The 3 must-know news stories of the week

1. A Peace Plan for Ukraine?

2. EUROPE: Towards a Sharp Slowdown in Wages in 2025.

3. The BOE Changes Its Tone.

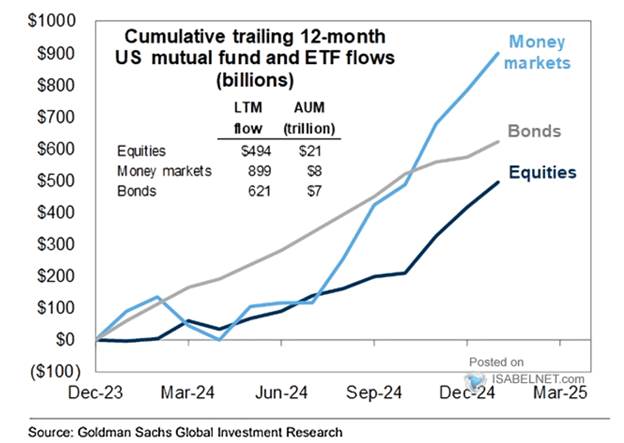

Chart of the Week: Flows into U.S. Money Market Funds…

A Peace Plan for Ukraine?

The U.S. president could announce his proposals to end the war in Ukraine within a week in Munich. The United States is maintaining pressure on both Moscow and Kyiv to force them into negotiating a ceasefire. After causing a shockwave by announcing a takeover of Gaza, the U.S. president now wants to put an end to the war in Ukraine. Although he has abandoned his promise of achieving peace within “24 hours,” he continues to pressure both Volodymyr Zelensky and Vladimir Putin.Donald Trump’s peace plan is ready, according to the White House. It could even be presented to world leaders at the Munich Security Conference, which will take place from February 14 to 16 in Germany. Keith Kellogg, the U.S. president’s special envoy for Ukraine and Russia, has confirmed his presence in Munich before heading to Kyiv. Donald Trump himself might also travel to the Bavarian capital.

As the third anniversary of the war in Ukraine approaches, President Zelensky fears losing U.S. financial support. To secure it, he has proposed a deal to Donald Trump: granting Americans the rights to exploit Ukraine’s rare earth minerals. The Ukrainian president has also expressed willingness to negotiate with Vladimir Putin. Until now, the Ukrainian president had also ruled out any discussions with the Russian enemy. Ukraine is facing significant military difficulties. Over the past year, the Ukrainian army has retreated, losing 4,168 km²—more than 40 times the size of Paris. Territorial losses have accelerated for Ukraine in recent months. Given his intention to reach an agreement with Putin to end the fighting, Trump may outline the key points of his plan in Munich and later leverage the NATO summit in The Hague (Netherlands) four months later to gain allied support for the negotiations.

Donald Trump favors a ceasefire and maintaining positions along the current front line. The U.S. president wants to pressure Ukraine into relinquishing sovereignty over the territories occupied by Russia, which account for about one-fifth of the country. In exchange, the Kyiv government demands security guarantees to ensure that Moscow does not resume the war.

Our Opinion: If Donald Trump manages to end the war in Ukraine (or at least create the perception that he will), it could improve sentiment on the other side of the Atlantic. The ceasefire episode in Gaza demonstrates that such announcements can be made, even if the probability remains lower. In the short term, we have reduced the divergence in our outlook between European and U.S. markets. We believe that, similar to what happened in Gaza, talks between Volodymyr Zelensky and Vladimir Putin will take place, creating a positive momentum for Europe—both in terms of inflationary concerns (commodity prices) and economic prospects (reconstruction, increased confidence).

