Key Messages

Freshwater, representing less than 1% of the Earth’s water directly usable, is becoming increasingly scarce and thus a strategic asset. Global demand is rapidly rising due to population growth, urbanization, and intensifying agricultural and industrial use. Today, in many regions, consumption already exceeds natural regeneration capacity, placing water among the most critical resources for the future.

It is essential to distinguish between withdrawals and consumption, as well as the importance of the water footprint, which includes “virtual water” indirectly mobilized in the production of goods and services. Agriculture, energy, and industry are major consumers, often inefficiently, while new uses such as data centers further increase pressure on resources. Water quality is also at risk, with persistent pollutants and concerning ecological conditions in many areas.

In response to these challenges, solutions exist to limit consumption and optimize management: reducing leaks, more efficient irrigation, reuse and desalination technologies, and the adoption of sustainable industrial and agricultural practices. Technological innovation and public policies, such as the European Union’s resilience plans, are essential to ensure more rational water use and preserve this vital resource for future generations.

Investment involvement

Water, now a strategic and limited resource, has significant implications for investors. Water-intensive sectors — irrigated agriculture, textiles, thermal energy, data centers — are particularly exposed to rising costs, supply disruptions, and regulatory pressures. Conversely, technologies and solutions that improve water efficiency (precision irrigation, leak detection, water recycling and treatment, more efficient desalination) represent structural growth opportunities. Companies such as Veolia Environnement, Xylem, Pentair, Severn Trent Plc, and Acciona are well positioned to capture this momentum.

Integrating the “water footprint” is now an essential criterion in ESG analysis and portfolio resilience. Beyond risk management, water emerges as a long-term investment theme, at the crossroads of food security, energy transition, and industrial sustainability. Investing in companies that develop efficiency and water-saving solutions, while protecting against exposure to vulnerable sectors, appears to be a key strategy to capture the value created by the scarcity of “blue gold.”

Contents

- Key principles

- Today’s reality is not tomorrow’s

- Sector impacts

- Needs & solutions

In 2010, a documentary broadcast on French television featured a now-iconic line from actor Jean-Claude Van Damme: “I love water. In 20 or 30 years, there won’t be any left.” While this statement may have seemed exaggerated at the time, it resonates with alarming relevance today, as the threat of water scarcity to meet our needs and sustain our economy looms large.

Paradoxically rare, only 3% of the world’s water resources are freshwater, but much of it is locked in glaciers or inaccessible in deep aquifers. Thus, less than 1% of the Earth’s water is directly usable.

Throughout the 20th century, freshwater withdrawals for domestic, agricultural, and industrial uses skyrocketed: from 600 km³ per year in the early 1900s to nearly 3,880 km³ in 20171. This trend is expected to continue, with demand projected to grow by 1%2 annually until 2050 due to population growth and urbanization.

However, in many regions, human consumption has already been exceeding natural regeneration capacity for decades.

Having become one of the most virtually traded raw materials in the world, water has been considered a major strategic issue for several years, earning it the nickname “blue gold.” Its sustainable management is thus one of the greatest challenges of the 21st century.

Key principles

Water in our society is used in many stages that are not immediately visible.

