Written on 28 February 2025

Unstable weather / Geopolitical lull but trade storms

As we wrote last month, the prospect of a peace plan in Ukraine is radically changing the economic and geopolitical outlook for this year. A truce in Ukraine could mark the beginning of a genuine economic reconstruction, beneficial to both Ukraine and Europe, in a deteriorating economic context. The United States expects to earn royalties and secure supplies of rare earths. Ukraine’s economic recovery depends on a massive mobilization of capital.

Mineral resources of Ukraine

Donald Trump’s strategy consists of a clear segmentation between politics (administration reform, congress), geopolitics (Gaza, Ukraine) and trade (the rest of the world).

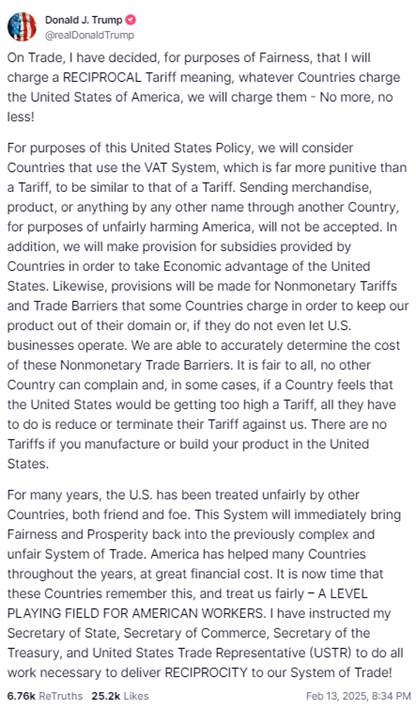

On the trade front, however, tensions are rising. Trump’s strategy is shaping up to be tough on his partners, and the method seems clear: negotiate better trade deals for the U.S. and encourage foreign companies to relocate production to U.S. territory. ” If they impose a tariff or tax on us, we impose exactly the same level of tariff or tax on them, it’s as simple as that,” declares Donald Trump. He believes that products entering the United States should be taxed at the same level as American products are taxed in their country of origin.

Donald Trump’s idea is to raise tariffs to partly finance tax cuts and absorb the growing trade deficit, but also to use them as a means of putting pressure on other states. The new president must find new sources of funding to get his budget through Congress. This is the urgency of the moment, particularly in view of the 2017 tax reform extension. He will therefore be stepping up his tariff ambitions in the coming weeks to remain credible in the face of the budget.

Donald Trump announces reciprocal tariffs on his social network

US: Trump’s earth-shattering statements follow one another, but they become a source of anxiety.

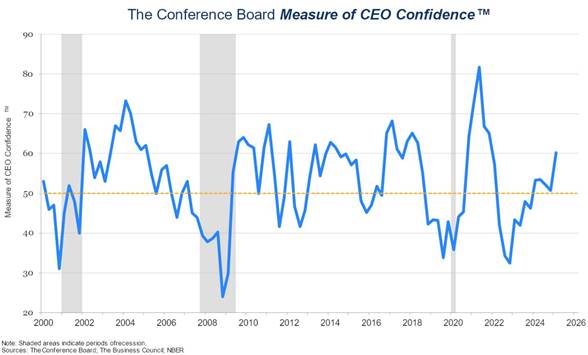

The optimism generated in business circles by Donald Trump’s election is giving way to growing concern about inflation prospects and the uncertainty generated by the proliferation of presidential executive orders. Witness the 9-point rise in the Conference Board’s quarterly CEO survey in Q1 2025, taking it to its highest level in three years.

