The 3 must-know news stories of the week and our opinion

- J. Powell’s pivot in Jackson Hole paves the way for FED Funds rate cuts, in line with our previous forecasts.

- The India/US trade dispute is intensifying, posing a challenge for the Indian economy, which can leverage some of its strengths to resist.

- High-risk (lost) gamble for François Bayrou.

J. Powell’s pivot in Jackson Hole paves the way for FED Funds rate cuts, in line with our previous forecasts.

The end of August was marked, as usual, by the annual summer seminar of central bankers, gathered around the FED at the Jackson Hole Symposium. J. Powell’s eagerly awaited speech did not disappoint, revealing the outlines of the monetary policy decisions to be taken at the next FOMC meetings, in light of the most recent economic developments.

To put it in a nutshell, the FED Chair confirmed the imminent resumption of FED Funds rate cuts:

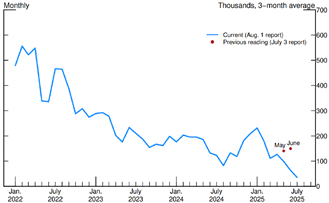

- This is justified by the marked deterioration in employment figures, as reflected in the revision of the establishment surveys for May and June, bringing the three-month moving average monthly job creation in July to just 35,000, far below its historical trend outside of crises (183,000 jobs created monthly between 2010 and 2019, for example).

Monthly job creation in the USA

In thousands, 3 month moving average

- Still, the situation is not one of serious deterioration. For example, the unemployment rate remains historically low (at 4.2% in July), while the drop in hiring is accompanied by a decline in the labor supply (due either to a spontaneous or forced decrease in immigration), economic activity is fairly robust (latest estimate of real GDP in Q2 2025 at + 3.3 % seasonally adjusted at annual rate), and, above all, inflation has not disappeared (personal consumption expenditures deflator steady at + 2.6 % year-on-year in July, far from the 2% target). Future rate cuts will therefore be neither rapid nor systematic.

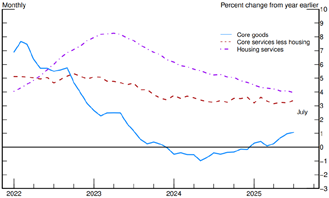

Personal consumption expenditures deflator in the USA

Annual variations, in % / Note: on the graph, July data are estimates based on the consumer and producer price indices.

More broadly, the current economic outlook is particularly challenging for the FED. Its monetary policy now resembles a balancing act to fulfil its dual mandate of price stability and maximum employment in a context where these two objectives diverge and would require opposite approaches (maintaining a restrictive monetary policy to combat rising inflation, easing monetary policy to boost the job market).

How does J. Powell resolve this dilemma? He considers that:

- First, it is possible that the price increases linked to the trade war are only temporary rather than permanent (an increase in the general price level rather than a rise in inflation), while pointing out at the same time that the increases could be gradual and that, with tariffs still evolving (sectoral ones to come), the upward trend is not over.

- Second, that the onset of a wage-price spiral in response to trade war-related inflation is not the most likely scenario given the weakness of the labor market, which is another argument in favor of a rise in the general price level rather than inflation.

- Finally, while the risk of higher inflation expectations is real, it is not material at this stage, given the levels measured by surveys and financial instruments.

Perhaps we could also add that J. Powell has bitter memories of being criticized for reacting too late to the surge in inflation at the end of the pandemic, and that he would not want to see a repeat of this experience, this time with an unexpected deterioration in the job market.

Our opinion: J. Powell’s change of tone at Jackson Hole leaves no room for doubt and paves the way for FED Funds rate cuts. However, with the economic outlook still highly uncertain (evolving tariff situation, Trump administration’s immigration policies and potential effects on inflation), a data-dependent approach and gradual decision-making without forward guidance remain key. Our forecast therefore remains unchanged and we continue to believe that, given the combined risks to the labor market and price stability, the FED will be able to cut the FED Funds rate twice by 25 bps between now and the end of 2025. A first cut could even come as early as the September FOMC meeting, with the FED Funds rate ending the year in the 3.75%/4% range.

The India/US trade dispute is intensifying, posing a challenge for the Indian economy, which can leverage some of its strengths to resist.

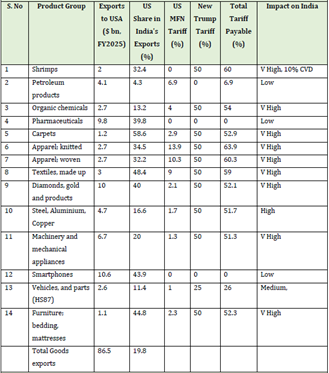

On August 27, 2025, a new 25% tariff on Indian exports to the United States came into effect. This is in addition to the 25% tariffs put in place from August 1 onwards, which are among the highest imposed by the Trump administration on its global trading partners.

