- The Hidden Side of Online Travel Agencies

- Siemens, full stop, finally in sight, for the ‘fleet of ships strategy’

US EQUITIES

The Hidden Side of Online Travel Agencies

- On November 7, 2025, Expedia, one of the largest online travel agencies, reported its third-quarter results. It was well received by investors. The stock rose 18% the day after its publication and 44% year-to-date.

- Bookings on its websites grew by 12%, revenue by 9% and adjusted operating income rose by 27% thanks to a 370 basis point margin expansion. This strong third quarter led Expedia’s management to raise its 2025 growth outlook. Revenue is now expected to grow by 6.5%, compared with the 3-5% previously forecasted. Its EBITDA margin is expected to expand by 2 points, versus the 1 point previously forecasted.

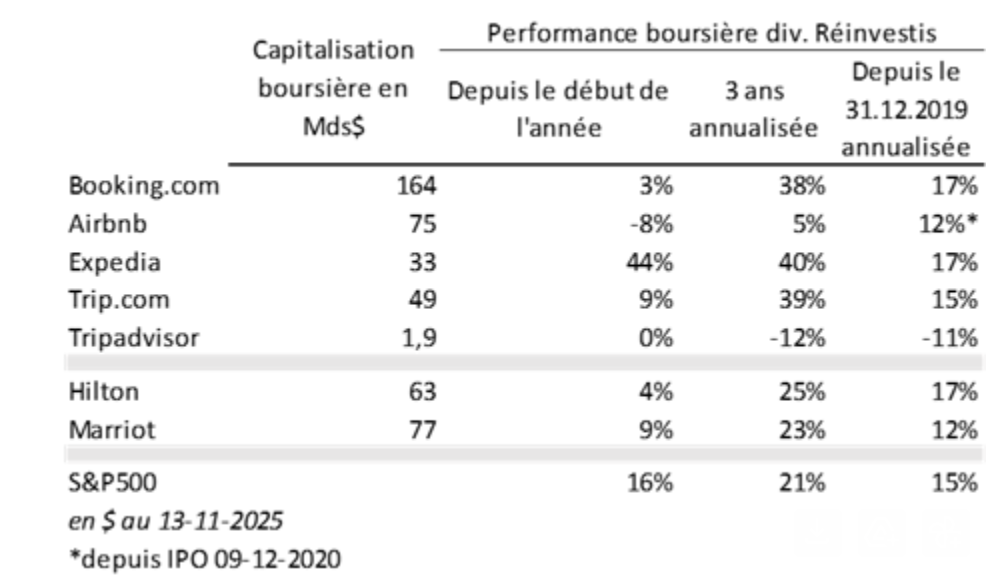

- Expedia is one of the pioneers of online travel agencies. It was founded by Microsoft in 1996 and went public in 1999. Today, there are four major online travel agencies: Booking.com, Airbnb, Expedia, and Trip.com. Their market capitalizations are close to or exceed those of the largest publicly traded hotel chains such as Hilton and Marriott.

- For 25 years, online travel agencies have shared two key success factors and one major obstacle to creating stock market value.

Firstly, the travel industry has grown tremendously thanks to the development oflow-cost airlines such as those offered by Ryanair and new accommodation models such as Airbnb. In 2024, the travel market (transportation, accommodation, tours and activities, catering) was estimated to be worth over $3 trillion, according to Phocuswright. In 2024, Expedia recorded gross bookings(value of bookings on its website) of $111 billion, while Booking.com reached $166 billion.

Secondly, these agencies’ marketplaces benefit from powerful network effects. The more they attract, retain, and provide value to hoteliers and other travel service providers, the more appealing they become to consumers. Increased traffic, in turn, encourages more suppliers to join.

However, many of them are still dependent on traffic from search engines such as Google, which also offers competing services. For example, Expedia’s marketing and sales expenses accounted for 51% of its revenue in 2024.

- In the future, the travel market is expected to continue growing. The middle classes in emerging countries continue to grow richer, wealthy American and European baby-boomers are keen travelers, and business travel is on the rise. Network effects continue to reinforce themselves. In addition, online travel agencies continue to improve their processes, increase organic traffic to their platforms, and can still hope to gain market share. Since 2020, Expedia has, for example, reduced the complexity of its organization by unifying the marketing platforms of its Vrbo (equivalent to Airbnb), hotels.com, and Expedia websites. Between 2019 and 2024, Booking.com increased organic traffic to its site by around 5 points from 50% to 55%, enabling it to reduce its marketing expenses from 5.15% to 4.4% of the value of bookings. Finally, the share of travel service bookings made through online travel agencies continues to grow. It stands at 69% in 2024, compared to 65% in 2021. In the United States, Expedia reported that the number of overnight stays on its sites grew at the fastest pace in three years in the third quarter of 2025, a sign of great management execution.

