The 3 must-know news stories of the week

1. Fed’s Message: No Rush

2. ECB: “The Disinflation Process Is Well on Track”

3. DeepSeek: A Wave of Panic?

Chart of the Week: Breakdown of French GDP

Fed’s Message: No Rush

Following its monetary policy meeting last night, the Fed unanimously decided to keep its target interest rate range unchanged (at 4.25%-4.5%) after three consecutive cuts at the end of last year. This level appears appropriate given the recent trends in U.S. growth, which remains resilient, and inflation, which has been slow to ease toward the end of the year. As a result, the Fed will wait for more favorable signals before continuing the normalization of its monetary policy. Furthermore, the improved balance in the labor market should support continued disinflation. Observing this trend will therefore be a key focus for the Fed. However, there is no pressing need to cut rates, as both the labor market and consumer spending remain strong in the U.S. With no necessity to stimulate growth, the central bank can maintain interest rates above the level considered neutral for the economy in order to support the decline in inflation.

“We want to maintain a relatively restrictive policy to encourage further progress toward 2% inflation,” said Fed Chair Jerome Powell. “And we do not need to see additional labor market weakening to achieve this goal.” This indicates that the Fed is no longer deliberately seeking to slow down the labor market, as it did between 2022 and 2024, to prevent economic overheating. In December, it had already signaled a more wait-and-see approach in 2025 after several months of higher inflation, despite significant progress made over the past year.

Unlike previous meetings, the statement released on Wednesday no longer mentions the trend of labor market softening or improvements in inflation. “The unemployment rate has stabilized at a low level in recent months, and labor market conditions remain strong.” Additionally, while Jerome Powell refrained from making any comments on the future policy of the Trump administration, this uncertainty likely weighs on the trajectory of interest rates, prompting the Fed to exercise greater caution. Repeatedly asked about the Fed’s stance regarding the tariffs proposed by President Donald Trump, Jerome Powell reaffirmed that the central bank would wait to assess the actual measures implemented by the new administration.

“I think the committee is waiting to see what policies will be adopted. We do not know what will happen with tariffs, immigration, fiscal policy, or regulatory policy,” he said. “The public must have confidence that we will continue to do our job as we always have, focusing on our tools to achieve our objectives,” added Jerome Powell, clarifying that he had had no contact with the new U.S. president.

Our View : Powell continues to consider the current monetary policy as “significantly restrictive,” suggesting that the Fed has not yet completed its rate-cutting cycle. The FOMC is in no rush to lower rates and is hesitant to make a decision before gaining more clarity on the upcoming policy changes from the Trump administration—implying that a rate cut in March is unlikely. Once the administration’s intentions become clearer, the bar is not very high for further progress on inflation to justify another cut. We continue to anticipate a disinflationary trajectory in the coming months. Our outlook remains unchanged—we have been expecting two rate cuts this year, in June and December..

ECB: “The Disinflation Process Is Well on Track”

Unsurprisingly, the ECB proceeded with another 25bp rate cut, bringing its key interest rate down to 2.75%. The press conference did not signal any major shift in messaging either. The governing council appears more concerned about growth than inflation. The decision was made unanimously, following a proposal by Philip Lane. The ECB remains confident that inflation will return to its target: “The disinflation process is well on track. Wage growth is moderating as expected, and corporate profits are partially absorbing its impact on inflation.”

Since the last committee meeting in December, data has generally evolved in line with forecasts. When asked about the limited progress in reducing services inflation, Christine Lagarde pointed out that all indicators suggest a slowdown in wage growth—whether it be employee compensation, the Indeed wage tracker, negotiated salaries, or job vacancies. “We are closely monitoring the services sector, which is largely sensitive to wages, and we are also paying attention to ‘latecomers,’ such as insurers, which tend to raise prices with a delay.”

ECB surveys indicated that businesses were less inclined to pass on price increases at the start of the year compared to 2024. The ECB remains confident in an economic recovery. The labor market remains strong, consumption is picking up, and exports should contribute to growth—unless a trade war disrupts the outlook. However, downside risks to growth persist, particularly if consumption and investment fail to recover as expected. When asked about the potential impact of the Trump administration’s U.S. policies on Europe, Lagarde stated that little concrete had been announced so far and that the ECB would take such developments into account when necessary.

Financing conditions remain restrictive, and any debate on the neutral rate is clearly premature. In the final quarter of 2024, eurozone growth stagnated. This weak performance is largely due to a contraction in Germany (-0.2% quarter-on-quarter vs. -0.1% expected) as well as in France (-0.1% quarter-on-quarter vs. stable expected), where investment and external trade have faced a new slowdown.

Our view : As stated in Davos, the normative rate is generally seen around 1.75%-2.25%. Given Lagarde’s confidence in the disinflation process, we believe that another rate cut on March 6 is highly likely. While a pause in April is still being considered, we expect the ECB to opt for another rate reduction to at least reach the upper bound of the recently communicated normative rate range. We are targeting 2%, or even 1.75%, as early as July. In this context, the euro is likely to remain weak against the dollar.

DeepSeek: A Wave of Panic?

Why Such Panic? Investors are increasingly wary of the competition posed by DeepSeek, a Chinese-made AI boasting a low-cost model. This chatbot has become the most downloaded app on the App Store, surpassing ChatGPT, developed by the American company OpenAI. More details are emerging about the startup behind this new AI model, which is free, open, and accessible to all. The open-source model on which DeepSeek is based could give rise to a new low-cost AI economy.