Summary of applicable tariffs by sector for Indian exports to the United States as of August 27, 2025

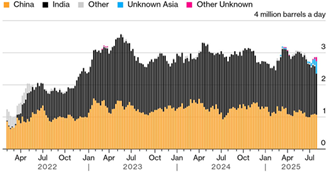

The US President justified his decision to impose a quasi-embargo on certain Indian exports by India’s continued purchase of large quantities of Russian oil (nearly 40% of India’s supply), a crucial source of revenues for Vladimir Putin in financing the war in Ukraine.

Destinations of Russian oil exports by ship to Asia

Four-week moving average of seaborne oil shipments from Russian ports to the rest of Asia, in millions of barrels per day

This escalation of the trade war poses a challenge for the Indian economy, particularly for its most affected sectors (textiles and apparels, jewellery, shrimps, carpets, furniture). Given the contemplated tariff levels, Indian exports would lose all competitiveness. The main economic damages to be expected include:

- A fall in Indian exports to the United States (trade channel);

- Beyond that, high risk of rising unemployment in the sectors most affected, due to their high labor intensity (consumption channel);

- Private investment could also weaken given the more uncertain environment (private investment channel);

- Finally, India would find itself at a disadvantage compared to other Asian countries in the race to capture Chinese goods flows seeking to divert from their original trajectory to the United States.

Our opinion: Indian assets were quick to react to the escalating trade conflict with the United States. Over the course of a month, the Rupee plummeted below its historic low of 88 INR/USD. Similarly, equity markets declined (Sensex down 1.9% over one month at Friday’s close, Nifty 50 down 1.6%). From a pure macroeconomic perspective, two factors could enable the Indian economy to mitigate the shock and maintain its current growth trajectory despite everything:

On the one hand, it is relatively less dependent on exports (especially when compared to some of its Asian counterparts). Exports account for only 20% of India’s GDP (GTRI), compared to around 60% for private consumption (Reuters).

On the other hand, the Modi government wants to use this shield. It has already announced a reform of the Goods & Services Tax (GST) around Diwali, which would involve both simplifying the tax system and lowering the applicable tax rate. This would boost consumption and support the movement towards self-sufficiency and promotion of “made in India” products, which is dear to the Indian leader.

Finally, tax cuts would also help to further reduce inflation, allowing the Reserve Bank of India (RBI) to continue lowering key interest rates, which would further support domestic demand.

High-risk (lost) gamble for François Bayrou

On Monday, August 25, during a press conference aimed at raising public awareness in France about the urgent need to control the public deficit and debt, Prime Minister François Bayrou announced that he would call on the National Assembly to vote on a motion of confidence on September 8, pursuant to Article 49, paragraph 1, of the Constitution.

The Prime Minister’s gamble is fraught with consequences. In order for the government to remain in power, it must obtain a majority of votes without having to reach a specific threshold. Thus, unlike typical no confidence votes required by deputies, abstentions and non-participations are not deemed to constitute support to the government. Overall, if the government does not win the National Assembly’s confidence, the Prime Minister must submit his government’s resignation to the President of the Republic, pursuant to Article 50 of the Constitution.

