At its July Governing Council, the ECB unsurprisingly kept its three key interest rates unchanged (deposit facility rate, main monetary policy rate at 2%, refinancing rate at 2.15% and marginal lending facility rate at 2.40%).

At the press conference that followed, Christine Lagarde indicated that she considered the institution to be in a comfortable position to “hold and watch” given that:

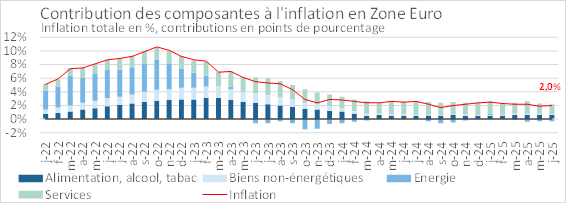

- Inflation had now returned to the 2% target (see below), helped in the short term by the gradual decline in wages in line with expectations and the continued absorption of the increase in unit labor costs by unit profits, and in the medium term by anchored inflation expectations at the 2% target.

- The Old Continent’s economy had shown resilience in a challenging global environment, helped not only by the rise in net exports frontloading, in anticipation of the entry into force of additional US tariffs, but also by the gradual increase in household consumption (historically low unemployment, solid balance sheets) and investment, which was not necessarily expected given the uncertainty.

- While the risks surrounding economic growth were mostly bearish, those related to inflation were less certain. In fact, risks to inflation could well tilt: to the downside, in the event of a stronger Euro, or if some other trading partners (not least China) were to dump their excess capacity in Europe; but they could also trend upwards, fuelled by the fragmentation of global value chains and the resulting bottlenecks.

CPI – Euro area

Going forward, the ECB’s conduct of monetary policy remains unchanged. It will continue to be data-dependent, with no forward guidance and maintaining a meeting-by-meeting approach, without committing to a predetermined path. In this context, the three pillars of future decisions remain:

- The inflation outlook, including related risks.

- The dynamics of underlying inflation.

- The strength of the transmission of monetary policy decisions to the real economy.

During the Q&A session that followed, with Christine Lagarde remaining firm on her position not to hint towards any forward guidance, we still managed to retain that:

- It was too early to comment on the economic effects and monetary policy implications of a possible trade agreement with the United States that would include reciprocal tariffs of 15% (similar to Japan’s, according to press reports released on the evening of July 23). As a matter of fact, Christine Lagarde indicates she would not rule out any possibility for the future, including a rate hike if the trade war outcome turns out to be more favorable for economic growth and spurs inflation.

- Fears that inflation would fall below the ECB’s target are justified, as the economic forecasts presented by the institution itself at its June Governing Council included this possibility for 2026 (inflation at 1.6%). However, the 2% price stability mandate is not based on a specific point in time, but rather on a medium-term trend, and in this regard, given the uncertainty surrounding the trade war and how people will react to the new tariffs, it is better to wait for more clarity before making any decision.

- The decision to keep key interest rates unchanged in July was taken unanimously by the Governing Council.

Our opinion: Today’s ECB decision is in line with our forecast. We continue to believe that with a deposit facility rate at 2% and a gradual recovery in domestic demand, the ECB is in a comfortable position going forward. Furthermore, at this level, real rates remain just above 0, preventing the institution from returning to the side effects of the long period of negative rates that prevailed until the beginning of the 2020s (inefficient allocation of capital, bubbles, etc.). Our forecast for the end of 2025 remains at 1.75%/2%, with a further 25 bp rate cut still possible from September onwards in the event of a further deterioration of the economic outlook.