This week’s top three news stories and what we think of them

- By giving in to American demands, the European Union avoids escalation and momentarily reassures, but the sealed trade agreement puts it in a weak position.

- In July, the FOMC votes to keep the Fed Funds rate unchanged..

- A busy week for macroeconomic statistics: the United States outperforms and the Eurozone holds up well.

1. By giving in to American demands, the European Union avoids escalation and momentarily reassures, but the sealed trade deal puts it in a weak position.

On Sunday July 27, European Commission President Ursula Von Der Leyen and US President Donald Trump concluded weeks of intense negotiations by announcing the USA and EU had reached a trade deal, described by the US President as the “biggest deal ever”. In more details, it comprises of:

· 15% tariffs on EU exports to the United States, including the automotive, pharmaceutical and semiconductor industries;

· In return, American products exported to the EU are exempt from tariffs;

· The agreement also includes the end of non-tariff barriers, calling for greater cooperation in the sanitary and phytosanitary domains, the automotive industry standards and other quality standards in a number of additional industrial sectors;

· Aluminum and steel remain subject to the 50% sectoral tariff, with both partners working towards the eventual introduction of a quota system;

· A list of so-called “strategic” products, including aerospace, certain chemicals, semiconductors, agricultural products and critical raw materials, will benefit from a total exemption from tariffs on both sides;

· The EU also pledges to buy USD 750 bn worth of US energy (oil, gas and nuclear) by 2028, USD 40 bn worth of AI chips, and to increase its purchases of US military gear;

· Finally, the EU is committed to mobilizing an additional USD 600 bn in private investments in the US by 2028 as well.

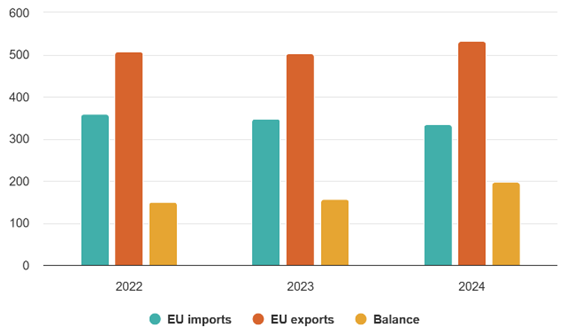

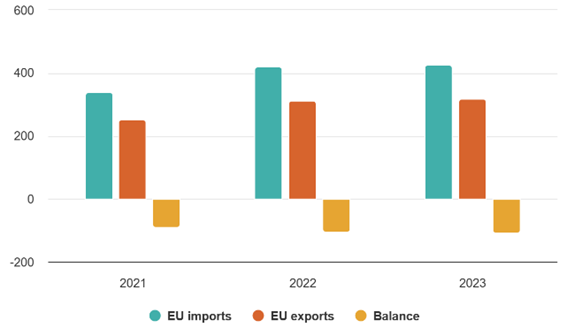

On the surface, this deal is good news for the transatlantic partners and for world trade (see charts below), since it avoids the punitive 30% tariffs that were due to come into force on August 1st before, had the trade deal not been announced. As Marco Sefcovic, the Commission’s chief negotiator, points out, the 30% tariffs would simply have brought bilateral trade to a standstill.

Bilateral trade between the EU and the USA

Goods, in bn EUR

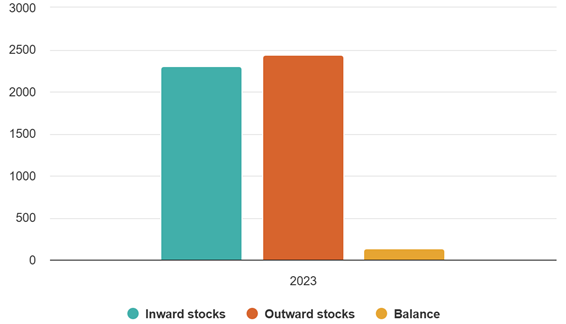

EU FDI in the United States in 2023

in bn EUR

On closer examination, however, the agreement appears unbalanced, with at least three elements, beyond the tariff differential, being unfavorable to the EU.

· First, while the 15% tariff currently applies to the semiconductor and pharmaceutical sectors, the US administration has not abandoned its plans for sector-specific tariffs, and is expected to make announcements in this regard in the coming weeks;

· Also, the EU’s energy commitments, particularly in the fossil fuel sector, appear disproportionate with regards to the current situation (in 2024, the Europeans purchased energy products from the United States, including almost a third of gas and two-thirds of oil, for around USD 65 bn only), and could well weaken the European trajectory towards carbon neutrality by 2050;

· Last, private investment is not something the EU controls, and the European Commission has made no provisions for incentive mechanisms towards companies that could be interested. As a result, the Commission finds itself in a weak position for the future, as the United States reserves the right to deem the agreement as not being respected, which would enable renegotiations detrimental to the EU.