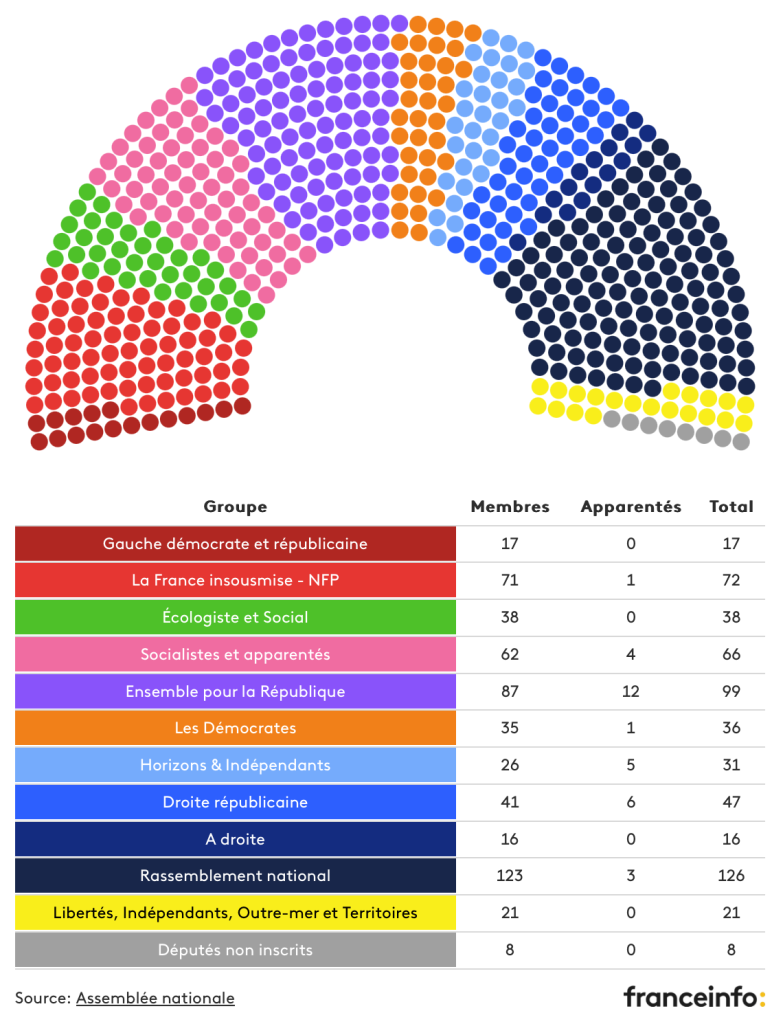

National Assembly Composition

In number of seats

Political reactions were swift following this announcement, and a quick back-of-the-envelope calculation shows that François Bayrou’s government has very little chance of staying in power. The four left-wing groups, the National Rally, and Eric Ciotti’s “A Droite” group have all indicated that they will vote ‘against’ (with a slight nuance on the part of the Socialists, who may abstain rather than vote “against,” but with no impact on the final outcome of the vote). The total number of votes “for” would thus only reach 242 at most, far from a majority, which would automatically lead to the fall of the government.

The markets reacted swiftly in this context, with Tuesday’s closing figures showing:

- The CAC 40 falling by nearly 1.5% after already dropping 1.6% the previous day, with financial stocks among the most heavily sold (Société Générale – 6.8 %; Crédit Agricole – 5.4%, BNPP – 4.2 %, Axa – 4.0%);

- French sovereign bond yields rising by almost 10 bps compared to the August 22 close, with the 10-year OAT now reaching 3.5%;

- The France/Germany spread widening to nearly 80 bps, compared to 70 bps at the August 22 close.

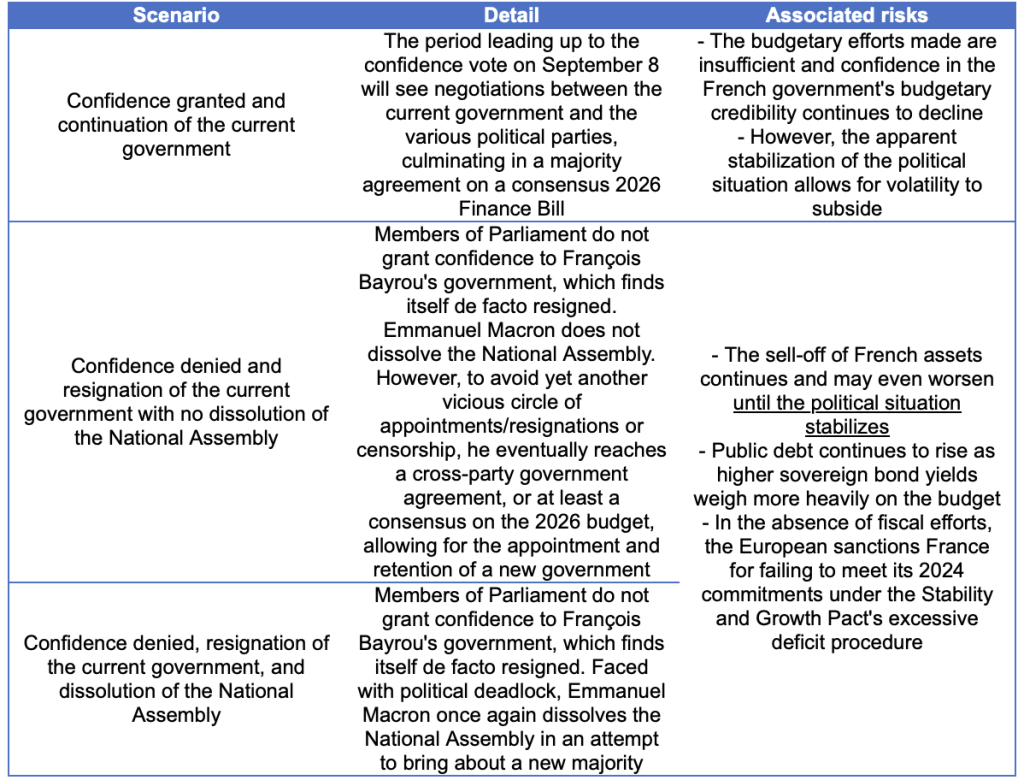

In this context, three possible scenarios emerge for the future (see below).

Possible scenarios and associated risks

Our opinion: Given the latest announcements, we believe that François Bayrou’s government is unlikely to remain in power. The period of political instability that is now beginning could last until the President of the Republic manages to form a new governing majority, either through cross-party dialogue or by dissolving the National Assembly and holding snap elections. In this context, we continue to believe that the 10-year OAT/Bund spread will widen, possibly even testing the 100 bp level reached during the 2024 snap elections, particularly due to fears that extreme parties with very low economic credibility will come to power. As for France’s economic situation and financial risk as such, the country’s ability to raise taxes has not changed and safeguards are in place (Special Finance Law, etc.) to ensure the continuity of the State. In addition, France continues to place its debt on the markets without difficulty. There is no cause for alarm, therefore, but rather a need for clarity and caution, certainly with regards to sovereign debt, but also on the equity markets, where investors may prefer to hold non-French Eur