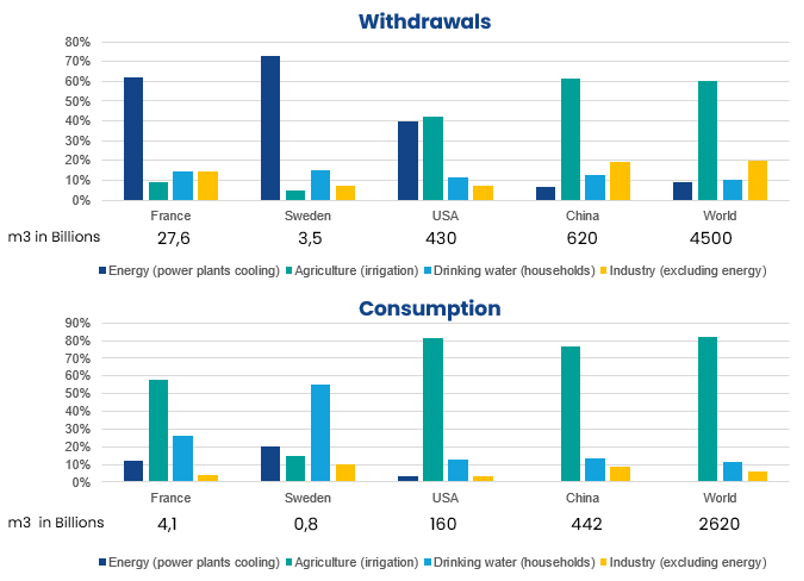

Withdrawals and Consumption

First, it is essential to establish a fundamental distinction in water resource management: that between withdrawals and consumption.

Withdrawals refer to the total volume of water extracted from the environment—whether from rivers, lakes, reservoirs, aquifers, or non-conventional sources such as recycling or desalination. Some of this water is returned after use, sometimes with limited impact on the natural cycle.

Consumption, on the other hand, refers to the volume of water effectively removed from the cycle, particularly through evaporation, plant absorption, incorporation into finished products, or losses within distribution networks.

Not all withdrawals translate into actual consumption. In France, for example, a large share of withdrawals is used for cooling nuclear power plants (open-circuit), with water returned to the environment, resulting in relatively limited net consumption. In Sweden, hydropower requires massive water flows, but this does not count as consumption. Conversely, in China, most withdrawals are for agricultural irrigation — often inefficient — leading to particularly high real consumption. It is therefore essential to distinguish between withdrawals and consumption to accurately assess water needs.

Additionally, a significant portion of withdrawn water is lost due to leaks in distribution networks, representing both economic and environmental waste. In France, about 20%3 of treated drinking water never reaches the end consumer. Globally, this rate ranges between 30% and 50%4. These losses are referred to as Non-Revenue Water (NRW).

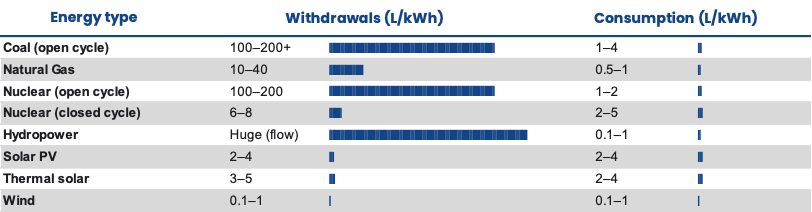

While open-circuit nuclear power plants have high water requirements for cooling, it is worth examining the water demands of other energy sources.

Withdrawals and consumption by energy type

Thermal energy sources with open circuits, whether fossil or nuclear, are particularly water-intensive due to cooling needs, although some of this water is returned to the environment.

In contrast, renewable energies are significantly more water-efficient, especially during their operational phase. For photovoltaics, 70%5 of the water used is during the manufacturing stage of the panels.

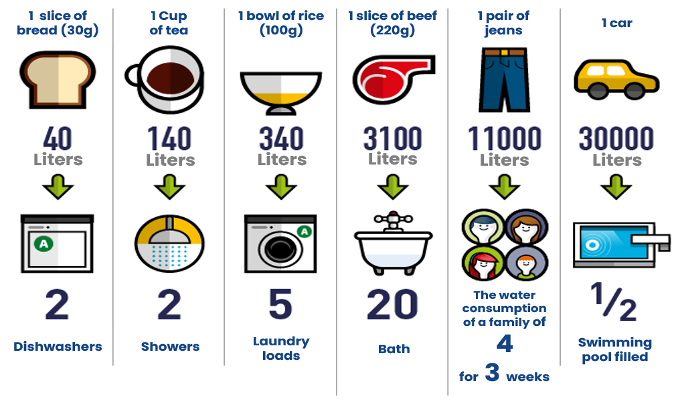

Water Footprint and Virtual Water

So far, the analysis of withdrawals and consumption was focused on directly used water. However, to comprehensively assess the impact of an activity on water resources, the concept of the water footprint must be considered. This measures the total volume of water used, directly or indirectly, to produce a good or service. It includes not only consumed water but also the water required to dilute and treat pollutants generated during production, ensuring that discharges meet acceptable environmental standards. Thus, everyday product incorporates a significant amount of “invisible water” used upstream in its lifecycle.

