The 3 must-know news stories of the week 9

- German elections: a less fragmented political situation brings reassurance

- The escalation of tariffs continues

- Credit and wages: two pieces of good news for the ECB

- Chart of the Week: In Japan, the birth rate has dropped even further in 2024

German elections: a less fragmented political situation brings reassurance

Germany has elected a new parliament. According to preliminary official results, the conservative CDU/CSU alliance, led by Friedrich Merz, won the election with 28.5% of the vote, ahead of the far-right AfD, which secured 20.8%. Notably, the far-right AfD achieved a historic surge (20.8%), while the Social Democrats of the SPD lost ground (16.4%). Outgoing Chancellor Olaf Scholz failed to convince many undecided voters to support his Social Democratic party, which recorded its worst result since World War II. The Greens and the left-wing party Die Linke also secured seats in parliament. However, the anti-migrant left-wing party BSW and the liberal FDP did not reach the required 5% threshold to enter parliament. Budgetary prospects could be complicated by the fact that the AfD and Die Linke together hold 216 seats (34.3%) in parliament, potentially forming a constitutional blocking minority against reforming the debt brake or creating an off-budget defense fund, which would require a two-thirds constitutional majority. However, the actual blocking minority opposing the debt brake consisted of the AfD and the FDP. The left-wing party Die Linke has advocated for easing the “debt brake” to allow increased public investment, particularly in social housing. Its program proposed investing €20 billion per year in non-profit housing, which would require exceeding the current debt limits set by the German constitution. This position contrasts with that of the AfD and the Free Democratic Party (FDP), both of which oppose lifting the debt brake. However, negotiations with this party will be subject to discussions and concerns about a possible budgetary drift.

There is a higher probability that the debt brake (which limits the deficit to 0.35% of GDP) will be modified. Indeed, while a two-thirds majority is required, the combined support of key parties potentially in favor (CDU/CSU under conditions, SPD, the Greens, and Die Linke) accounts for over 76% of the votes. It is clear that discussions will be challenging regarding the allocation of additional spending, but if a favorable outcome is reached, it would be good news for the German economy.Furthermore, the prospect of a less fragmented political landscape in Germany than before is broadly reassuring. A traditional two-party coalition between the CDU/CSU and SPD is highly feasible. Germany’s European partners are hoping for the swift formation of an executive government. Friedrich Merz, who previously stated his goal of forming a government by Easter, is expected to turn to the SPD. This alliance, known as the “grand coalition,” between the two parties that have dominated post-war politics, is also the preferred option for Germans, who are seeking stability after the constant disputes within Olaf Scholz’s tripartite government with the Greens and the liberal FDP.

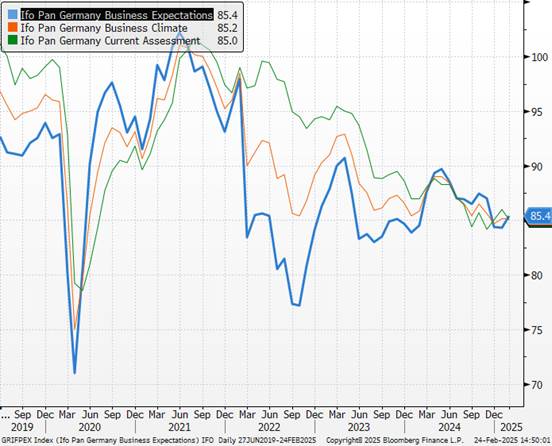

Friedrich Merz enjoys the support of many European leaders, but his positions on European foreign and defense policy are sparking debates and concerns among other partners. Merz has criticized European foreign and security policy, describing it as a “state of desolation.” He has also called for greater European independence in defense matters, suggesting an alternative to NATO in its current form. German businesses have high expectations for the new government after the elections, as reflected in the Ifo Business Climate Index. While business expectations have improved, the assessment of the current situation has declined significantly.