Our opinion: The trade deal achieved between the USA and the EU bears a strong resemblance to what Japan agreed to last week. And as early as last week, press reports were already pointing to its imminence. As a result, the markets had already anticipated it would be announced, which explains why the positive market reaction was only short-lived. Hence, the slight rebound in equity indices and the appreciation of the EUR at the start of trading on Monday July 28 quickly gave way to a decline in equity markets and a fall in the EUR. With this trade deal, European exports to the United States now face the double price-competitiveness shock of 15% tariffs and the depreciation of the USD (EUR/USD at around +10% YTD as of the end of July). Also, while the agreement reduces uncertainty, at least for the time being, allowing European companies to rethink their investment and recruitment plans with greater peace of mind, its contours leave the USA free to renegotiate and toughen it in the future. The respite is therefore immediate, but the US/EU trade confrontation at the start of 2025 further entrenches the Old Continent’s lagging competitiveness in relation to the two major competing economic powers, the USA and China. As for our interest rate forecasts for the end of 2025, we are maintaining them unchanged in the light of the agreement, with analysis now focusing more particularly on forthcoming macroeconomic publications.

2. The FOMC votes to keep FED Fund rates unchanged in July

In July, the FOMC voted to keep the FED Funds rate unchanged at 4.25%/4.50%.

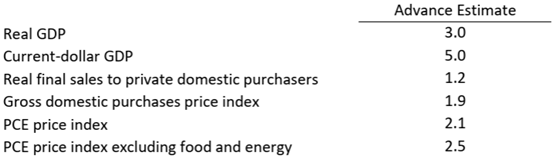

The monetary policy statement explained this decision by pointing to persistently high inflation despite slowing economic growth, against a backdrop of a still-strong labor market and low unemployment (see summary table of data published on the same day by the Bureau of Economic Analysis below).

In addition, the decision-making process surrounding monetary policy remains unchanged and continues to be based on the three pillars of incoming data, the evolving outlook, and the balance of risks (maximum employment and stable inflation at 2%).

Lastly, the vote within the FOMC was not unanimous. Two members of the FED’s monetary policy committee, Christopher Waller and Michelle Bowman (both relatively close to the Trump administration’s ideas), would have preferred to lower the FED Funds rate by 25bps immediately.

GDP and related data

Quarterly change Q2 2025/Q1 2025 annualized, in % (Q2 2025/Q1 2025 annualized)

From the Q&A session led by J. Powell, we note that:

· The FED’s current monetary policy stance is moderately restrictive in response to inflation staying above target, even when looking through tariffs and their potential economic effects. In this regard, J. Powell indicates that the institution is in a comfortable position to analyze upcoming macroeconomic data (two reports on employment and two others on inflation before the next FOMC meeting in September), reassess the balance of risks, and make the right decision at the right time. In fact, a decision to cut rates too early could threaten price stability, whereas a decision too late could weaken the labor market;

· On the labor market, even though it is still in equilibrium, J. Powell notes that the continued low unemployment rate is also explained by the decline in the labor supply (the administration’s anti-immigration policy). Thus, there are downside risks to employment that must be considered going forward. This is one of the arguments put forward by the two board members who were in favor of lowering rates immediately;

· On uncertainty, it had not necessarily changed since June, because even though the level of applicable tariffs had now been clarified, their macroeconomic effects remained largely unpredictable. However, J. Powell concedes that the possibility of only seeing temporary price increases (a rise in the general price level rather than widespread reflation) was plausible, and that this was why rate hikes had not been discussed at this stage;

· More generally, J. Powell reiterated that the concept of a neutral rate was theoretical and essentially unobservable (but rather achieved empirically). He also declined to comment on the Trump administration’s policies (the OBBBA, while indicating that it was only moderately expansionary since most of the measures were in fact extensions of pre-existing laws; the weakness of the dollar, which is the responsibility of the Treasury; budget cuts in the administration, particularly in agencies responsible for collecting macroeconomic data, which he nevertheless described as the “gold standard” for the work of the central bank and the private sector; his resignation from his position at the FED at the end of his term as Chairman of the FOMC, no comment).

Our opinion: The FED’s decision on July 30 is in line with our forecast. We continue to believe that the current slowdown (in household consumption and job creation) will enable the US central bank to cut its key rates twice between now and the end of 2025, bringing them between 3.75% and 4%, while maintaining control over the return of inflation to the 2% target. That being said, the next employment data will be key. While real GDP growth in Q2 2025 came in at +3% (annualized quarterly change), exceeding expectations, any further positive surprises, particularly in the labor market, would further delay the prospect of a rate cut. In this regard, beyond the monthly employment reports (Employment Situation from the Bureau of Labor Statistics), we will also be paying close attention to the annual revision of the Current Employment Statistics survey, the preliminary results of which will be published at the beginning of September. To be continued.

