The 3 must-know news stories of the week and What We Think

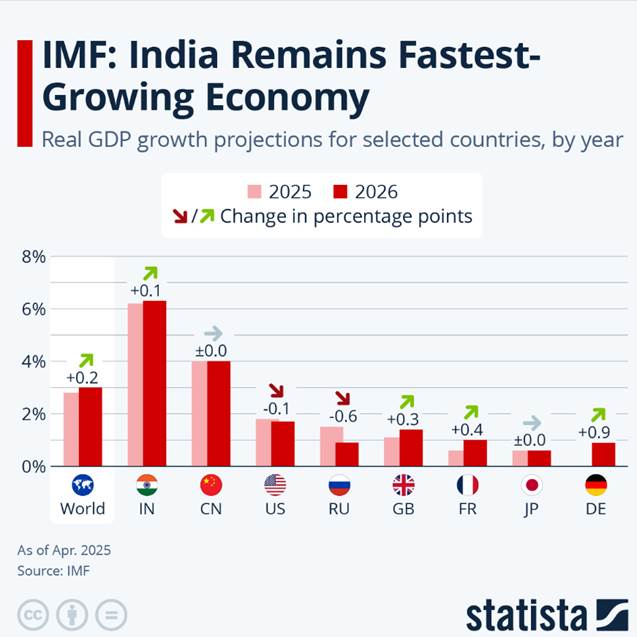

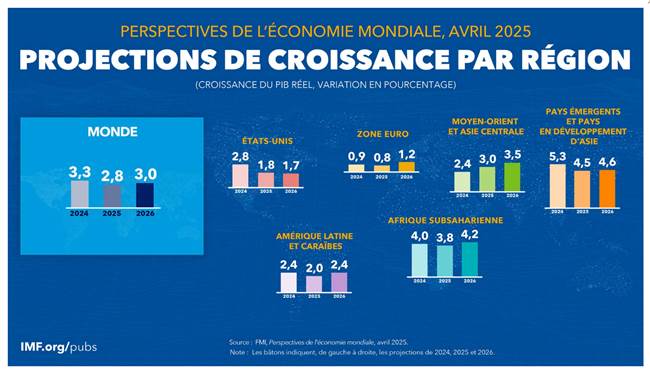

1. The IMF sounds the alarm

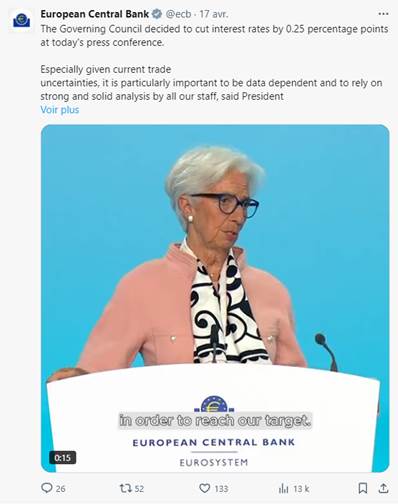

2. The ECB eases its monetary policy

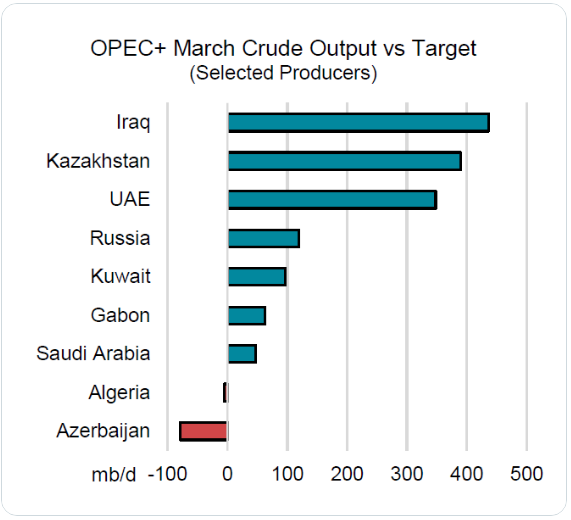

3. The cohesion of OPEC+ in question

Chart of the week

The IMF sounds the alarm

The global economy “is at a critical juncture,” warns the International Monetary Fund in its latest outlook. The culprit: the tariff escalation initiated by Donald Trump, which casts “unprecedented” uncertainty over global trade and undermines confidence among both households and businesses. Not since nearly a century ago, reminds Chief Economist Pierre-Olivier Gourinchas, have Washington’s tariffs reached such levels. The fallout is harsh: the U.S. growth forecast for 2025 has been downgraded from 2.7% to 1.8%, a cut of 0.9 percentage points — a revision of rare magnitude in the IMF’s records. While the institution refrains from using the word “recession,” others, such as the Institute of International Finance (IIF), already fear two consecutive quarters of contraction across the Atlantic. Driven by the American shock, global forecasts have been reduced by half a point: the world is now expected to grow by only 2.8% in 2025, down from the 3.3% hoped for in January. No major bloc is spared (Mexico: a sharp shift from expected growth of 1.4% to a recession of -0.3%, the steepest downgrade on the chart; Canada: +1.4% [-0.6 point], Japan: +0.6% [-0.5 point], China: +4% [-0.6 point], and the Eurozone: +0.8% [-0.2 point]). The IMF notes that at the start of 2024, confidence still prevailed in the United States; it has since deteriorated, weighed down by inflation (2.4% year-on-year in March, with an average of 3% expected in 2025) and the looming threat of tariffs. Consumption, traditionally the backbone of American growth, is already slowing. The persistence of inflation above the Federal Reserve’s target will complicate any further rate cuts, even as Donald Trump publicly pressures Jerome Powell to ease monetary policy — a standoff that is fueling market jitters. Treasury yields have climbed, the dollar has erased its post-election gains, and the credibility of an independent Fed, the IMF reminds us, remains a “cornerstone” of financial stability.

Our view: Donald Trump has recently launched a fierce attack on the monetary policy of the U.S. central bank, suggesting that his administration might consider dismissing its chairman, Jerome Powell. Trump has intensified his criticism, publicly labeling Powell a “big loser” and calling for a preemptive rate cut, even going so far as to write on social media that Powell’s departure “can’t come soon enough.” This rhetorical escalation represents a significant short-term threat to financial markets, further aggravated by recent uncertainties over tariffs and growing questions