The 3 must-know news stories of the week and our opinion

- In the USA, the sharp downward revision in job creations over one year is yet another argument in favor of a cut in the FED Funds rate at the September FOMC.

- In France, despite political instability, the economic outlook appears resilient in the short run. Caution remains key.

- Unsurprisingly, the ECB choses to pause in September.

In the USA, the sharp downward revision in job creations over one year is yet another argument in favor of a cut in the FED Funds rate at the September FOMC.

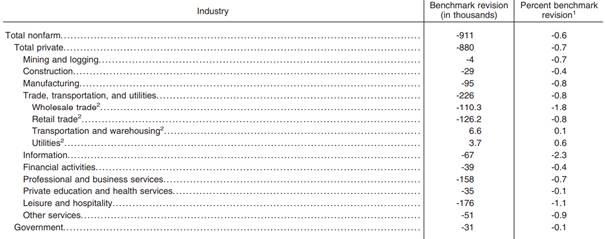

On 9/9, the Bureau of Labor Statistics (BLS) published its preliminary annual revision of job creation numbers for the year ending in March 2025. While the consensus among the economic and financial industry was for a downward revision, its magnitude came as a surprise. The BLS reported that 911,000 fewer jobs had been created over the period (a revision of -0.6%).

Breakdown by sector of the preliminary revision of job creations for the annual period ending in March 2025 in the USA

Notes: (1) A value of 0 corresponds to the interval [-0.05; +0.05]. (2) Belonging to the trade, transport, and utilities sectors. Source: BLS, September 2025, the final revision will be published in February 2026.

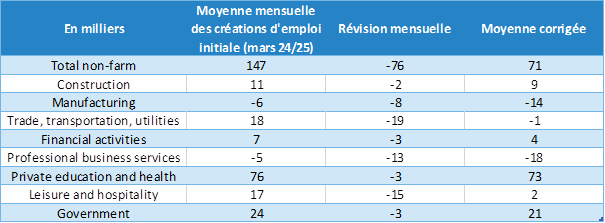

Thus, while it was initially estimated that the US economy had created 147,000 jobs per month over the period (monthly creations for “total non-farm”), this figure is now revised to 71,000, further proof, if any were needed, of the weakness of the US job market.

Revised monthly creations by sector, over the period

Specifically, manufacturing and professional business services, which are highly cyclical sectors, appear to be the most affected. Over the annual period ending in March 2025, they saw job losses of around 14,000 and 18,000 per month, respectively.

In addition, the week was also marked by the publication of inflation figures based on the producer and consumer price indices for August.

- Contrary to expectations, producer prices fell over the month and slowed over the year (down 0.1% and up 2.6% respectively, compared with up 0.7% and up 3.1% in July for the seasonally adjusted final demand index). This change is mainly due to the decline in producer prices in services (-0.2% over one month), while producer prices for goods slowed but remained on the rise (+0.1% over one month). It is also worth noting that the underlying producer price index, excluding food, energy, and trade prices, slowed but remained on an upward trend (+0.3% over one month).

- On the other hand, consumer prices showed a slight acceleration overall (+2.9% year-on-year, +0.4% month-on-month) whereas the underlying index stayed steady (+3.1% and +0.3% respectively), in the wake of the inflationary risks posed by the ongoing trade war.

Our opinion: The sharp downward revision of US employment figures for the year ending March 2025, coupled with unsurprising inflation figures for August, should reinforce the change in tone adopted by the FED at Jackson Hole. We therefore continue to believe that the US central bank will be able to cut the FED Funds rate by 25 bps at the next FOMC meeting (press conference by J. Powell on 9/17), bringing it to between 4% and 4.25%. Beyond that, our forecasts remain unchanged and we still expect a further 25 bp cut in the FED Funds rate between now and the end of 2025, probably in December, allowing the FED to take its time in balancing the risks to its dual mandate of maximum employment and stable prices.

In France, despite political instability, the economic outlook appears resilient in the short run. Caution remains key.