3. The week was busy with numerous macroeconomic statistics: the USA continues to outperform and the Euro area holds up

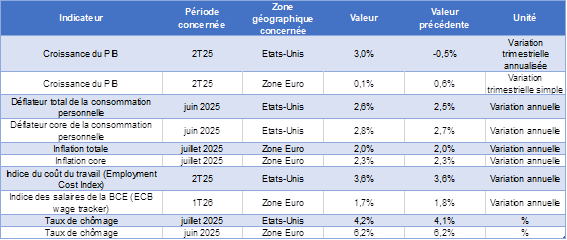

The last week of July was very busy in terms of macroeconomic statistics, particularly in the United States and the Euro area (see summary of relevant data published during the week below).

Inflation, wages, unemployment and GDP were on the menu of the week’s publications.

On the growth front:

· The performance gap between the USA and the Euro area in Q2 2025 is back in the spotlight, after figures for Q1 2025 were significantly distorted by stockpiling in anticipation of the entry into force of US tariffs. This had resulted in an unprecedented widening of the US trade deficit (GDP at -0.5%) and, conversely, a strong contribution from the European trade surplus to growth on the Old Continent (GDP surprisingly up at +0.6%). Thus, in Q2 2025, the US regained its momentum (GDP at +3.0%, above its potential), while the Euro area remained virtually stagnant (GDP at +0.1%);

· That being said, underneath the surface, the overall slowdown continues. In the USA, household consumption (68% of current GDP) slowed to +1.4% (compared to an average of +2.8% over the last four quarters, but still above its long-term average outside crises at +0.8%). Non-residential private investment is also slowing (+1.9% compared to an average of +3.8% over the last four quarters). Lastly, the measure of final sales to private domestic purchasers (an indicator often cited, not least by the FED) is also slowing, to +1.2% (compared to an average of +2.7% over the last four quarters). In the Euro area, the relapse of German growth below 0 (-0.1%) is weighing heavily, as is Italy’s underperformance (-0.1%), both of which are paying the price of the ongoing international trade turmoil. French growth is surprisingly strong (+0.3% compared to +0.2% forecast by the INSEE in its latest economic report published in June), but care should be taken not to overinterpret this result. In fact, much of the increase is attributable to inventories (contribution of +0.5 points) and, conversely, final domestic demand excluding inventories remains sluggish (zero contribution to growth), the rebound in household consumption is very weak (+0.1%) and, above all, investment (the pillar of growth potential) continues to decline (-0.3%).

On the job market side, demographic aging is anchoring the unemployment rate at historic lows in both the Euro area and the USA. Across the Atlantic, the effects of the Trump administration’s anti-immigration policies are also playing out favorably. Thus, the continuing monthly decline in job creations, to a surprisingly low 73,000 in July, is virtually colorless given the continuing fall in the working-age population (unemployment only marginally up, to 4.2%).

As for wages, while they are no longer a source of inflation in the Euro area, their slowdown in the USA is this time hampered by the decline in the labor supply.

Lastly, in terms of inflation, the stable prices in Europe, in line with the central bank’s 2% target, contrast with the situation in the USA, where the preliminary negative effects of the trade war are beginning to emerge, but without completely derailing long-term inflation expectations and the FED’s price stability mandate.

Our opinion: With uncertainty surrounding US tariffs having eased somewhat, the long-term trends of US economic outperformance and structural weakness in the Euro area are back in the spotlight, and this is unlikely to change anytime soon. In light of the trade agreement signed between the transatlantic partners, which is highly favorable to the USA, this observation comes as no surprise. The Euro area continues to suffer from a significant competitiveness deficit, particularly in its industrial sector, which bears the heavy burden of higher energy prices and now additional 15% tariff and a strong Euro. Looking ahead, in the US, the resumption of the FED’s rate cuts will be a pivotal factor that will only materialize once there are signs of a deterioration in the job market or the transitory nature of inflation linked to the trade war. In the Euro area, the main driver will be Germany’s stimulus plan, but here too uncertainties remain: the country’s rearmament could well involve orders placed with US companies rather than European ones. Also, France faces a busy social agenda in the fall, which could also weigh on the economy. Overall, while our strategic allocation continues to favor European equities over their US counterparts, the macroeconomic statistics due in August and J. Powell’s speech in Jackson Hole could well lead us to shift our view in favor of the United States. This remains to be confirmed in light of developments and may be accompanied by an appropriate hedging policy against the US dollar, for which the risks of depreciation remain high.