Ifo Index (Business Climate in Germany)

Our view : We believe this is a positive outcome for confidence in German assets. Greater stability and the absence of political blackmail from certain parties to maintain government cohesion are reassuring in terms of managing a budget deficit that is set to rise. Merz’s positions should benefit German equities in general, particularly industrial and defense stocks, as well as German midcaps. The MDAX, which represents Germany’s mid-sized companies, is also an attractive segment, aiming to capitalize on upcoming interest rate cuts by the European Central Bank and a potential ceasefire in Ukraine. Given that the MDAX is closely tied to the German economy, it stands to benefit the most from these expectations. Defense spending could be organized through European mechanisms, bypassing Germany’s debt brake, while the left-wing party Die Linke is likely to support changes in infrastructure investment. Conversely, long-term interest rates are expected to remain high (due to increased financing needs), despite ECB rate cuts, leading to a steepening of the yield curve. Indeed, Die Linke could have negotiating power as a potential player in the blocking minority.

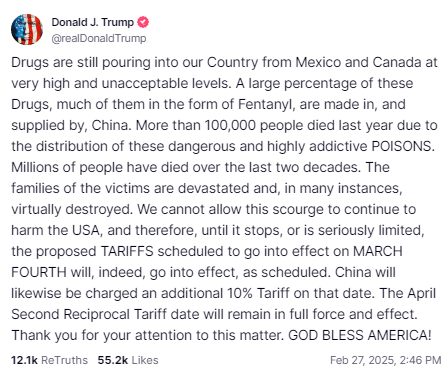

The Escalation of Tariffs Continues

Day after day, Donald Trump’s trade announcements keep shaping the agenda. After sowing doubt on Wednesday, the president ultimately confirmed last night that a 25% tariff on imports from Mexico and Canada will take effect as of Tuesday, March 4. The White House justifies this measure by citing the insufficient efforts of these countries to curb the trafficking of fentanyl into the United States— a synthetic opioid responsible for over 70,000 overdose deaths in the country last year, according to the Centers for Disease Control and Prevention. At the same time, Donald Trump has acknowledged “progress” on immigration but insists that it remains insufficient to reverse his decision.

The presidential announcements don’t stop there: an additional 10% tax has been imposed on Chinese imports, on top of the 10% already implemented on February 4. This decision, presented as a new pressure tactic against Beijing, immediately prompted the Chinese government to vow retaliatory measures. With U.S.-China negotiations still not officially underway, this move further jeopardizes any potential talks. Many economists fear an escalation in bilateral tensions and a negative impact on China’s already slowing economic growth. Next week’s annual sessions of the Chinese Communist Party will be closely watched in hopes of announcements regarding economic support measures.

These tariffs could soon extend to other trading partners. Reciprocal sanctions with the European Union are being considered for April amid tense trade negotiations. “It will be 25% across the board, and it will apply to cars and everything else,” Donald Trump declared on the night of February 26–27 during the first meeting of his cabinet at the White House. He also reiterated that the EU was “designed to rip off the United States,” echoing rhetoric he has used in the past.For reference, the EU accounts for nearly 20% of U.S. imports, with a significant share coming from the automotive sector, according to data from the Office of the United States Trade Representative.

Donald Trump’s Statement on His Social Media Platform

Our view : Donald Trump’s strategy is based on a clear segmentation between politics (administrative reform, Congress), geopolitics (Gaza, Ukraine), and trade (the rest of the world). His approach involves raising tariffs to partially fund tax cuts, reduce the growing trade deficit, and use them as leverage over other states. The new president needs to find additional funding sources to push his budget through Congress—an urgent priority, particularly with the upcoming extension of the 2017 tax reform. As a result, he is likely to accelerate his tariff agenda in the coming weeks to maintain credibility regarding the budget. However, the rebound in inflation complicates the economic equation for the White House and Federal Reserve officials. The Fed is expected to adopt a wait-and-see approach in the coming months, remaining cautious about the risk of renewed inflationary pressures from other administration measures. It is likely to hold off on any action, with the next rate cut expected in July—coinciding, by chance, with the end of the ECB’s accommodative cycle. In the short term, doubts prevail, as reflected in economic surprise indicators. While trade policy appears to support domestic industry, uncertainty and investment are not a good mix. Close attention should be paid to corporate investment data in the coming months.