On 9/8, following a failed vote of confidence in the National Assembly, former French Prime Minister François Bayrou was forced to submit his government’s resignation to the President of the Republic, in accordance with Article 50 of the Constitution. The latter immediately appointed a new Prime Minister, Sébastien Lecornu, a close associate of Emmanuel Macron, counting on continuity in the exercise of executive power, but with one slight difference. Sébastien Lecornu’s mission at this stage is not to form a government, but rather “to consult with the political forces represented in parliament with a view to adopting a budget for the nation and building the agreements essential for the decisions of the coming months” according to a statement from the Elysée Palace.

In any case, developments at this stage are not likely to calm a highly unstable political situation, which could permanently anchor the 10-year OAT-Bund spread at 80 basis points, with the risk of further slippage in the event of new snap elections or further deterioration of the situation.

Spreads on French, Italian, and Spanish treasury bonds relative to the 10-year Bund

In bps

However, macroeconomic indicators remain fairly favorable.

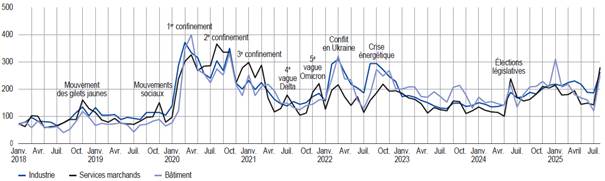

- The Banque de France, which published its monthly economic survey in early September, continues to forecast quarterly real GDP growth of around +0.3% in Q3 2025, unchanged from Q2 2025. This performance would be made possible by robust prospects in three sectors: industrial production, while mixed, remains strong in aerospace and capital goods; activity in market services is growing, particularly in holiday-related sectors; and in construction, activity is exceeding companies’ expectations. Overall, in September, although more cautious, expectations remain quite favorable, as the uncertainty indicator is rising sharply, to a level comparable to that observed at the last snap elections (see below).

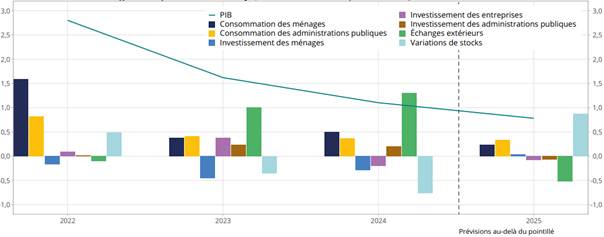

- The INSEE, which published its “Note de Conjuncture” this week, revised its growth forecast for France upward to +0.8% in 2025 (compared to +0.6% previously). The improvement is mainly driven by the agriculture, tourism, real estate, and aerospace sectors, while elsewhere the mood remains gloomy. The stockpiling trend over the year is the main positive contributor to growth in 2025 (see below). Above all, compared to its European neighbors, France is characterized by sluggish household consumption and a savings rate that continues to rise. The institute highlights in particular the sharp dichotomy between sentiment (regarding the employment climate, for example, which is close to its lowest level since the end of the pandemic) and actual statistics, which remain resilient (unemployment is relatively low and is expected to rise only slightly to 7.6% by the end of 2025). Pessimism is at a 40-year high in the country, with global and domestic political uncertainty weighing heavily, particularly with regards to the public finances recovery.

Uncertainty indicator in the comments section of the Banque de France’s monthly economic survey

Raw data

Note: The reference value is set at 100 and corresponds to the value around which the indicator fluctuates in normal times. Source: Banque de France, September 2025 survey.

Annual changes in GDP and contributions from the main demand components

Annual changes in GDP, calendar adjusted, in % and contributions in percentage points

Reading: in 2024, GDP grew by 1.1% (calendar adjusted change); foreign trade contributed +1.3 percentage points to this growth. Source: INSEE « Note de Conjoncture », September 2025.

Our opinion: Political uncertainty is weighing on France’s still fragile economy. However, strong economic performance in the first half of the year, particularly in industrial production in the aerospace sector, tourism-related consumption, and the recovery in construction activity, should drive growth in 2025. Looking ahead, a robust rebound can only come from a recovery in household consumption. This remains possible given the still low unemployment rate and the restoration of purchasing power. For this to happen, uncertainty must recede and confidence must return. In addition, an improved business climate would also restore business investment following the ECB’s rate cuts. On the other hand, a prolonged political impasse, or an even further deterioration of the situation (snap elections, a new divided parliament, etc.), could further weigh on consumer and business confidence and hamper future economic activity.