- Although these agencies are well-managed companies, they have performed in line with the S&P 500 over the past six years. However, generative AI may be a game-changer for their business model. For several years now, online travel agency recommendation systems have been usingmachine learning to adapt to different internet users (different website organization depending on customer profile, targeted discounts and advertising, etc.). In the future, generative AI will undoubtedly change the way we book hotels online. It may no longer be necessary to fill in a long list of criteria (number of people, dates, price, various options) to perform a search, customer reviews will be synthesized by a Large Language Model (LLM). In short, searching for travel services may take the form of a conversation with a chatbot. In particular, ChatGPT, which has 800 million users, is partnering with online travel agencies to offer a new gateway to their services. Their interest is shared: Google is their shared competitor. While customer experiences with Booking.com and Expedia chatbots appear positive so far, large-scale adoption of their services is still in its infancy.

EUROPEAN EQUITIES

Siemens, full stop, finally in sight, for the ‘fleet of ships strategy‘

- By announcing its intention to deconsolidate Siemens Healthineers (SH) by transferring 30% of SH shares to its shareholders via a direct spin-off, Siemens will close the final chapter of its simplification process, which began seven years ago. In 2018, under the leadership of influential CEO Joe Kaeser (2013-2021), the group ended its long-standing ‘fleet of ships’ strategy, a metaphor describing the decentralised strategy of the Siemens conglomerate in the 2010s. For decades, Siemens did not see itself as a single ‘ocean liner’ but as a fleet of independent ships (its subsidiaries), sailing autonomously in the same direction. In addition to governance issues and various scandals that tarnished the group in the 2000s, this strategy was deemed too fragmented and overly complex, limiting synergies and clarity for investors. Two dates were key in the deconstruction of the conglomerate: March 2018 and September 2020, with the IPOs of the Healthcare (Siemens Healthineers, 15% of whose capital was floated) and Energy (Siemens Energy, of which Siemens currently holds less than 14% of the capital) divisions, respectively.

- In practical terms, the spin-off, which has been approved by the board of directors, must now be approved by the shareholders of each entity at two general meetings (extraordinary?) in 2026, a timetable considered too distant by some investors who would have preferred a final decision to be made now. Nevertheless, we welcome the clarification of the group’s intentions.

- Siemens’ objective is to reduce its stake in SH to a financial asset (i.e. certainly less than 20%). No details have been provided on the tax efficiency of the spin-off, but it would appear to be tax-exempt for Siemens (unlike a share exchange offer). There is a strong likelihood that, between now and the spin-off, Siemens will continue to sell some SH shares on the market (it declares 67% of the capital, compared with 69% two months ago), which will weigh on SH’s share price. Once the spin-off is complete, SH’s share price may also suffer from a flow back by certain Siemens shareholders.

- While it is therefore too early to take a position in Siemens Healthineers, post-spin-off the market may focus on the fundamentals of this group, which enjoys leading positions in the medical imaging and radiotherapy markets (via Varian, acquired in 2021) and whose Diagnostics business, at the bottom of the cycle, is in the process of recovery.

- Siemens is therefore refocusing on three major strategic areas: Smart Infrastructure (43% of revenue, offering exposure to datacenters and electrical networks), Digital Industries (35% of revenue, including automation and software) and Mobility (22% of revenue, rail transport and urban mobility).

- Alongside the announcement of the spin-off, the group published fairly solid Q4 results (although below expectations in Mobility) with organic growth of 6% (consensus at +5.05%) and record free cash flow generation of £5.3 billion (well above the £4.1 billion expected). The sharp decline in the share price on Thursday 13 November (-9.35%, but note that it is still outperforming the DAX since the beginning of the year) is due to the announcement of disappointing 2026 outlook (acquisition integration costs, higher negative currency effects and lower margin forecasts in Digital Industries) and the absence of medium-term margin targets by division.

- The group is therefore adopting a conservative approach to communication, which is understandable given that it is entering a transition phase with its CFO. The consensus is likely to remain cautious until there is greater visibility on software integration (key to profitability), AI monetisation and capital allocation following the SH demerger.

- In the medium term, the investment case remains intact, driven by automation, continued expansion of software margins and electrification. The group is ideally positioned to provide solutions that fuel the industrial AI revolution: datacenters remain a key driver of growth (revenue +40% in 2025compared to +30% for Legrand) and visibility, with an order book extending to 2027.