about Trump’s economic management. On his Truth Social platform, Trump claimed that there is “virtually no inflation” and warned that the economy could slow down “unless Mr. Too Late, a big loser, lowers interest rates immediately.” While these public attacks on Powell are not new (Trump had already criticized Powell during his first term without dismissing him), they now carry a more troubling tone due to the recent firings of other Senate-confirmed leaders of independent agencies (notably at the FTC, Federal Trade Commission). These precedents heighten concerns that Trump might indeed attempt to remove Powell or other members of the Fed’s Board of Governors, although such action would face significant legal, regulatory, and obviously political hurdles. While the likelihood remains low given the legal protections surrounding Powell’s mandate, an early departure cannot be entirely ruled out. Jerome Powell’s current term runs through May 2026. Such a scenario could seriously undermine confidence in the U.S. economy and financial markets, potentially accelerating the depreciation of the dollar and pushing up long-term U.S. interest rates amid fears of losing control over inflation. Although the legal possibility of removing Powell is very slim, its mere potential poses a major risk to economic and financial stability. A decline in the dollar remains our main scenario. Trump has stated that the U.S. economy should have lower interest rates in anticipation of the widely expected weakness following his trade war. To calm the markets (and the president!) without compromising the Fed’s credibility, Powell may opt for a symbolic rate cut as early as July (or even May), with the goal of easing tensions while avoiding a systemic crisis and without endangering the Fed’s credibility.

The ECB eases its monetary policy

Focus on inflation in the eurozone is shifting: energy and exchange rates rather than tariffs.

On Thursday, April 17, the European Central Bank lowered its rates for the sixth consecutive time, stating that “the disinflation process is well underway.” The ECB’s three key interest rates will be reduced by 25 basis points, with the deposit facility, main refinancing operations, and marginal lending facility rates set to fall to 2.25%, 2.40%, and 2.65% respectively, effective April 23, 2025. Headline and core inflation slowed in March to 2.2% and 2.4% respectively, while service price inflation also eased significantly to 3.5% in March. The ECB also justified its decision to ease financing conditions in Europe based on its assessment that “growth prospects have deteriorated due to escalating trade tensions, while heightened uncertainty is expected to weaken household and business confidence.” It noted that “negative and volatile market reactions to trade tensions are likely to tighten financing conditions,” which supports lowering the rate without speeding up the pace of cuts.