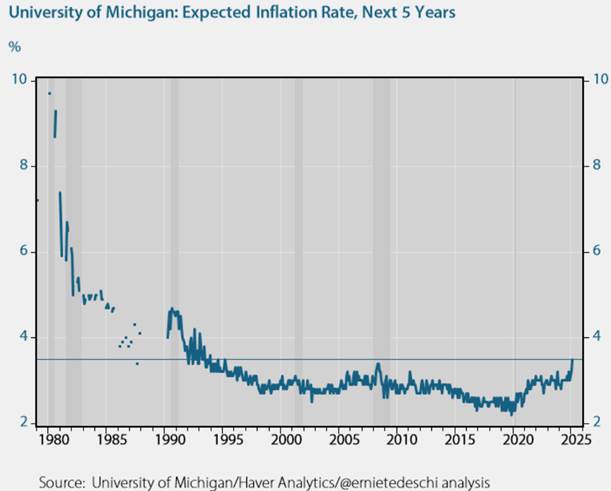

According to a recent CNN poll, 62% of American households feel that the President has not done enough to curb inflation. The University of Michigan’s Consumer Sentiment Index was revised sharply downwards for February (to 67.8 units, its lowest level since November 2023), including a rise to 3.5% in five-year inflation expectations, a level not seen since 1995.

The rebound in inflation complicates the economic equation for the White House and for the members of the central bank. The Fed is therefore likely to adopt a wait-and-see attitude in the months ahead.

One of the few pieces of data to satisfy the Fed that the US economy is on a soft landing was the 1.3% real decline in retail sales in January. However, this decline needs to be put into perspective, as retail sales are still up 1.2% year-on-year. Americans are becoming increasingly concerned about the economic outlook, due to trade tensions, a worsening labor market and the risk of a rebound in inflation.

Validation by the House of Representatives of a resolution to pass a budget plan comprising a $4.5 trillion tax cut and a $2 trillion reduction in government spending has yet to be agreed with the Senators. The negotiations are therefore likely to last several months, with the impact on the US economy likely to materialize in the second half of 2025 and in 2026.

In the short term, doubts prevail, as evidenced by the economic surprise indicators. While trade policy seems to be stimulating domestic industry, uncertainty and investment are not going down well. We’ll be keeping a close eye on business investment data over the coming months.

US versus Euro economic surprises

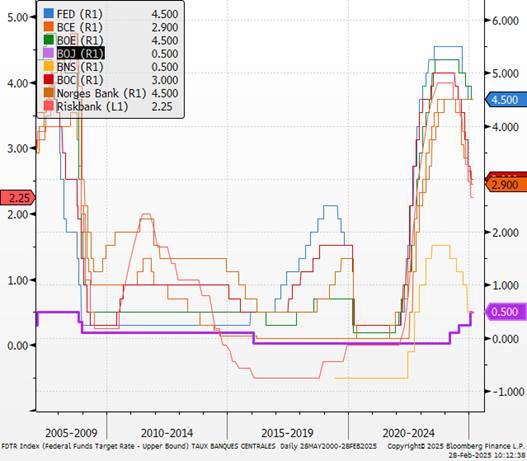

For the Fed, the forthcoming economic slowdown will be a strong argument in favor of a resumption of key rate cuts. However, it will remain cautious in the face of the risk of a resurgence of inflationary pressures induced by other administration measures, and will be patient before acting. The next rate cut is scheduled for July. Coincidentally, this will be the month in which the ECB completes its accommodative cycle…

Euro: better but soon … trade war

Short-term growth prospects in the eurozone remain weak, but data has shown some signs of improvement (notably a flash composite PMI), given the very low expectations at the start of the year.