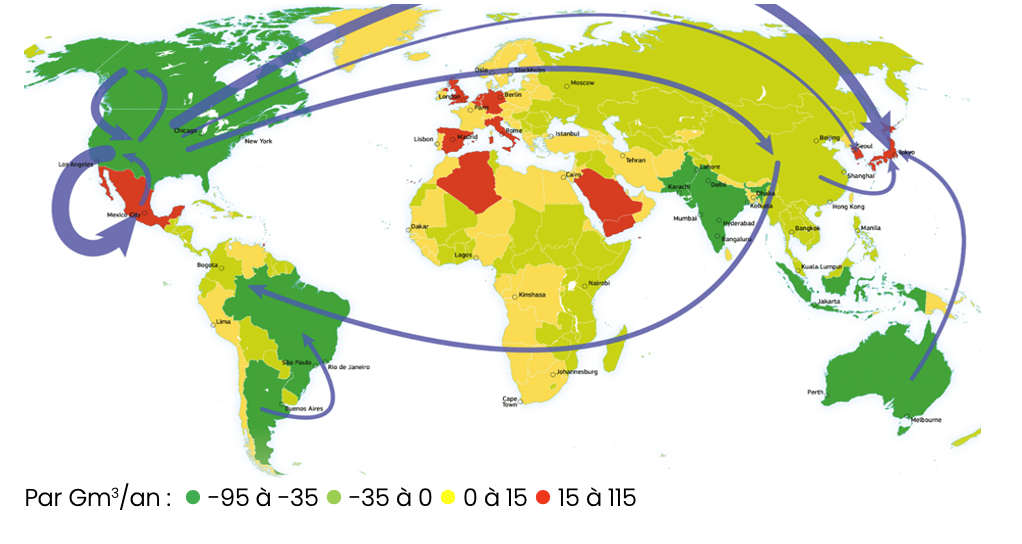

In this context, we distinguish between imported virtual water, which is the water used abroad to produce goods consumed locally, and exported virtual water, which refers to the water used domestically to produce goods for export. The balance between these two flows determines whether a country is a net importer or exporter of virtual water.

The textile sector is a striking example of the hidden aspect of this footprint: dyeing, washing, and finishing clothes are highly water-intensive, often in countries already experiencing water stress.

Today’s reality is not tomorrow’s

Regeneration of Resources at Risk

The planetary boundaries framework defines a space within which humanity can develop without compromising resource availability for future generations. For freshwater, this means maintaining a balance between demand and the natural regeneration capacity of resources. However, this balance was officially broken in 20236, due to several major pressures:

- Population growth and urbanization, increasing domestic and industrial demand.

- Soil artificialization, reducing natural infiltration and exacerbating flood risks.

- Agricultural intensification, particularly for cereals and livestock, which are highly water-intensive.

- Industrial development and mining, often involving water-intensive processes.

- Climate change, altering the water cycle: fewer regular precipitation events but more extreme weather events

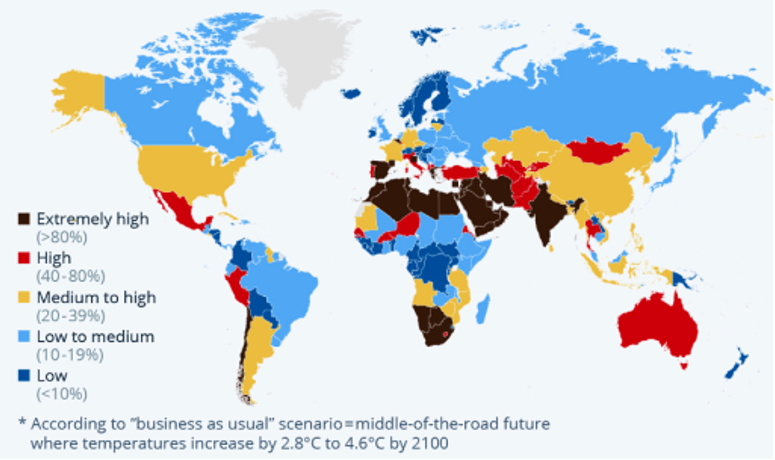

Water stress projection 2050

AAccording to the IPCC, global water demand could rise by 20–30% by 2050, while resources shrink. Each additional degree of warming enables the atmosphere to hold approximately 7% more moisture, intensifying extreme weather. These changes do not necessarily allow water sources to regenerate (due to soil artificialization and rapid runoff that is not absorbed into aquifers).

