At the September Governing Council meeting, the ECB unsurprisingly kept its key interest rates unchanged (deposit facility rate at 2 %), citing inflation around the 2 % target. The main explanation given by Christine Lagarde for the (at least temporary) halt to rate cuts at a terminal level of 2% lies in the changing balance of risks to economic growth. Compared with the rather bearish outlook discussed in June, the risks to growth are now more balanced:

- Uncertainty surrounding the trade war with the USA has diminished with the signing of a trade deal in July.

- The risk of retaliatory tariffs being imposed by the European Union, which would have further weighed on growth and inflation, has now disappeared thanks to the signing of the agreement.

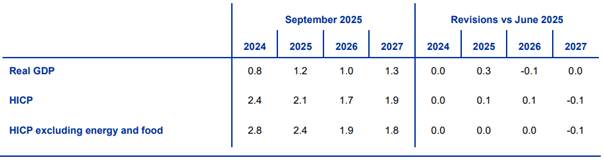

Also, compared with the macroeconomic projections presented in June, the September update revises growth upward in 2025 and inflation upward in 2025 and 2026 (see below).

September 2025 macroeconomic projections

Annual variations, in % ; revisions in percentage points

Christine Lagarde, speaking at a press conference following the monetary policy meeting, explained these revisions by pointing to resilient economic growth in the Euro Area. In H1 2025, this was helped not only by strong US stockpiling in anticipation of the introduction of tariffs, which boosted exports, but also by the rebound in household consumption (made possible by low unemployment and a recovery in purchasing power) and investment (with the gradual decline in interest rates slowly feeding through to corporate lending).

Looking ahead, European growth should continue to be driven by the ongoing recovery in household purchasing power and the decline in household savings rates, boosting consumption on the one hand. On the other hand, the effects of the German defense and infrastructure investment plan and the disbursement of the remaining funds from the Recovery and Resilience Facility should also provide support.

Beyond analyzing and understanding the mechanisms that led to today’s decision, we take away the following points from Christine Lagarde’s press conference:

- The ECB’s monetary policy approach remains unchanged: gradual, meeting by meeting, data-dependent, and based on three factors: the inflation outlook, underlying inflation dynamics, and the quality of transmission of monetary policy decisions to the real economy. In this context, while the ECB is now in a comfortable position (“we continue to be in a good place”), this does not mean that the future is predetermined (“no predetermined path”).

- Today’s decision was taken unanimously by the Governing Council. In response to a question raising Isabel Schnabel’s hawkish view on residual inflationary risks, Christine Lagarde replied that the discussion surrounding risks always combined growth and inflation, not just inflation. She thus reiterated the evolution of the analysis compared to June, which now justifies the pause: the risks surrounding economic growth are more balanced. Finally, on a more colorful note, she recalled: “I’m an owl, neither hawk nor dove.”

- Finally, in response to numerous questions regarding the situation in France, Christine Lagarde reiterated that she does not comment on specific countries but that she can confirm that interest rate markets continue to function orderly and that liquidity conditions remain good.

Our opinion: The new macroeconomic projections and analysis presented today by the ECB reinforce our view of a terminal deposit rate of 2% by the end of 2025 in the absence of any further macroeconomic shocks. The evolution of German sovereign rates following the press conference also points in this direction: convergence of the 2-year Bund rate towards 2% and near stability on the 10-year Bund rate around 2.65% after a temporary peak of around 2.68%. To be continued.