On the balance sheet side, the ECB’s portfolio continues to decline (at a predictable pace) by around €500 billion this year — equivalent to 11.00% of the outstanding balance as of December 2024 and 17.00% of the excess liquidity recorded at the end of 2024.

Our view: The phase of trade uncertainty is weighing on activity prospects, which will encourage the ECB to continue easing its monetary policy. As expected, the ECB lowered its three key rates and removed the reference to rates being “significantly restrictive.” We could therefore expect Christine Lagarde to soften her tone in upcoming meetings. And while it didn’t take the expected form, the door is now clearly open to several further cuts. The ECB is ready to adopt an accommodative policy. It will make this more explicit in June. It was reiterated during the press conference that the June projections will be a key element in understanding the impact of all the shocks currently affecting the eurozone economy; the impact on growth is clearly negative in the ECB’s view.

What about inflation? The consensus among the Governing Council members is less clear. Conditions are highly favorable for disinflation, thanks to slower wage growth, the strengthening of the euro, falling commodity prices, and imported deflation caused by the diversion of Chinese goods from the U.S. to Europe. There may be just one potential upside risk: defense stimulus plans, particularly in Germany. However, like the president of the German central bank, we do not believe these programs will be inflationary, as they are primarily focused on investment. “As far as I can see, this won’t be inflationary,” Nagel stated. “We are emerging from a stagnation situation, a kind of recession. This will not be inflationary in the coming years. It is helpful for the economy. It means economic growth. That is good news.” If even the Bundesbank isn’t concerned… why should we be? We believe the ECB will support defense-related policies. European integrity should go beyond its mandate. “We are in an existential moment for Europe,” Christine Lagarde added in a recent interview, calling for a collective push “toward independence in defense, energy, and financially and digitally.” “We must take the reins now,” she insisted. We therefore believe inflation forecasts will be revised downward and fall below 2%. The June projections are a key element in the policy path of our central scenario. Based on current data, we even think these forecasts will indicate medium-term inflation closer to 1.5% than 2%, signaling the need for an accommodative monetary policy. Our forecast was 1.75%–2% by the end of July, with a pause of several months. We now believe the European Central Bank could go significantly further, with a forecast for the deposit rate to reach 1.5% by September. For now, we expect a 25 bp cut on June 5, followed by two additional cuts in July and September, for a terminal rate of 1.5%.

OPEC+ cohesion in question

Brent crude prices dropped sharply after Kazakhstan indicated it was prioritizing its national interests over those of OPEC+. In doing so, the country confirmed its reluctance to comply with the production quotas set by the cartel, particularly the compensation plan for past overproduction, which would require an immediate cut of around 400 kb/d (approximately 20% of Kazakhstan’s total output of 1.8 Mb/d in March). This openly strategic break rekindles old tensions for OPEC following Angola’s exit last year and Qatar’s in early 2019.

Media sources also mention the possibility of a fresh acceleration in output from the cartel’s major members in June (with a decision expected on May 5), as these countries grow increasingly weary of sacrificing market share to nations that fail to meet their commitments — a reflection of mounting internal rifts. This stance could also be explained, at least in part, by the organization’s confidence in the United States’ ability to effectively sanction Iranian oil exports (which stood at 1.6 Mb/d in March). Such a move would present a perfect window of opportunity for Saudi Arabia, Russia, and the United Arab Emirates to regain market share without excessively destabilizing global supply.

OPEC countries’ production vs production targets

Our view : While these U.S. sanctions are a key factor, prices are also influenced by trade-related compromises between the United States and the rest of the world, as well as by sustained support from OPEC+ — a point that now seems more uncertain to us. The United States is the world’s top oil producer, and Donald Trump aims to boost domestic output. However, current barrel prices threaten the profitability of U.S. oil operations, particularly due to OPEC’s decision to also open the taps. We have held a negative view on oil for several months, with a target of $60 for WTI — the ultimate tolerance threshold for producers. Even though current levels are close to our target, OPEC’s cohesion is, for the moment, under strain. As shown in the charts above, OPEC+ crude exports are not higher this month despite the increase in production. The countries that have broken ranks have already done so. Any upcoming production increases will be negligible. We should therefore see a short-term stabilization in prices.