The effects of climate change are already being felt in agricultural production and food markets. Extreme weather events are devastating crops and driving up prices. For example, between 2022 and 2023, droughts in Spain and Portugal caused a 50%7 increase in the price of olive oil. Similarly, heatwaves in Ivory Coast and Ghana contributed to a 280% surge in cocoa prices. Many other examples illustrate the growing impact of climate disruption on global food security.

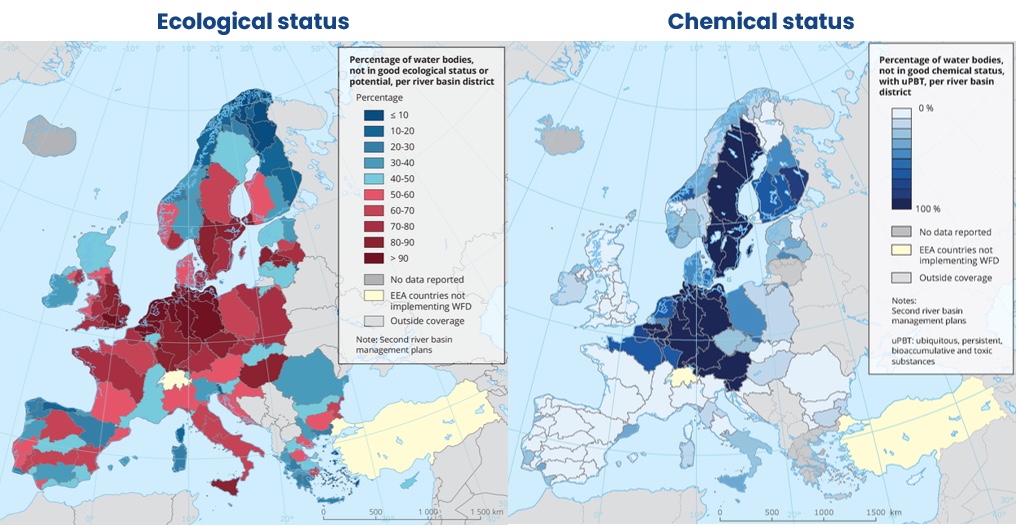

Deterioration of Water Quality

Surface and groundwater quality is also alarming. Only 30% of surface waters show good chemical status (vs. 86% for groundwater), and only 40% show good ecological status.

hese figures exclude PFAS, the so-called “forever chemicals”, representing a rising health threat.

EU Resilience Strategy

Europe is a global leader in water technologies, holding nearly 40% of international patents. Its water industry generates approximately €107 billion in revenue and supports nearly 1.7 million jobs8.

However, the EU’s industrial relocalization strategy is expected to increase pressure on this resource in the coming years. To address these challenges and enhance the continent’s resilience to future risks, the European Union has adopted a resilience plan aimed at improving water use efficiency by at least 10% by 2030.

Sector impacts

Sectors that are heavy water users must adapt to this new reality. Specialized companies, global leaders in water technologies, already offer innovative solutions to support this transition. Among them are the French company Veolia Environnement, a global leader in the sector, and American firms Xylem and Pentair, which are key players. Most European water utilities remain unlisted, with the exception of Severn Trent Plc in the United Kingdom.

Most Affected Sectors

As the world’s largest water consumer, agriculture still relies heavily on intensive irrigation and groundwater overexploitation, compromising the sustainability of crops. Two major areas for improvement are emerging:

– Irrigation techniques and water reuse: drip irrigation, micro-sprinkling, and water recovery and recycling are promising solutions. Several American companies, such as Lindsay Corporation, Valmont Industries, and Toro Company, are “pure players” in these fields.