Credit and Wages: Two Pieces of Good News for the ECB

The European Central Bank is receiving encouraging signals at the start of the year: on the one hand, wage growth in the eurozone is slowing, and on the other, bank credit continues its slow improvement. These two developments support the monetary institution’s strategy, which is engaged in a gradual reduction of interest rates to contain inflation.

The slowdown in wages is confirmed. According to the latest published data, the growth of negotiated wages in the eurozone fell to +4.1% year-on-year in the fourth quarter of 2024, down from +5.4% in the previous quarter. This deceleration, in line with ECB forecasts, should help limit the rise in production costs and, ultimately, bring down service inflation, which is currently stuck at around 4%. For reference, nearly 70% of overall inflation is driven by the services sector in several eurozone economies, a point of particular concern for the ECB. However, the wage slowdown is proving less pronounced than expected, prompting the “hawks” to urge caution. In their view, easing monetary policy too quickly could reignite inflationary pressures, especially if growth strengthens further in the second half of the year.

At the same time, statistics published on Thursday by the ECB reveal a gradual improvement in credit in the eurozone: outstanding bank loans continue to rise, although this increase remains moderate. The M3 money supply—which includes all liquid assets in circulation, such as short-term deposits, funds, and negotiable certificates of less than two years—also continues its annual recovery. These figures reflect the impact of previous key rate cuts, which are still filtering through to the real economy. Despite the tightening observed in certain credit criteria at the end of last year (according to the ECB’s quarterly survey), investment-related loan demand remains steady, supporting GDP growth estimated at around 0.3% quarter-on-quarter.

Central Bank Money Supply

Our view : For now, short-term growth prospects in the eurozone remain modest. The IMF and the European Commission recently projected annual GDP growth of around 1.0% in 2025 (0.8% according to our estimate), while leaving room for further upward or downward revisions depending on energy price trends and the geopolitical context. Nevertheless, the improvement in bank credit, combined with wage moderation, suggests a more controlled inflation trajectory. These positive signals come at the right time for the ECB, which sees this dual trend as a validation of its strategy: the gradual recovery of investment should support growth, while slower wage increases will facilitate further rate cuts while keeping inflation in check. Given these trends, the ECB now has room to continue its monetary easing cycle. According to several analysts, the institution is expected to lower its key interest rates as early as March, followed by two additional cuts by the end of July, with a pause in June. The deposit rate could reach 2% this summer, with a possible further 0.25% cut at the end of the year or early 2026.

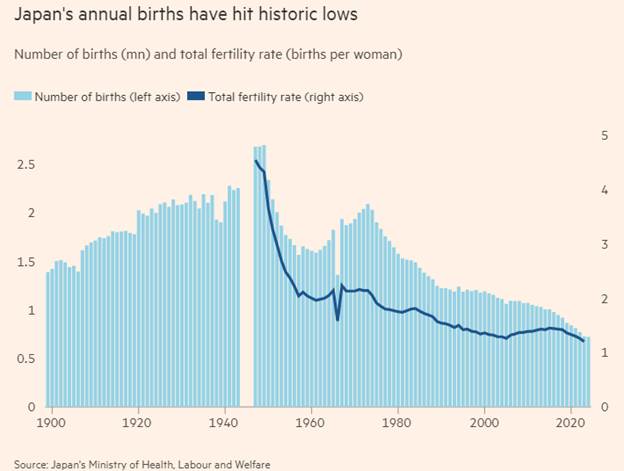

Chart of the Week: In Japan, the Birth Rate Dropped Even Further in 2024.

A tough year for Japan: in 2024, and for the ninth consecutive year, the country’s birth rate and number of marriages continued to decline, despite government efforts to reverse the trend. Additionally, Japan’s total population fell to 123.54 million, a 0.46% decrease from the previous year, according to data from the Ministry of Internal Affairs published last week.