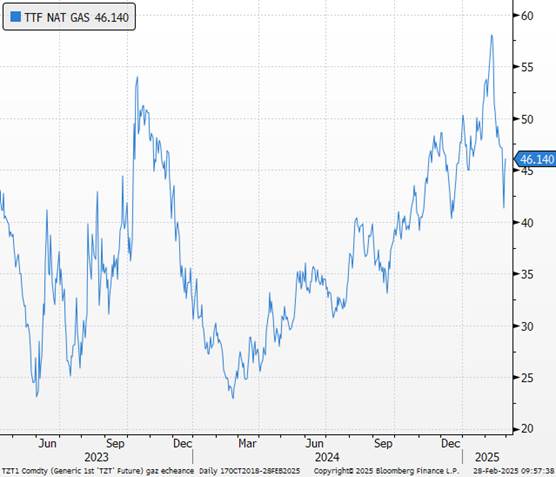

Signs of improvement were already hinted at last month, but this time they are materializing. The German election results have increased the likelihood of a pro-growth coalition. Defense spending is expected to rise sharply, reaching 2.5% of eurozone GDP over the next few years, which should support growth (+0.1% in 2026 and +0.2% in 2027). The peace agreements in Ukraine should also boost growth and confidence. Lower energy prices, particularly gas, should reduce pressure on consumers, businesses and above all the central bank, leading to more flexible financial conditions.

Gas prices in Europe

Wage growth in the eurozone slowed at the end of 2024, supporting the European Central Bank’s plans to continue cutting interest rates as inflation falls. As we anticipated, this data supports the ECB’s assumption that wage growth should now slow after adjusting to rising inflation in recent years. Isabel Schnabel reiterated her fears that monetary policy could be too accommodative, given the rise in the “neutral” rate in her view, and called for a more cautious approach on the part of the ECB. This intensification of debate suggests a less clear-cut consensus on future decisions.

We consider that the deterioration in growth and the slowdown in inflation, thanks in particular to the deceleration in wages, will provide the ECB with sufficient room for maneuver to lower its key rates at the beginning of March, and on two further occasions between now and the end of July, with a pause in June. This would bring the deposit rate to 2% in July, followed by a temporary halt (a further 0.25% cut is possible at the end of the year or in early 2026).

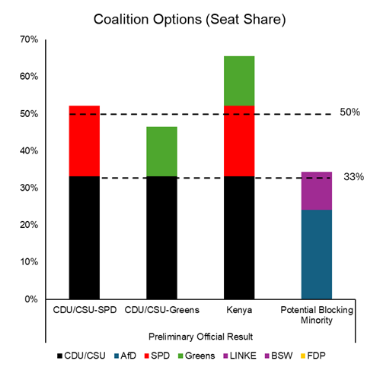

Headwinds remain, particularly with rising trade tensions with the United States, which are likely to lead to the imposition of new tariffs on European products. We expect GDP growth in the eurozone to reach +0.8% in 2025, supported by an improvement in the business climate in Germany, linked to the hope of a political breakthrough after the elections. A classic two-party coalition of CDU/CSU and SPD is largely possible. Germany’s European partners are keen to see an executive formed as soon as possible. Friedrich Merz, who had said he was aiming for Easter, is likely to turn to the SPD. This alliance, known as the “grand coalition”, between the two formations that dominated the post-war political landscape, is also the coalition favored by Germans, in need of stability after the incessant wrangling of Olaf Scholz’s tripartite government with the Greens and the FDP liberals.

2025, a turning point for China

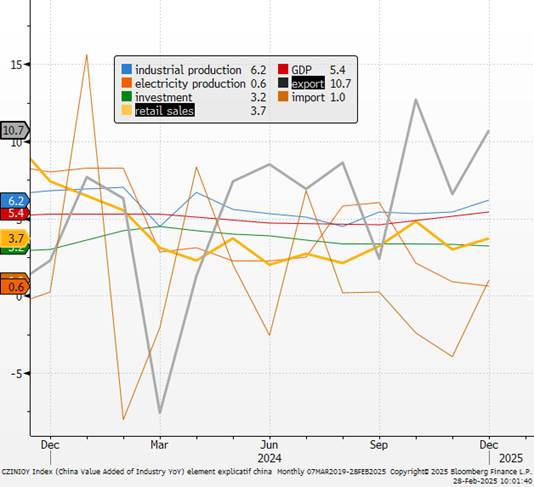

Faced with a difficult real estate market and economic uncertainties, China is continuing to step up its economic support. In the medium term, the authorities are betting on investment and a proactive industrial policy in a number of cutting-edge sectors (electric vehicles, renewable energies, high technology, etc.), in order to increase export volumes. Exports remain one of the main growth drivers.