– Agricultural practices and seeds: developing drought-resistant varieties is a key lever. French company Vilmorin & Cie and German firm **KWS Saat are pioneers in this area.

The increasing role of sensors and meteorological data to optimize water use is another area where the American company Trimble Inc. stands out.

The energy sector is also highly dependent on water, particularly for cooling thermal and nuclear power plants, fuel extraction, and facility cleaning. Solutions to reduce this dependency include closed-circuit cooling towers and air-to-air cooling (dry cooling), offered by companies like the Swedish firm Alfa Laval AB, as well as enhanced wastewater treatment plants, which represent a major investment focus.

In industry, solutions for reducing water consumption align with those in the energy sector, particularly in metallurgy, steelmaking, and construction. However, some industries have specific needs.

The textile industry, which is highly water-intensive for dyeing, washing, and finishing, is exploring alternatives such as waterless dyeing (supercritical CO₂, plasma), recycling colored water, closed-loop systems, and microfiber filtration.

For petrochemicals, the treatment and reuse of chemical effluents are crucial. Key players in this area include the American company Ecolab and the Finnish firm Kemira for chemical water treatment. For technical waste management, Séché Environnement is the leading independent operator in France.

Technological evolution is giving rise to new water-consuming sectors. The growth of artificial intelligence (AI) is driving a surge in demand for computing infrastructure (“data centers”), which require significant amounts of electricity and water for cooling. Between 2020 and 2023, Microsoft’s water withdrawals increased by 60%9.

A joint investigation by SourceMaterial and The Guardian also reveals that several tech giants are building new data centers in areas already under severe water stress. Their consumption could double by 203010, intensifying competition for access to this resource among sectors. Explored solutions include air cooling and immersion in non-aqueous liquids.

Water, as a precious resource, is the subject of numerous controversies, from intensive pumping in fragile areas (such as Volvic in Auvergne) to toxic discharges from fast fashion in Asia, and the excessive consumption of data centers in Europe. Increasing vulnerabilities related to cybersecurity are also a concern. In 2021, a hacker infiltrated the network of a water distribution plant in Florida and attempted to alter the chemical composition of the distributed water.

Needs & solutions

Many solutions aimed at optimizing and reducing water withdrawals and consumption are currently under development. Among these, leak management, also known as non-revenue water (NRW), is a major leverage. This water, although extracted, treated, and stored, is lost in the distribution network before reaching the end consumer.

In Europe, the Water Framework Directive and associated national plans require communities to reduce leaks to below 15–20%. In the United States, initiatives such as the EPA’s WaterSense program and federal funding through the Infrastructure Investment and Jobs Act support infrastructure renovation and proactive leak detection. Companies like Advanced Drainage Systems are involved in these efforts, while Severn Trent Plc uses drones to locate leaks.

Another often-touted solution is desalination. Although this technology is controversial due to its high energy consumption—often from fossil fuels—it remains an option for water-stressed regions. Its environmental impacts include marine biodiversity disruption and concentrated brine discharge. Improvement efforts focus on integrating renewable energy, optimizing membranes, and energy recovery. In this regard, the Spanish group Acciona stands out for designing and operating desalination plants that incorporate these innovations.

Conclusion

Water is a strategic and limited resource, and its sustainable management is a major challenge of the 21st century. The increasing pressure from global population growth, industrial development, and climate change makes an integrated approach essential, combining loss reduction, optimized use, and innovative technologies.

Efforts must focus on improving infrastructure, adapting agricultural and industrial practices, and raising consumer awareness.

Only coordinated action at the local, national, and international levels will preserve access to water for present and future generations while ensuring the resilience of ecosystems and economies.

1 French Ministry of ecological transition

2 Unesco, 2022

3 Study by the French observatory on public water and sanitation services

4 Veolia

5 MDPI Study

6 Stockholm Resilience Center

7 Novethic, Environmental research letters

8 European Commission

9 Statista.com

10 IEA