On Tuesday, October 21, the election of Sanae Takaichi, the first woman to head the Japanese government, put an end to several weeks of political uncertainty in Japan. Her rise to power follows a parliamentary vote that initially gave her 237 of the 465 votes in the lower house and a second, less important victory in the upper house.

Having come out on top in the ruling Liberal Democratic Party (LDP) elections in early October, her accession to power was no longer guaranteed following the withdrawal of the Komeito party from the ruling coalition and the opposition’s desire to present a single opponent to challenge her. However, this did not take into account the announcement of a new coalition on Monday, October 20, between the LDP and the right-wing Ishin (Japan Innovation Party).

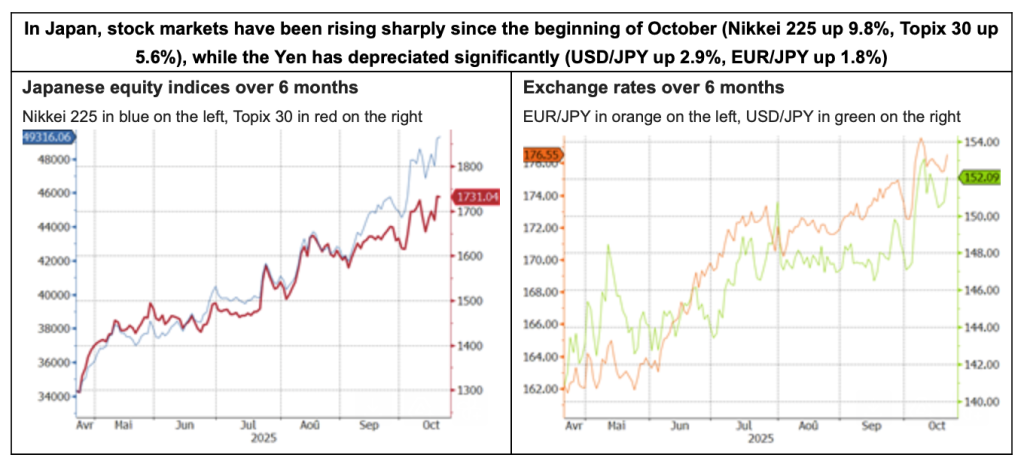

The Japanese markets were quick to react to the new political situation, continuing and confirming the upward trend in equities and the depreciation of the currency that had begun at the start of the month. These reactions are in line with Takaichi’s penchant for “Abenomics,” i.e., an economic policy based on the three pillars of fiscal stimulus, increased exports, and a weak Yen, once championed by Prime Minister Shinzo Abe, who was assassinated in 2022, and which he had deployed in addition to an ultra-accommodative monetary policy of sovereign yield curve control to pull Japan out of deflation.

Our opinion:

The reaction of Japanese markets (rising stocks, currency depreciation) follows expectations of greater fiscal stimulus and the assumption that the BoJ is now less inclined to raise its key interest rate, given the new government’s economic policies and despite the current rise in prices (inflation at 2.7% in August 2025).

But nothing can be taken for granted:

• Japan’s public debt-to-GDP ratio is one of the highest in the world (237% according to the IMF in 2024) and even though it is mainly domestic debt, the government’s room for maneuver in this area seems limited.

• The new LDP/Ishin coalition does not have an absolute majority in parliament and will have to maneuver with opposition parties to push through its policies. Ishin is also in favor of budget cuts, which could limit the ambitions of the current government, even though Takaichi has appointed Satsuki Katayama, who is also pro-Abenomics, as finance minister.

• Finally, in terms of monetary policy, the BoJ’s priority remains the fight against inflation. Moreover, implicit policy rates have not changed since the elections in early October (current rate at 0.5%, implied rate in one month at 0.5%, unchanged from a month ago; in three months at 0.7%, also unchanged from a month ago).

While Japanese equity markets have already priced in the possibility of fiscal stimulus, and are now vulnerable to any disappointment on this front, the current sharp depreciation of the Yen has probably gone a little too far. The resumption of BoJ rate hikes should allow the Yen to appreciate again and, without returning to the levels seen a month ago, fall back below 150 by the end of 2025 for the USD/JPY.