program over four years. In December, during a meeting with Donald Trump, Masayoshi Son had previously shared this investment plan. However, these developments confirm that AI remains at the core of the United States’ strategic deployment, particularly in response to China. Companies across the entire value chain continue to be priority investment opportunities.

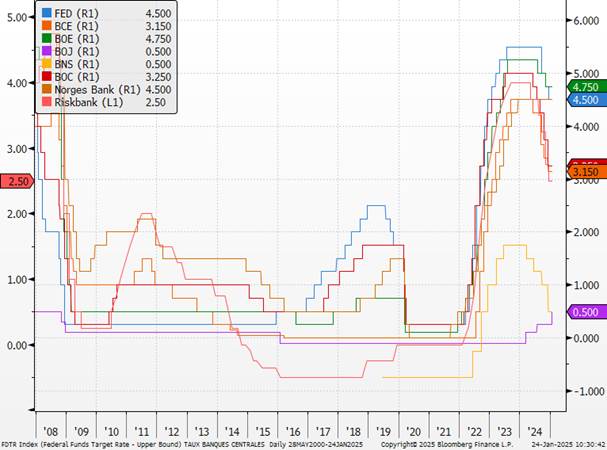

Japan: A Well-Established Rate Hike Cycle

The Bank of Japan (BOJ) has raised its key interest rate to 0.5%, its highest level in 17 years, and has adopted a more optimistic outlook on inflation. Ueda’s third rate hike in less than a year was widely expected after he and his deputy hinted last week that such a decision was in the works. The decision to wait until January to raise the rate was partly due to the need to monitor the initial reaction to Donald Trump’s return. Additionally, acting in January allows the BOJ’s monetary policy to remain separate from the political agenda, as Prime Minister Shigeru Ishiba seeks to secure a budget deal with the opposition. The BOJ emphasized in its statement the relative stability of global financial markets as a favorable factor. This stands in stark contrast to July, when the previous rate hike caught many investors off guard, contributing to a global market downturn and the largest single-day drop ever recorded in the Nikkei 225.

The rate increase followed a report released earlier on Friday, showing that consumer prices, excluding fresh food, were rising at a faster pace of 3%, well above the central bank’s inflation target. In its outlook report, the BOJ raised most of its inflation forecasts, indicating that all six projections were at 2% or higher for the first time since they began being published. While acknowledging the risk that these forecasts may still be underestimated, the central bank also reiterated its intention to continue raising rates if its economic outlook materializes. Japan is now approaching the interest rate levels of other countries, creating room to respond to future economic events in a more conventional manner if needed. The BOJ now shares the title of the world’s lowest interest rate with the Swiss National Bank, rather than holding it alone.

Central Bank Rates

Our opinion: The BOJ’s confident outlook on inflation stability is likely to reinforce the market’s perception that it will aim to raise rates at a gradual pace, approximately every six months. The relatively hawkish statement hints at further rate hikes, which could occur as early as May if wage pressures are confirmed.

If the BOJ raises rates too quickly, the yen will appreciate sharply, and import prices will fall, making it difficult to achieve the 2% inflation target. The BOJ’s rate hike is favorable for the yen, and it is likely to strengthen further. The narrowing interest rate differential will provide additional support for the yen, especially as the Federal Reserve is now perceived as slowing the pace of its rate cuts—a factor that previously amplified downward pressure on the yen.

Chart of the Week: The Global Adoption of AI

The study conducted by Ipsos and Google shows that global optimism toward AI is increasing as its use becomes more widespread. The survey reveals that 48% of respondents now use AI, and 57% are excited about its potential, particularly in the fields of healthcare and scientific research. Moreover, 74% of users are already integrating AI into their work. The majority of respondents prioritize innovation over strict regulation.

The key issues highlighted by the study include:

- Growing adoption: AI usage is rapidly expanding across various sectors, influencing the daily lives of individuals and businesses.

- Balance between innovation and regulation: Respondents prioritize innovation, but the need for appropriate regulation remains crucial to manage potential risks.

- Perception and trust: Enthusiasm is growing, but some concerns persist regarding AI’s impact on employment and data privacy.

- Beneficial applications: Healthcare and scientific research are seen as key areas where AI provides significant value.