- TSMC

- ASML / ASM I

US EQUITIES

Will TSMC’s salvation be American?

- TSMC (Taiwan Semiconductor Manufacturing Company) was founded in1987 by Morris Chang (94 years old), at the initiative of the Taiwanese government and thanks to funding from Philips, which originally held 28% of the capital. Since 1997, TSMC has been listed in the United States through an ADR.TSMC is the first pure-play foundry, meaning it only handles the manufacturing of chips that designers outsource to it. Until the early 2000s, electronics conglomerates designed and manufactured all their electronic devices from the chip to the system; they are called IDM (Integrated Device Manufacturers). The creation of TSMC therefore marks the beginning of a first revolution in the semiconductor industry.

- Over time, TSMC became the leader in outsourced chip manufacturing, and even more so in the production of the most advanced processors. First, TSMC became the leader in processors for mobile phones after 2007. Although the United States lost its leadership in chip manufacturing from at least the early 1990s to Asian countries, 2017–2018 marked a second turning point for the industry. At that moment, TSMC surpassed Samsung and Intel by being the first to master the 7 nm process (1 nm = 10^-9 m). In 2026, TSMC began large‑scale production of 2 nm chips, while Intel still struggles to catch up technologically.

- The publication of Q4‑25 on 01-15‑2025 and the new investment announcements from TSMC on American soil teach us four things. 1-demand for AI computing processors is very strong; 2-TSMC’s leadership is reflected inrecord margins; 3-capital intensity is accelerating; 4-by 2030, the United States should drastically reduce the supply risk linked to the ambition of the People’s Republic of China (PRC) to reunify Taiwan with mainland China.

- TSMC reported revenue of $34 billion in Q4‑24, up 26% in USD. Gross margin and operating margin reached their historical records at 62.3% and 54%. Net income increased by 41%. In 2026, management expects 30% revenue growth, driven in particular by a growth rate of 55–60% per year for AI accelerator processors by 2029.

- This growth requires investments, which have so far been very profitable. TSMC spends more than half of its cash flows on capex. These will amount to between $52 and $56 billion, or 27% to 37% more than in 2025. Beyond the increase in demand described above, two other elements explain the acceleration in investment growth. The cost of production and the selling price of chips manufactured by TSMC relative to their number of transistors(the basic element of a chip) have risen sharply over the past two years and should increase further with upcoming technological nodes. The ever‑smaller transistor costs more! However, for several years, TSMC’s transistor has been the most energy‑efficient compared to those of its competitors, a key element for its clients.

- Finally, 70% of its revenue is generated from American customers, and the PRC aims to reunify Taiwan with China by force if necessary in the medium term. In this context, the United States obtained from TSMC and Taiwan that they invest significantly in the United States in order to be sovereign over this strategic industry. In practice, at the end of 2025, TSMC has 15 factories: 2 in China, 1 in Arizona, 1 in Japan, and 11 in Taiwan. At the end of 2025, only 4 factories can produce chips below 7 nm. The first plant in Arizona is equipped to produce up to 4 nm; the other three are in Taiwan. Announced in May 2020, the construction of the Arizona plant costed $12 billion and has been operating since late 2024 with a capacity of a few hundred thousand wafers per year, compared to 17 million in total for TSMC in 2025. Two other plants in Arizona are under construction and another is awaiting a building permit. The second is expected to enter production in the second half of 2027.

- In March 2025, TSMC announced a new $100 billion investment for three additional foundries in the United States, two packaging plants, and an R&D center, in addition to the $65 billion of ongoing projects in Phoenix. This expansion plan should allow TSMC to reach 1.2 to 2.4 million wafers per year in the medium term, according to our interpretation of management’s comments during the earnings release. The next day, the U.S. administration and Taiwan agreed on reduced customs duties of 15%, or even 0%, up to 1.5× their semiconductor production capacity in the United States. In return, Taiwan and its companies must invest at least $250 billion in the United States. TSMC could therefore go from one plant in Arizona in 2024 to a dozen before 2030.

- While investing in equipment seems the easiest part, maintaining high productivity in the United States will be a challenge for TSMC. Its leadership depends above all on the know‑how of its employees and suppliers from the Republic Of China (Taiwan), as well as their industrial secrets. A brain drainequivalent to that of the Manhattan Project from 1942 to 1946 and then for the development of rockets will undoubtedly be necessary for the United States to get back in the race, and offering a chance to Taiwanese technicians to continue to live in a liberal society if the PRC were to invade Taiwan.

EUROPEAN EQUITIES

Record stock prices for semiconductor equipment manufacturers in Europe!

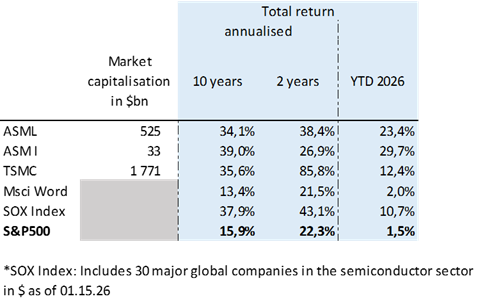

- The European semiconductor sector, specifically equipment manufacturers, is the most sought-after sector among investors at the start of 2026. In just 10 trading sessions, ASML Holding, ASM International and BE Semiconductors (BESI), all listed in the Netherlands, gained between 25% (ASML Holding, which has rebounded by more than 60% in the last six months) and 31% (ASM International). All of them have seen their share prices reach new all-time highs, surpassing their previous record set in July 2024.

- The key factor supporting the sector is the expected very strong global demand for artificial intelligence applications, which is enabling Taiwanese giant TSMC to forecast capital expenditure for 2026 well above expectations ($56 billion, more than a quarter higher than in 2025), a strong signal from TSMC about current capacity constraints and its conviction that AI-related spending will continue.

- ASML, the largest market capitalisation in the European sector, will be the primary beneficiary of the increase in capacity at TSMC, its main customer (representing 20 to 30% of sales of its flagship EUV (Extreme UltraViolet lithography) machines). ASML’s delivery times, which can be up to 18 months, mean that a large part of TSMC’s 2026 capital expenditure is probably already included in current orders. It is the period after 2026 that is at stake here and will offer the European group tremendous visibility thanks to this prospect of multi-year growth linked to higher value-added processors.

- When TSMC increases its investments, ASML is automatically the primary beneficiary, as TSMC cannot increase its capacity in advanced nodes without purchasing more EUV/DUV lithography machines, for which ASML Holding has a virtual monopoly. In addition, AI-related calculations are very memory chip-intensive. Investment in dynamic random access memory (DRAM) production is expected to increase following the explosion in its price in 2025. The three main DRAM manufacturers (Samsung Electronics, SK Hynix and Micron Technology) have all announced that they will be adding greenfield capacities in 2026. This will reduce the risk of bottlenecks and alleviate concerns about clean room space constraints. ASML should therefore benefit from the DRAM super cycle, but also from strong demand for computing processors. TSMC plans to expand its 3 nm capacity to meet AI-related demand; 3 nm is the node with the highest lithographic intensity, which is therefore very positive for ASML Holding.

- The increase in TSMC’s capacity also means more orders for ASM International machines, the leader in ALD (Atomic Layer Deposition) technology, which is critical for depositing materials used in advanced node chips (where growth is strongest). Finally, naturally, more orders for tools for advanced chip packaging on their electronic systems are also expected. Here,BESI will be the primary beneficiary thanks to its unique expertise.

- TSMC’s management, reiterating that AI demand is ‘real and sustainable’,reinforces the sector’s bullish bias for European suppliers whose tools (EUV, deposition or advanced packaging) are key to efficiency gains.