Two key inflation indicators were on the menu of US statistical releases this week: the Consumer Price Index (CPI) and the Producer Price Index (PPI) for June.

CPI – US

PPI** – US

** of final demand

The much-feared reflationary effect of tariffs is only just beginning to bite, particularly in the CPI:

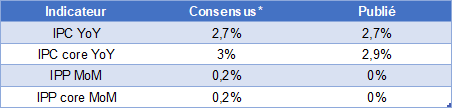

- Over one month, consumer price inflation reached 0.3%, the highest since January 2025, after only +0.1% in May;

- Year-on-year, consumer price inflation climbed to 2.7% from +2.4% in May;

- Also year-on-year, core inflation excluding the most volatile food and energy prices climbed to +2.9% from +2.8% in May.

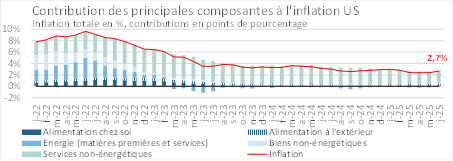

Concerning CPI components, over one month :

- Non-energy services remain the biggest contributors to total US inflation, particularly the housing component (shelter), which comes as no surprise given the continuing rise in US residential property prices (most recent S&P CoreLogic Case-Shiller home price index at +2.7% year-on-year in April 2025).

- Energy makes a positive contribution to overall inflation, given the rise in oil prices over the month (Iran-Israel conflict).

- New and used vehicles make a negative contribution to overall inflation, keeping prices of non-energy goods, which are highly exposed to tariffs, in check.

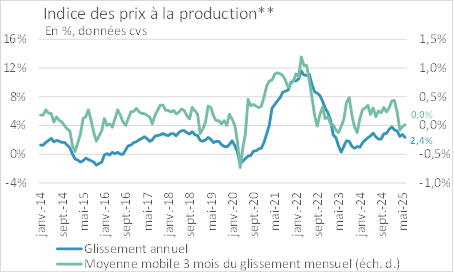

In any case, the markets did not react strongly to these releases. On the CPI front, US sovereign yields picked up a few bps: the US Treasury 10-year gained almost 10 bps, closing at 4.48%, while the 30-year touched the 5% mark again. As for the equity markets, they seemed more interested in the corporate earnings releases in progress for 2Q25. As a matter of fact, the figures published turned out to be in line with or, for PPI, even more benign than investors had expected (see below).

Comparison between published inflation figures and consens* forecasts

* Survey by Dow Jones Newswires and The Wall Street Journal, published by MarketWatch.com.

Our opinion: June’s inflation data are unlikely to change the FED’s monetary policy stance at the end of July (FOMC scheduled on July 29/30). The central bank is likely to opt for a status quo, keeping the FED Funds rate unchanged in the 4.25% / 4.50% range. This remains in line with our forecasts for key US interest rates. We continue to believe that two 25-bp rate cuts could take place from September onwards, when the effects of the trade war on the US economy become real (a combination of slowing consumption and lower inventories), bringing the FED Funds rate to the 3.75% / 4% range by the end of the year.