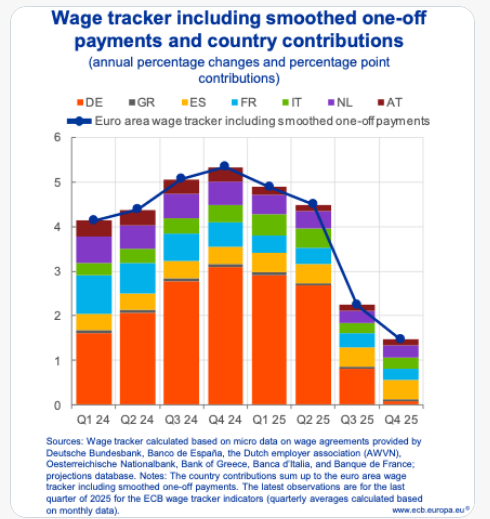

EUROPE: Towards a Sharp Slowdown in Wages in 2025

The European Central Bank’s key indicator for future wage trends in the eurozone continues to signal a sharp slowdown in 2025, reinforcing hopes for a further decline in inflation. The ECB’s wage indicator, published this week, forecasts an annual wage increase of 1.5% in the fourth quarter of 2025. Although this is slightly higher than the 1.4% forecast in December, it remains well below the peak of 5.3% recorded a year earlier. The ECB’s confidence in achieving its 2% inflation target this year is based on the assumption of slowing wage growth and a decline in services sector inflation, which has remained close to 4% for over a year.

Following the January monetary policy meeting, President Christine Lagarde stated that “all the indicators we currently have are pointing downward and reinforce our confidence that wages will decline in 2025.” She was referring not only to the ECB’s wage indicator but also to compensation per employee, another measure provided by Indeed, and the ECB’s Corporate Telephone Survey.

The ECB’s December projections foresee a continued slowdown in wage growth, from 4.6% last year to 2.8% in 2027. Wages negotiated below 2% after August 2025, as indicated by the ECB’s projections, would not be far from pre-COVID trends and could signal an excessive slowdown in inflation. For instance, the IG Metall union has secured relatively moderate wage increases for the next two years. While the ECB needs wage growth to slow, it does not want an overly sharp deceleration or a significant deterioration in the labor market.

Our Opinion: With concerns over wage inflation now clearly alleviated, the European Central Bank is expected to continue steering its monetary policy back into accommodative territory in the coming months, with further 25 basis point rate cuts at each meeting (down to 2% by July). The ongoing easing of financial conditions will support both consumption and the recovery of credit dynamics.The ECB’s Q4 2024 Bank Lending Survey revealed that lending conditions are stabilizing after having significantly improved over the past two years. These factors should help support European growth by the end of the year. In the short term, European equities could regain attractiveness, as evidenced by the return of capital flows at the start of the year.

The BOE Changes Its Tone

The Bank of England cut interest rates by 25 basis points today, as expected. However, the two dissenting votes in favor of a larger 50-basis-point cut, along with a particularly convoluted meeting summary, highlight deep divisions within the Monetary Policy Committee (MPC). This decision to continue monetary easing reflects a shared desire among members to ease financial conditions, given the stalling UK growth and waning inflationary pressures.

While the resumption of monetary easing was anticipated, the key issue of this meeting was the communication strategy and forward guidance. In his speech, the BOE Governor left the door open for further rate cuts, citing the ongoing decline in inflation. However, he also emphasized that the central bank would maintain a gradual and cautious approach, considering uncertainties, particularly those linked to Trump’s policies.The BOE was also expected to update its macroeconomic outlook for 2025, which now projects slower growth and persistent inflationary pressures. The central bank raised its inflation forecasts, citing higher energy prices and certain regulated costs, while the underlying inflation trend is expected to remain favorably oriented.

At the same time, its growth forecast for 2025 has been revised down to +0.75%. The BOE anticipates quarterly economic contraction in Q4, driven by worsening confidence indicators and fiscal constraints. The bank’s latest growth projection is below consensus, while its inflation forecast is notably higher, underscoring the MPC’s struggle to balance short-term inflationary pressures with weak economic growth. Persistently high inflation despite weak growth partly reflects the view that the economy’s supply capacity has weakened, along with the expected rise in future energy prices…

Our Opinion: We believe the Bank of England will be able to gradually lower its key rates, with 25-basis-point cuts per quarter until mid-2026, bringing the policy rate down to 3.75% by the end of 2025. The continued monetary easing in the UK will support the decline in British sovereign yields throughout the year. The currency should remain stable against the euro, hovering around 0.84..

Chart of the Week: Flows into U.S. Money Market Funds

Despite the Federal Reserve’s rate cuts, investors continue to show a strong appetite for U.S. money market funds, reflecting an ongoing trend of seeking safety and yield.