Construction in China

At a meeting at the end of September, the Politburo had called for ” intensified countercyclical adjustment of monetary and fiscal policy”, with “necessary fiscal spending “, relying on

” the driving role of public investment ” and ” sharp rate cuts “. We’ll have to wait until March and the third annual session of the 14ᵉ National People’s Congress to learn the details of the new fiscal stimulus measures. At all their economic meetings, the Chinese authorities give very clear priority to supply-side policies and public support measures.

More structural reforms were also announced, including :

- The recapitalization of the six major banks, which should enable them to cope with falling profitability and rising bad debts.

- Partial assumption of local debt at central level, with the aim of making public finances cleaner and easier to understand.

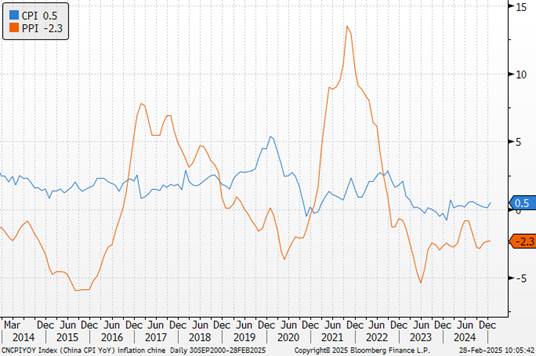

- Increased attention to inflation by the central bank, pointing to new measures for 2025.

Producer and consumer prices

The year 2025 could thus mark a turning point for China, with new economic reforms and strategic adjustments.

Several trends are emerging:

- More targeted monetary measures: the central bank could pursue a policy of lowering interest rates to support investment.

- Strengthening supply-side policies: the government will step up its support for strategic industries to ensure sustainable competitiveness.

- Adapting to international tensions: Beijing will have to navigate between cooperation and confrontation with the United States and Europe.

Elements explaining Chinese growth

Japan: monetary policy adapts to inflation

Japan’s GDP grew at an annualized rate of 2.8% over the period October to December 2024, well ahead of analysts’ consensus estimates and marking a third consecutive quarter of expansion. The Japanese economy remains in good health despite the turbulence associated with the Bank of Japan’s decision last year to “normalize” its monetary policy and begin a cycle of interest rate hikes.

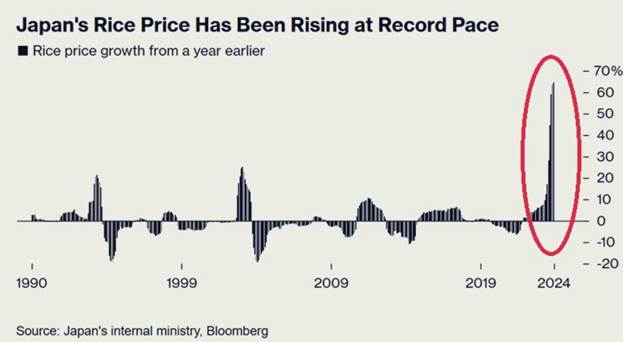

This increase is due in part to the contribution of foreign trade and investment. Private consumption, which accounts for around half of the country’s economic output, rose by 0.1% over the quarter, contradicting most analysts’ contraction forecasts. Japanese real wages remain negative, however, due to rising inflation. Japan is experiencing a sharp rise in rice prices, linked to exogenous factors (climate and tourism) as well as political decisions. This masks a more structural trend towards a return of inflation in Japan, prompting the central bank to accentuate the shift in its monetary policy.

Year-on-year change in rice

A dynamic economy and growing inflationary pressure will encourage the Bank of Japan to continue raising its key rate. We consider that the neutral rate, estimated at at least 1%, should be reached in the second half of fiscal 2025 (April 2025 to March 2026) in order to curb inflationary pressures.

Main central bank rates