Developed by a startup of the same name, founded by tech prodigy Liang Wengfeng and based in Hangzhou—the “Silicon Valley” of eastern China—this chatbot offers many features similar to its American counterparts. DeepSeek was launched through a hedge fund created to leverage mathematics and AI in stock trading. High-Flyer built its first AI model in October 2016 before fully utilizing these models to develop almost all its stock market positions in 2017. It then assembled a research team dedicated to AI algorithms. High-Flyer’s commitment to fundamental AI research has made it one of the largest quantitative funds in China, according to The Economist, with its portfolio growing from 1 billion yuan (€130 million) in 2016 to 10 billion yuan in 2019. AI Under the Grip of Chinese Censorship. However, DeepSeek is heavily subjected to Chinese censorship. When asked, for instance, about the Tiananmen Square massacre in Beijing on June 4, 1989, DeepSeek states that it cannot “answer this question,” explaining that it is “guided by directives aimed at avoiding sensitive or controversial topics, particularly those related to complex historical or political events.”

A Disruptive Business Model : This chatbot has surprised experts with its ability to compete with Western counterparts, particularly in writing complex code, despite its founders claiming to have invested only $5.6 million in its development. DeepSeek has successfully reverse-engineered various tools developed by Western companies. While the prevailing trend in AI seemed to be an exponential increase in data consumption—limiting the future of AI to tech giants capable of funding ever-larger data centers—DeepSeek’s engineers have managed to create AI products at a fraction of the cost incurred by American hyperscalers.

This is a negligible sum compared to the billions spent by Silicon Valley firms to achieve a nearly identical outcome. Whereas American chatbots are built with high-performance chips unavailable to China, DeepSeek relies on H800 chips, which are accessible on the Chinese market. Additionally, its open-source code allows anyone to access and modify it, unlike its rivals, which have developed proprietary models. This means that DeepSeek does not require the most advanced GPUs to operate, significantly lowering its operational costs and enabling it to offer more competitive pricing to clients.

A Wake-Up Call for the U.S. Tech Industry? On Monday, Donald Trump called DeepSeek’s rise a “warning” for American tech firms, urging them to “stay laser-focused on competition in order to win.” Last week, the U.S. president announced a plan exceeding $500 billion to strengthen AI capabilities in the United States.

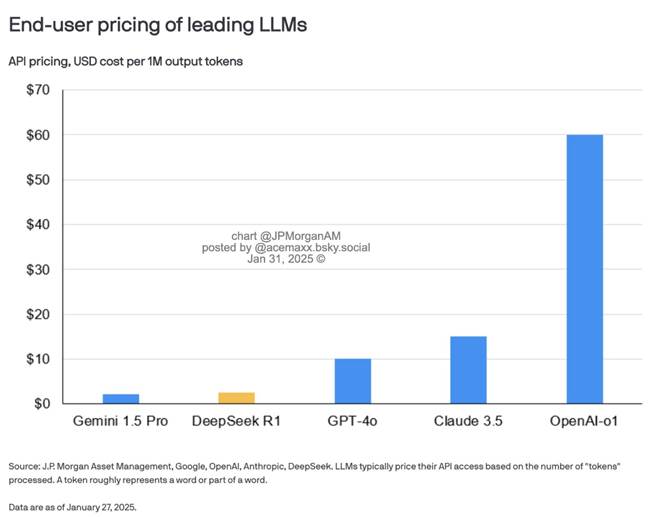

A Turning Point for the AI Economy? In summary, the “DeepSeek revolution” lies in the fact that its latest version delivers performance comparable to the latest iteration of ChatGPT—but at a cost 20 to 30 times lower for the end user. OpenAI CEO Sam Altman has publicly acknowledged the achievements of DeepSeek-R1 while promising a response with even more advanced models. Two years ago, at a conference in India, Altman confidently dismissed the idea that an emerging startup could challenge OpenAI’s dominance. According to him, training foundational models required resources far beyond the reach of new entrants in the sector.

However, early tests suggest that DeepSeek operates at only 3% to 5% of the computing cost of its competitors, making it over 20 times more efficient.

Notre avis : Many unknowns remain regarding the Chinese startup, but further announcements are expected. It is still too early to assess the viability of its business model or its security. French and Italian regulators are already questioning its operations and its compliance with user privacy regulations. What is certain, however, is that this does not challenge the ongoing AI revolution—on the contrary, it is likely to accelerate the process by lowering barriers to entry. The number of players in the sector will grow faster than anticipated, and prices will decline. The DeepSeek case is highly significant, as it could have a deflationary effect and impact the entire value chain. From a macroeconomic perspective, this could be a positive development. However, for certain companies, business models built on aggressive growth rates and high margins could come under pressure. While DeepSeek’s latest versions may have shaken investors in some firms, they should also be seen as a source of optimism for the broader market. DeepSeek highlights how competition and innovation can drive down AI costs, making it more accessible and useful worldwide…

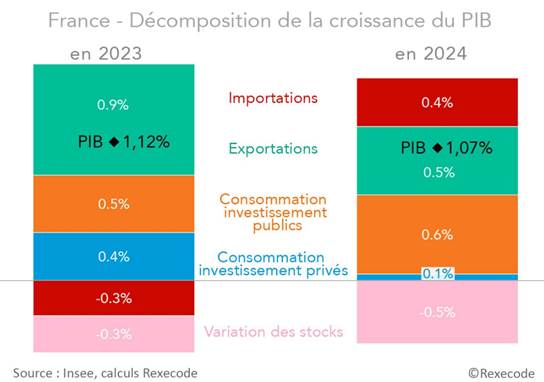

Chart of the Week: Breakdown of French GDP

France: Final private expenditures (consumption and investment) contributed only +0.1 percentage points to growth, compared to +0.6 percentage points from public spending.