Caution is therefore warranted on the markets.

- On the interest rate front, the spread remains under control at around 80 bps, but a further deterioration is possible. In this regard, we will be monitoring the decision of Fitch, which is due to announce its sovereign rating for France this evening (current rating at AA-, corresponding to “high quality,” with a negative outlook). A downgrade to A+ would mean that France’s credit rating would fall to the “above average quality” category and would no longer be eligible for purchase by certain pension funds, insurance companies, and banks that favor ratings above AA. The spread would therefore automatically increase. That being said, France’s ability to raise taxes remains intact and the continuity of the state is not in question, as a ruling by the Constitutional Council prevents budgetary deadlocks by allowing the passage of a Special Finance Law to keep the administration functioning.

- On the equity markets, given domestic demand weakness as described above, selectivity is essential. Many CAC 40 companies are multinationals operating worldwide. By definition, their business is less directly affected by internal developments. These are the stocks we favor, while at the same time avoiding sectors most exposed to the international trade war. Last but not least, we avoid domestic financial stocks due to their exposure to the French sovereign debt

Unsurprisingly, the ECB choses to pause in September.

At the September Governing Council meeting, the ECB unsurprisingly kept its key interest rates unchanged (deposit facility rate at 2 %), citing inflation around the 2 % target. The main explanation given by Christine Lagarde for the (at least temporary) halt to rate cuts at a terminal level of 2% lies in the changing balance of risks to economic growth. Compared with the rather bearish outlook discussed in June, the risks to growth are now more balanced:

- Uncertainty surrounding the trade war with the USA has diminished with the signing of a trade deal in July.

- The risk of retaliatory tariffs being imposed by the European Union, which would have further weighed on growth and inflation, has now disappeared thanks to the signing of the agreement.

Also, compared with the macroeconomic projections presented in June, the September update revises growth upward in 2025 and inflation upward in 2025 and 2026 (see below).

September 2025 macroeconomic projections

Annual variations, in % ; revisions in percentage points

Christine Lagarde, speaking at a press conference following the monetary policy meeting, explained these revisions by pointing to resilient economic growth in the Euro Area. In H1 2025, this was helped not only by strong US stockpiling in anticipation of the introduction of tariffs, which boosted exports, but also by the rebound in household consumption (made possible by low unemployment and a recovery in purchasing power) and investment (with the gradual decline in interest rates slowly feeding through to corporate lending).

Looking ahead, European growth should continue to be driven by the ongoing recovery in household purchasing power and the decline in household savings rates, boosting consumption on the one hand. On the other hand, the effects of the German defense and infrastructure investment plan and the disbursement of the remaining funds from the Recovery and Resilience Facility should also provide support.

Beyond analyzing and understanding the mechanisms that led to today’s decision, we take away the following points from Christine Lagarde’s press conference:

- The ECB’s monetary policy approach remains unchanged: gradual, meeting by meeting, data-dependent, and based on three factors: the inflation outlook, underlying inflation dynamics, and the quality of transmission of monetary policy decisions to the real economy. In this context, while the ECB is now in a comfortable position (“we continue to be in a good place”), this does not mean that the future is predetermined (“no predetermined path”).

- Today’s decision was taken unanimously by the Governing Council. In response to a question raising Isabel Schnabel’s hawkish view on residual inflationary risks, Christine Lagarde replied that the discussion surrounding risks always combined growth and inflation, not just inflation. She thus reiterated the evolution of the analysis compared to June, which now justifies the pause: the risks surrounding economic growth are more balanced. Finally, on a more colorful note, she recalled: “I’m an owl, neither hawk nor dove.”

- Finally, in response to numerous questions regarding the situation in France, Christine Lagarde reiterated that she does not comment on specific countries but that she can confirm that interest rate markets continue to function orderly and that liquidity conditions remain good.

Our opinion: The new macroeconomic projections and analysis presented today by the ECB reinforce our view of a terminal deposit rate of 2% by the end of 2025 in the absence of any further macroeconomic shocks. The evolution of German sovereign rates following the press conference also points in this direction: convergence of the 2-year Bund rate towards 2% and near stability on the 10-year Bund rate around 2.65% after a temporary peak of around 2.68%. To be continued.